Crowdstrike Earnings: AI Hype vs Reality: Weak Q2 Guidance Sparks Valuation Reset

$CrowdStrike Holdings, Inc.(CRWD)$ Q1 FY2026 results show solid revenue growth (+20% YoY) and ARR growth of 22% to support subscription-based strategy, but widening GAAP loss and declining gross margins reflect cost pressures.Q2 and full-year guidance, while maintaining 20%+ growth, is below market expectations, triggering valuation repricing risk.AI innovation and share buyback program boost confidence, but profitability and expense control will be the focus of the market in the near term

Performance and market feedback

Revenue and profit performance: Q1 total revenue of $1.103bn, +20% YoY, in line with LSEG's estimate of $1.10bn; non-GAAP EPS of $0.73 vs. $0.65 est. showing earnings resilience.However, GAAP net loss of $110m declined from year-ago net profit of $42.82m, reflecting cost pressure.

Operating data highlights: ARR up 22% to $4.44bn, net new ARR $194m, customer retention 97%, Falcon Flex deal value over $3.2bn, +6x YoY, subscription-based strategy advancing.

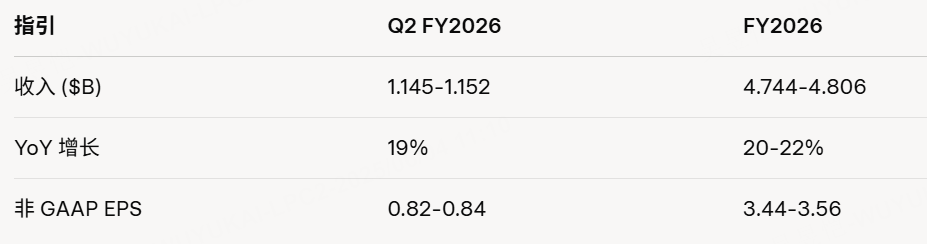

Guidance was off-market: Q2 revenue guidance of $1.145-1.152B, +19% YoY, below market expectations (~$1.15B); full year guidance of $4.744-4.806B, 20-22% YoY growth, lukewarm market reaction.

Market performance, after earnings release, shares fell 5% after hours, market worried about profitability and low guidance, investor sentiment is negative.

Investment Highlights

Solid Subscription and Platform Strategy, ARR Growth Drives Long-Term Value

ARR grew 22% to $4.44 billion, with net new ARR of $194 million, demonstrating the robustness of the subscription business.Customer retention 97%, net retention strong, Falcon Flex deal value of over $3.2bn, up 6x y/y, indicating AI and platform-based innovations (e.g., next-generation SIEM, cloud security) attracting large customers.Management emphasized "platform options in the age of AI" and ARR growth supported valuation, but slowing net new ARR could be a concern for the market.

GAAP loss widened, cost structure adjustment may drag down short-term profitability.

GAAP net loss of $110.0 million, down from net income of $42.82 million a year ago, primarily due to higher sales, marketing and R&D expenses, partially impacted by last year's software outage.Gross margins declined slightly, with GAAP subscription gross margins of 77 percent (78 percent last year) and non-GAAP 80 percent (81 percent last year), indicating cost structure adjustments.Free cash flow declined from $322 million to $279 million. Increased capital expenditures may pay for future growth but suppress profitability in the short term, and we need to pay attention to expense ratio trends.

Low guidance caused market concern, valuation re-pricing risk emerged.

Q2 revenue guidance of $1.145-1.152bn, 19% YoY growth, below market expectations (~$1.15bn), and full year guidance of $4.744-4.806bn, 20-22% YoY growth, was in line with Q1 performance, but market reaction was lukewarm, and the stock fell 5% after hours.Management's tone is positive, emphasizing AI and innovation, but guidance deviation may trigger valuation repricing, and we need to pay attention to whether Q2 actual performance exceeds expectations.

Share repurchase program boosts confidence, solid cash flow to support long-term growth

Company announces $1 billion share repurchase program, combined with $4,614 million in cash reserves, demonstrating financial flexibility.Operating cash flow of $384 million was essentially flat, supporting long-term investments.Buyback program may boost market confidence, but need to be vigilant about sustainability of capital allocation strategy against backdrop of widening GAAP losses.

Industry Competition and Changing Market Expectations, AI Innovation a Key Variable

Analysts have previously focused on increased competition ( $Palo Alto Networks(PANW)$ $SentinelOne, Inc(S)$ ) and profitability, and the Falcon Flex and AI innovations in the report (e.g., Charlotte AI) responded to the market's expectations for technology leadership.However, slower ARR growth and low guidance could alter market expectations, and attention will need to be paid to whether the industry landscape is further solidified by CrowdStrike's platformization strategy.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Valerie Archibald·06-04Smart money will accumulate at these levels. Two years from now you will look back and wish you bought the premier cybersecurity company while it was still cheap.LikeReport

- Enid Bertha·06-04Wouldn’t touch it over $250LikeReport