CoreWeave's listing has tripled, is it time to consider selling options?

From humble IPO to tripling market cap, CoreWeave stock soared.

On Tuesday, Nvidia-backed cloud computing service providerCoreWeave's stock price closed at a record high of $150.48, up more than 25%, and the company's stock price has soared 248% since its listing.

The AI computing power business is expanding wildly, and capital expenditures are expected to surge

CoreWeave's core business is to process artificial intelligence workloads based on Nvidia chips, and its data center is designed from scratch and optimized for AI computing.The latest lease agreement with Applied Digital further consolidates its layout of 33 AI data centers in the United States and Europe.

As a strategic partner of Nvidia, CoreWeave not only benefits from its technical support, but also attracts Microsoft, its largest customer, and OpenAI's five-year, $11.9 billion long-term cooperation.

In 2025, the company expects capital expenditures to surge 53% to $21.5 billion, underscoring its ambitions for AI infrastructure expansion.

In just two months, CoreWeave's market value has soared from $23 billion at the time of the IPO to an astonishing $72 billion, and its issue price has soared from $40 to the current $150.48.

Especially since the strong financial report was announced on May 15,Retail investors are betting four times more on their calls than on their puts.

However, the retail-driven spree didn't win the plaudits of Wall Street.

CoreWeave was not bullish in the early days of its IPO, and Wall Street was full of doubts about its high debt, customer concentration and management's cash-out behavior.

That led to investment banks having to downsize their offerings ahead of the IPO and distributing shares mostly to existing investors such as Nvidia and Fidelity, creating a "moat" in case the stock price crashes.

Currently, according to financial data firm S3 Partners,About 30% of tradable shares have been shorted, indicating that institutional investors are generally bearish on its valuation.

Matthew Unterman of S3 Partners pointed out that shorting CoreWeave has become an expensive gamble as short demand continues to be high and outstanding shares are limited, and borrowing costs continue to rise.

Shorting CoreWeave is proving to be a very bad decision in terms of current stock price action.

Special ownership structure, huge space for capital operation

CoreWeave's major shareholders include long-term investors such as Magnetar Capital, largest supplier and customer Nvidia, customer OpenAI, and Fidelity.

These investors, together with the company's three co-founders, hold more than 60% of the outstanding shares. This concentrated shareholding structure may become an important support for stock price stability.

Analysts believe that the surge in stock price provides CoreWeave with more room for capital operation.

In addition, the company's co-founders have cashed out US $500 million in the IPO, and the selling pressure may weaken in the short term. Analysts at MoffettNathanson wrote in a note to clients last week:

"The high share price gives CoreWeave the opportunity to create value through equity financing or mergers and acquisitions, which seems like an obvious possibility."

With regular post-IPO stock sale restrictions set to end by the end of this summer, executives, employees and existing investors will be able to sell more shares by then. However, many analysts remain cautiously optimistic about the company's prospects given its strong financial performance and market demand.

Strategy: Using Put Options to Go Long CoreWeave

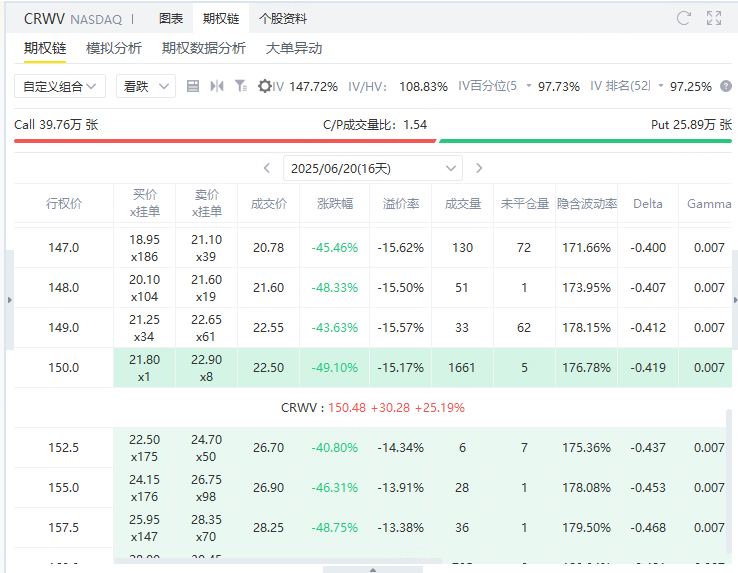

The current CoreWeave price is $150.48 and we can sell it by sellingExpires June 20, 2025, exercise price 150, premium $2250Put Option to go long CoreWeave.

Not only does this strategy profit when CoreWeave rises, it can still rely on premium to earn earnings even if CoreWeave goes sideways or falls slightly.

Current reference price: US $150/share

Option Type: American Put option (Put)

Expiry date: June 20, 2025

Exercise price: $150

Premium: $2250/contract (i.e. $22.5/share)

This strategy sells put options and collects premium first. If the stock price does not fall below the exercise price at expiration, the option will become invalid and the seller will retain premium in full; If the stock price falls below the strike price, the underlying price needs to be bought at $150.

Maximum Profit

Income ceiling = premium received = 2250dollar(i.e. $22.50/share). After selling the option, earnings are locked at this amount regardless of how the stock price rises.

Maximum benefit =$2250

Break ‑ even Point

Breakeven Price = Strike Price 150 − premium 22.5 = 127.5dollar。 When the underlying price equals $127.5 at expiration, your profit or loss is zero; Above that price makes a profit, below that price makes a loss.

This strategy is suitable for investors who are bullish in the medium term and tolerate a certain correction, but they need to reserve enough margin and consider cooperating with stop loss or hedging tools to control risks.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

這篇文章不錯,轉發給大家看看