Entering a Turbulent Market Cycle? Key Issues to Watch Before Stability Returns

In recent weeks, the market has been caught in a delicate state of turbulence, with many assets that are typically correlated diverging from their usual patterns. It is difficult to determine whether this is merely a temporary anomaly ahead of an eventual convergence in market trends, or if some assets are beginning to establish independent trajectories. However, when considering the element of time, it is unlikely that such abnormal relationships will persist for much longer.

Indications from the Foreign Exchange Market

The weakness of the US dollar index reflects the tariff battles initiated by the United States and the rising concerns over a potential economic recession. As a result, most non-US currencies have appreciated, with the Japanese yen standing out more prominently due to its safe-haven appeal amidst capital repatriation. Especially after last week’s market action—where the yen gapped up on news of a court ruling but then lost ground—increased pressure on the dollar has become more apparent in the short and medium term. From the perspective of the foreign exchange market, further volatility is expected after the current period of adjustment comes to an end.

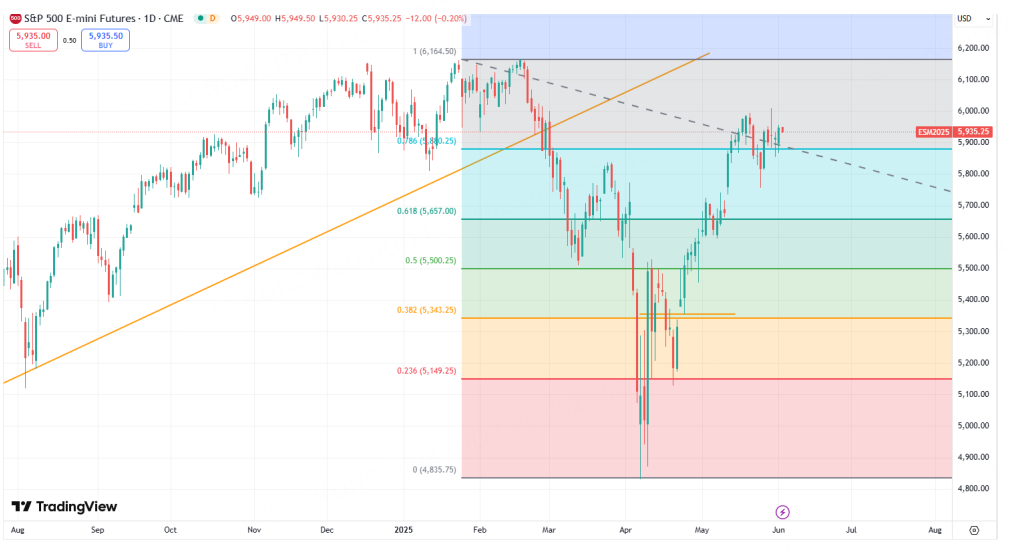

US Stocks Remain Relatively Strong

Meanwhile, US equities, the best barometer of risk appetite, have maintained their relative strength, even though the pace of gains has slowed. Any positive news related to tariffs during trading sessions has been sufficient to trigger notable rebounds. Of course, this relative strength is far from stable; when negative developments arise, declines can also be very swift.

The Strange Surge in Gold

This week, gold unexpectedly spiked alongside a strong rebound in silver. The unusual movements in precious metals prompted market speculation that a significant piece of news might be forthcoming. However, as of now, the anticipated news has yet to materialize. Gold, as the most prominent safe-haven asset this year, can still be seen as experiencing a normal rebound, so long as it hasn’t reached new highs. What sets the current correction phase apart—since the market peak at 3123— is that risk assets have also been rising, which is somewhat different from the previous logic.

Where Is the Problem?

Beyond the assets mentioned above, others like crude oil and cryptocurrencies have also demonstrated unique patterns in recent trading. What does this apparent lack of correlation—or temporary randomness—among different asset classes actually indicate?

We believe that, in addition to highlighting existing disagreements among investors regarding future prospects, there is also an implicit strategy of hedging both outcomes in the face of uncertainty. On one hand, capital has flowed into safe-haven assets, reflecting pessimism about the US and the global outlook; on the other hand, there is continued appetite for high-yield, high-volatility assets. Until decisive, pivotal news breaks, this undercurrent of divergent bets is likely to persist. It is also worth noting that President Trump’s 90-day grace period is drawing to a close. Unless he unexpectedly changes course, the core objectives he has set out make it difficult to avoid a new round of disputes. That is why, during last week’s live discussion about whether the Nasdaq could reach a new high, my view was that even if it does, it is likely to be a bull trap.

Periods when markets defy logical interpretation and indicators seem to contradict one another are not unusual. Yet, in today’s environment where politics and economics are deeply intertwined, one can gain a greater edge simply by understanding President Trump’s core motivations and considering which scenarios would maximize his interests. Whether we are weathering repeated tests at market tops or enduring the stress of market bottoms, patience and time are essential.

$NQ100指数主连 2506(NQmain)$ $SP500指数主连 2506(ESmain)$ $道琼斯指数主连 2506(YMmain)$ $黄金主连 2508(GCmain)$ $WTI原油主连 2507(CLmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- marketpre·06-05Interesting indeedLikeReport