"The first stablecoin stock" Circle exploded! How to do options?

Circle, the "first stablecoin stock", has risen by more than 247% since its listing, shocking observers in the encryption and traditional financial fields. Its stock price far exceeds three times the issue price of its "oversubscribed 25 times and additional issuance" initial public offering.

The document shows,$Circle Internet Corp. (CRCL) $Is a "revenue engine" located in a high-growth industry-in 2024 alone, Circle received more than$1 billion in interest income。

But at the same time, the financial statements also reveal that this business is built on many trade-offs-after paying huge partner fees, employee incentives and heavy compliance expenses,Circle barely makes a profit。

Circle is currently known for more than$60 billionOf cash and US Treasury Bond to back its USDC stablecoin issuance. Although USDC itself is non-profitable, Circle still achieved in 2024Total revenue of $1.7 billion。 However, the operating costs incurred to attract these reserve assets are equally high.

In 2024, Circle paid for "distribution and transaction costs"$1 billion, becomes the largest spending item, mainly used to pay partners (especially Coinbase) to distribute rewards to USDC users. In addition, Circle's payroll expenses are as high as$263 million, also spent on "day-to-day administrative costs" (including travel, office, insurance, legal and tax services)$137 million。

Circle's most noteworthy growth factor is its relationship with the world's largest asset managerBlackRock's Partnership。

In March 2025, Circle entered into a four-year memorandum of understanding (MOU) with BlackRock toBlackRock's managed share of Circle reserves increases to 90%。 The agreement clearly stipulates that BlackRock must give priority to using Circle's stablecoin for all scenarios related to US dollar payments.And shall not launch competitive stablecoin products。

One of Circle's main business models is to invest in short-term debt, which is continuously renewed at market rates. This also means:Downside interest rates are Circle's biggest profit risk。 As we all know, the Federal Reserve has recently released a signal to cut interest rates. If interest rates have been lowered before USDC supply increases significantly,CRCL investors may face difficulties。 While lower interest rates will also lead to fewer "distribution fees" paid to partners, partially mitigating the revenue shock, based on Circle's own interest rate sensitivity forecast (assuming the total USDC volume remains unchanged),Every 1% drop in short-term interest rates will reduce Circle's profits by about $207 million。

For those who want to go longCircleInvestors can consider using selling put options to go longCircle。

Options Strategy: Take advantage of the bull put spread to go long on Circle

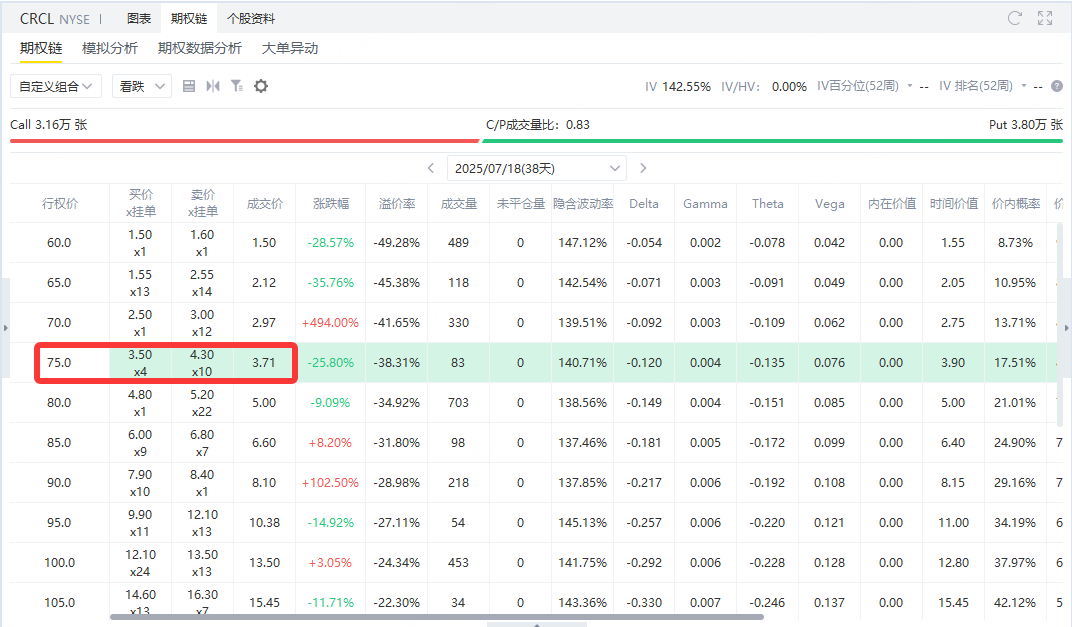

CurrentCircleThe current price is $115. We can sell itExpires July 18, 2025, exercise price 75, premium $371Put Option to go longCircle。

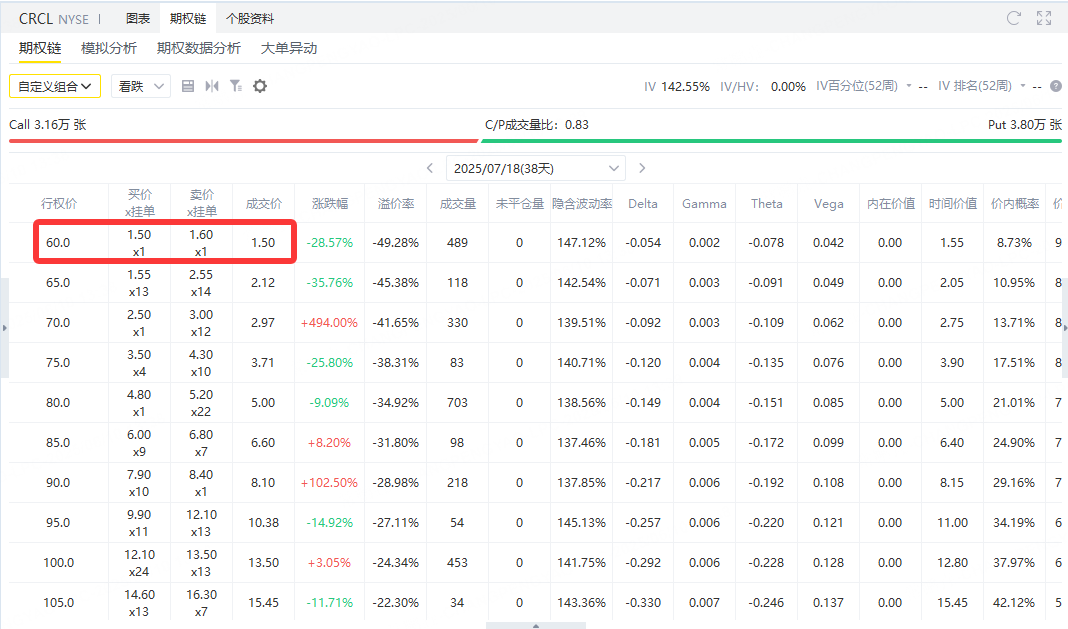

Because we are worried that the newly listed stock will plummet and cause huge losses to investors, we can also buy a put option with an exercise price of 60 and spend $150 to limit the maximum loss.

Strategy composition:

Sell a put option with an exercise price of $75 expiring on July 18, 2025 and get premium$371;

At the same time, buy a put option with the same expiration and an exercise price of $60 to pay premium$150。

Net income:

371 (sell)-150 (buy) =$221

Profit and loss analysis:

Maximum gain: $221When Circle's stock price is higher than $75 at expiration, neither option is exercised, and the investor retains all premium.

Maximum loss: $1,500-221 = $1,279When Circle falls to $60 or less, the option is fully exercised and the investor faces the maximum loss (75-60 = $15 * 100 shares = $1,500), minus $221 of income.

Breakeven: 75-2.21 = $72.79When the Circle price is $72.79 at expiration, investors have gained and lost.

Strategic advantages:

Compared with buying Circle stocks directly, the initial investment of this strategy is smaller;

While controlling the greatest risks, you can still enjoy the benefits brought by rising or stable stock prices;

Is particularly suitable forJust listed, violent fluctuationsOf new stock investors.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.