The Israeli-Iraq conflict breaks out! Time to go long crude oil?

As the Israel-Iraq conflict continues to break out, global funds poured into the crude oil market to do more. On June 13, the total trading volume of the U.S. crude oil options market reached 681,000 shares, and a large-scale call option transaction of $80 also occurred. The market is actively pricing in the possible impact on crude oil supply caused by the situation in the Middle East. Under the risk of geopolitical conflicts, crude oil prices have experienced a significant premium, and potential bypass costs have also risen.

Funds pouring into long oil prices

The outbreak of the Israel-Iraq conflict caused a huge shock in global markets. On June 13, local time, New York$WTI Crude Oil Main 2507 (CLmain) $Crude oil once soared by more than 14% and then fell back. Safe-haven assets such as gold rose significantly, and global stock markets fell collectively. As of the close, the main price of WTI crude oil closed up more than 7.5%, quoted at US $73.18 per barrel, the largest one-day increase since March 2022. The U.S. crude oil ETF rose 6.89%, hitting a five-month high.

According to the latest research report released by JPMorgan Chase's chief commodity strategist, the current oil price has at least partially reflected the geopolitical risk premium-the current crude oil price is slightly above $70. This means that the market has given a 7% probability pricing for the "worst scenario", in which oil prices will rise exponentially rather than nonlinearly, and its impact on the supply side may far exceed the decrease of Iranian crude oil exports by 2.1 million barrels/day.

According to the report, the current market focus is that the expansion of the conflict may lead to the closure of the Strait of Hormuz, or the comprehensive escalation of the war in the Middle East may trigger retaliatory reactions from major oil-producing countries in the region-these countries contribute one-third of the world's oil production. JPMorgan Chase estimates that if this extreme situation occurs, oil prices may soar to US $120-130/barrel.

Previously, market concerns about oil supply disruptions in the Middle East escalated, and the size of long positions that have pushed funds to bet on rising crude oil prices is still rising rapidly. According to U.S. CFTC data, as of the week of June 10, the net long position of NYMEX WTI crude oil held by speculators increased by 16,056 contracts to 179,134 contracts, a 19-week high. Data from the Intercontinental Exchange showed that the net long position of Brent crude oil increased by 29,159 contracts in the week ending June 10 to 196,922 contracts, a 10-week high.

After the Israel-Iraq conflict, investors bought a large number of crude oil call options, betting that oil prices would rise further to $80 in the future. According to data from the Chicago Mercantile Exchange, on Friday, June 13, 33,411 call options for WTI crude oil expiring in August 2025 with an exercise price of US $80 were traded, setting a single-day record since January this year. The total trading volume of the crude oil options market that day was as high as 681,000.

This is the first time such a large $80 call trade has occurred since Jan. 10. On January 10, the volume of $80 call options expiring in February 2025 was 17,030, and the total volume was about 302,000. A large amount of capital inflows show that the market is actively pricing in the possible impact of crude oil supply caused by the situation in the Middle East, and the oil price of US $80 is gradually becoming a new target for investors to focus on.

Using put options to go long on crude oil

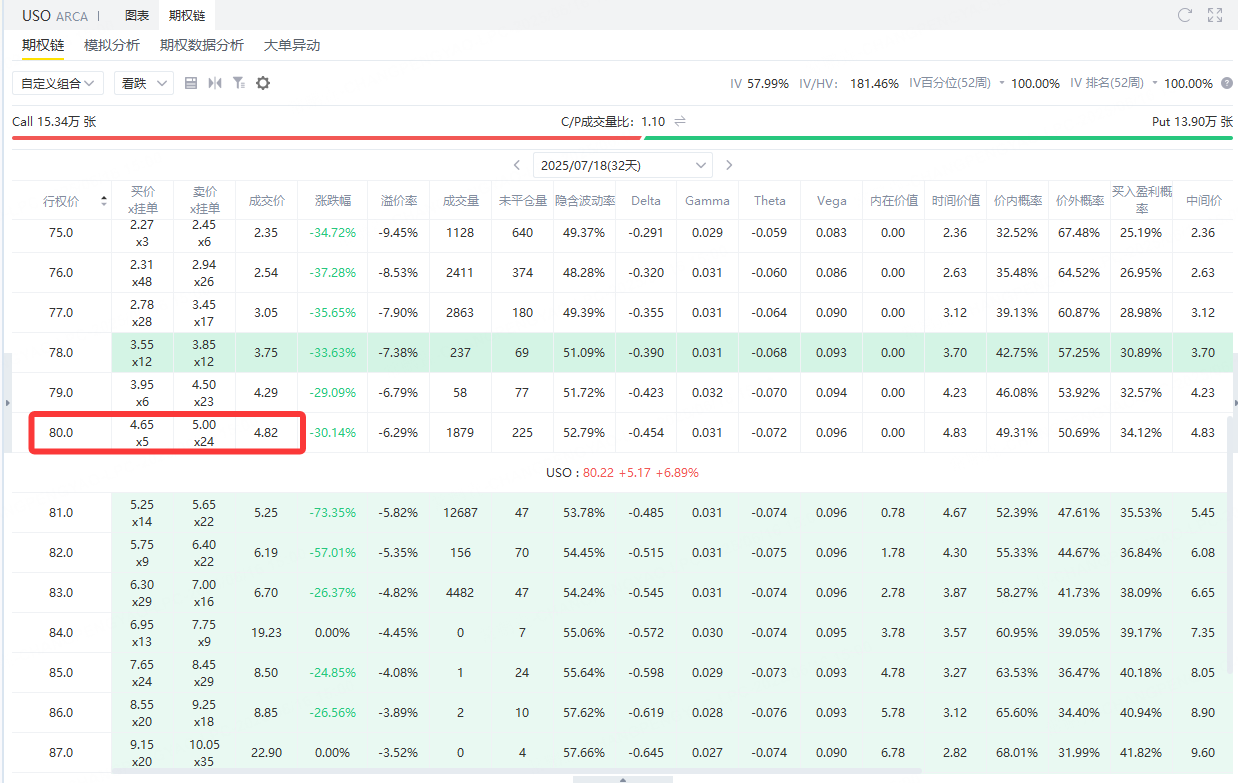

The current USO price is $80.22, and we can sellExpires July 18, 2025, exercise price 80, premium $482Put Option to go long$U.S. Crude Oil ETF (USO) $。

This strategy can not only make profits when crude oil rises, but even if crude oil goes sideways or falls slightly, you can still rely on premium to earn earnings.

Profit and Loss Analysis: Sell USO Put Strategy

The current price of USO is US $80.22. We can obtain a premium of US $482 by selling a put option with an exercise price of US $80 expiring on July 18, 2025, thereby realizing the long layout of USO.

Strategy Description

This strategy belongs to cash-guaranteed selling put options. Investors assume the obligation to buy when the USO falls below $80 in exchange for option premium gains.

If the USO price remains above $80 at expiration, the put option sold will not be exercised and the investor can retain the full premium.

Maximum benefit

The maximum gain is $482, which is the entire premium income earned by the investor if the option is not exercised.

When the market price of the USO on the expiration date is higher than or equal to US $80, the option buyer will not exercise the option, and the investor does not need to buy the USO to obtain full income.

Break-even point

The break-even point is $75.18. This price is equal to the exercise price of $80 minus premium received of $4.82.

If the USO expiration price is exactly $75.18, the premium gain will offset the buying loss, and the profit and loss will be zero.

Maximum loss

The maximum loss occurs in the extreme case where the USO price returns to zero. At this point, investors must buy USO, which has completely lost its value, at $80, resulting in a loss of $75.18 per share after deducting the $4.82 premium received, and a total loss of $7,518 (based on 100 shares).

Strategy Summary

Selling puts is a bullish strategy with limited risk and fixed returns, suitable for investors who believe USO will not fall significantly and are willing to take on the obligation to buy.

Investors should ensure that they have sufficient margin and recognize that the biggest risk of this strategy is that the USO falls sharply or even goes to zero. In addition, USO, as an ETF tracking WTI crude oil, has futures rolling and structural deviations, and its trend is not completely equivalent to the spot crude oil, so it needs to be judged based on the dynamics of the crude oil market.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.