618 Shockwave: Xiaomi’s $35.5B GMV & the Hidden Tech Behind It!

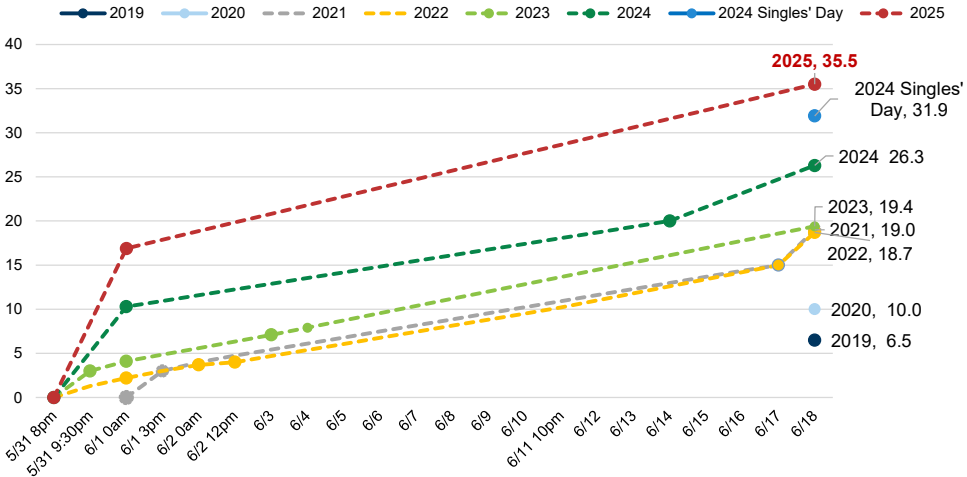

618 Shopping Festival Performance Summary

GMV reached RMB 35.5 billion during the 618 Shopping Festival, up 35% year-over-year and 11% higher than Double 11 2024

This performance was in line with expectations and equaled 71% of GSe's forecasted 2Q25 China smartphone and AIoT revenue

Historical comparison: 69% of 618 in 2024, 59% of 618 in 2023, 66% of Double 11 in 2024

Smartphone performance:

Ranked #1 in sales and GMV among domestic brands on the Jingdong platform

4 of the top 10 best-selling models (Redmi K80, Redmi Turbo 4 Pro, Redmi 14C and Redmi Note 14 Pro)

Strong performance in the ultra-high-end market ($6,000+), with the Xiaomi Mi 15 Ultra in the top 10

Discount levels remained the same as last year, with an average discount of about 19% (excluding state subsidies), and up to 33% after subsidies are taken into account

AIoT product performance:

Significant sales growth in smart appliances: air conditioners (+52% YoY), refrigerators (+62% YoY), washing machines (+63% YoY)

Sales of TVs and monitors grew by 24% and 90% respectively

150% growth in kitchen stove sales

Improvement in service capability: 20% increase in peak day installations and 27% increase in consumers enjoying installation services

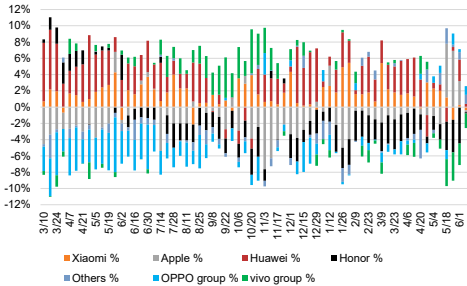

Market Competition Analysis

Market share change:

Xiaomi expanded its market share in China for three consecutive weeks (the weeks of May 18, May 25 and June 1) for the first time in a year

Apple expands market share with an additional 100 yuan (5%) discount

Price range performance:

Xiaomi accounted for 15 of the 70 best-selling models in the seven price ranges of 0.5-1k, 1-1.5k, 1.5-2k, 2-3k, 3-4k, 4-6k and 6k+

Future product plans

Upcoming product releases:

Cars: YU7 series (focusing on the first 30 minutes to 24 hours of orders)

Smartphones: Xiaomi Mi Mix Flip 2 and Redmi K80 Ultra

Portable AIoT:

Xiaomi Pad 7S Pro (powered by XRING O1 SoC, targeting iPad Air)

Redmi K Pad (powered by MediaTek Dimensity 9400+ SoC, targeting iPad mini)

Mi Band 10, Mi Watch S4, Mi OpenWear Stereo Pro

Possible release of Xiaomi's first AI glasses (expected to trigger a series of product launches from the tech giant in 2H25)

Home appliances:

Mijia AC Pro Healthy Wind

Vacuum Cleaner M40 S

Floor Cleaner 4 Max

Hair Dryer Pro

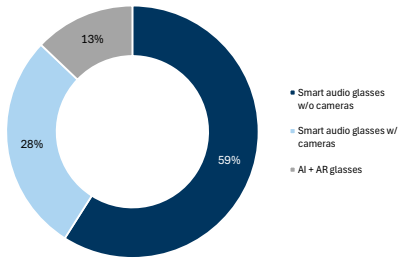

AI Glasses Market

China Smart Glasses Market to Grow 116% to 494k Units by 2025, Smart Audio Glasses to Grow 197%

IDC forecasts China smart glasses shipments to reach 2.9 million units in 2025, including 2.16 million units of smart audio glasses

Price distribution: about 60% of online sales in January-February were camera-less glasses

Retail price distribution: mainly in the range of $1,000-1,500

Valuation

Current share price: HK$53.80

2025E Revenue Forecast: 478.66 billion yuan (+30.8% YoY)

2025E EBITDA forecast: 52.56 billion yuan (+70.5% YoY)

With a forecast P/E ratio for the next 12 months (Forward PE) of 31.4x

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- NewmanGray·2025-06-23Xiaomi's growth is impressiveLikeReport

- wubbie·2025-06-23Great performanceLikeReport