H1 2025 Hong Kong Market Recap: Capital Inflows Fuel 10 Key Sectors; Laopu Gold, Pop Mart and Newborn Town Lead 17 Firms Set for H2 Growth

According to data from Wind, a financial data platform, 1,468 companies listed in Hong Kong reported share price gains in the first half of 2025, accounting for 55.5% of all listed stocks. This article focuses on analyzing the top gainers to provide valuable insights into capital allocation trends over the past six months.

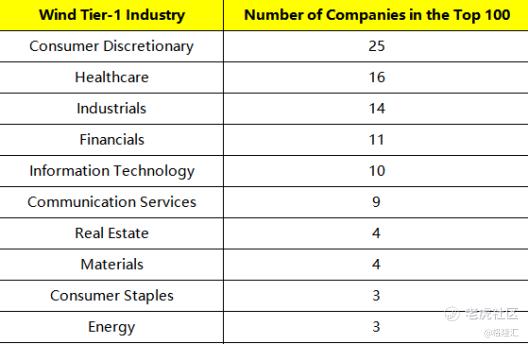

Among the top 100 stocks, companies spanned 10 industries classified by Wind as Tier-1, with 25 from the Consumer Discretionary sector, making it the best-performing industry.

Notably, gold-related stocks saw exceptional performance. Sales-end player Mount Everest Gold surged by over 900%, while Laopu Gold soared more than 300%. Four other companies involved in gold mining and refining experienced gains ranging from 175% to 332%, reflecting strong investor interest across the entire gold value chain.

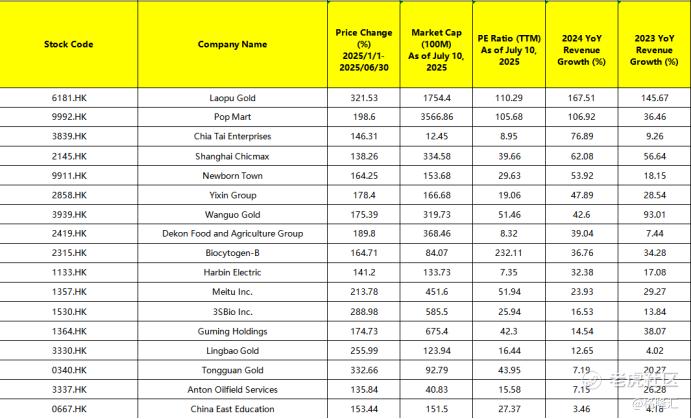

Which companies on the top 100 list are poised to become standout performers in the second half of the year? Which have strong fundamentals and are well-positioned for further gains? By analyzing metrics such as year-on-year revenue growth for 2024 and 2023, price-to-earnings (P/E) ratios, and share prices, the author identified 17 companies with consistent revenue growth over the past two years and P/E ratios within a reasonable range.

Based on year-on-year revenue growth for 2024, the top five are: Laopu Gold, Pop Mart, Chia Tai Enterprises, Shanghai Chicmax, and Newborn Town.

Consumer Discretionary Stocks Lead the Rally; Hong Kong Pharma ETF Surges 44%

Within the top 100 list, the Consumer Discretionary sector led with 25 companies (Wind Tier-1 Industry, same below), followed by 16 in Healthcare, 14 in Industrials, 11 in Financials, and 10 in Information Technology (see Table 1).

Table 1. Number of Companies by Industry Among the Top 100 HK Stock Gainers in H1 2025 (Source: Wind)

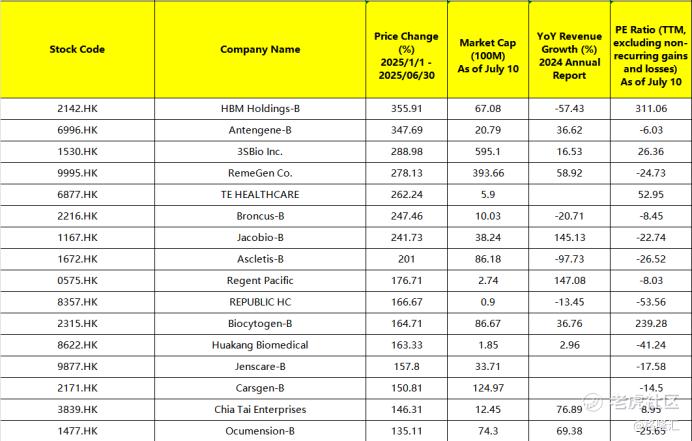

Healthcare is the standout sector this year. Among the top 100 list, HBM Holdings-B surged by 355.9%, and Antengene-B gained 347.7%. Additionally, six other healthcare firms saw increases of over 200% (see Table 2).

Table 2. Healthcare Companies Among the Top 100 HK Stock Gainers in H1 2025 (Source: Wind)

The HK Pharmaceutical ETF (159718) surged 44.1% in H1 (according to Tonghuashun, as noted below), significantly outperforming the Healthcare ETF (159929), which rose by 5.6%.

In the Consumer Discretionary sector, Laopu Gold and Pop Mart stole the spotlight. Laopu Gold surged by 321.5% (according to Wind, as noted below), while Pop Mart soared by 198.6% in H1. Both brands generated long queues outside their stores, with scalpers reselling products at premium prices. At Laopu Gold’s IFC store, customers must scan a QR code to join the queue—each person receives one number, and missed numbers are forfeited.

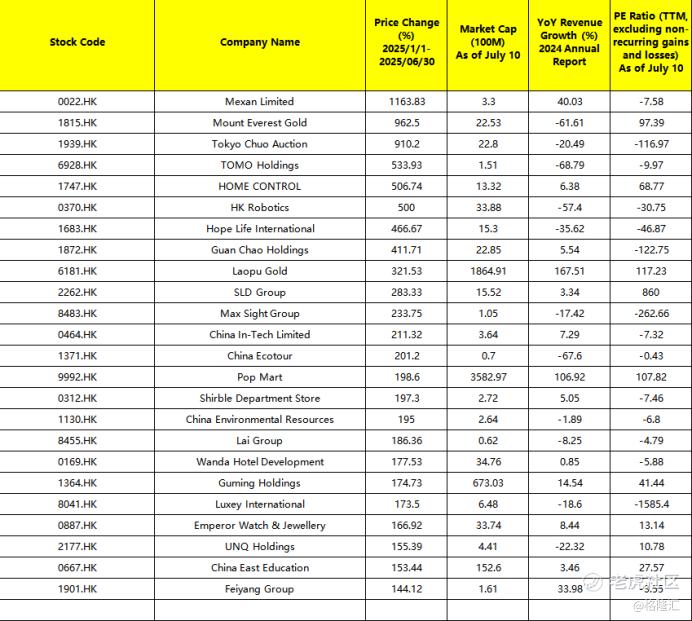

Other major gainers included Mexan Limited (+1,163.8%), Mount Everest Gold (+962.5%), and Tokyo Chuo Auction (+910.2%). Companies such as TOMO Holdings, HOME Control, and HK Robotics also saw gains of over 500%.

Note of Caution: Mexan Limited and TOMO Holdings are priced below HK$1 (see Table 3).

Table 3. Consumer Discretionary Companies Among the Top 100 HK Stock Gainers in H1 2025 (Source: Wind)

Among the top 100 gainers, there are four gold mining companies, including Tongguan Gold, Lingbao Gold, China Hanking, and Wanguo Gold, which benefited from surging gold prices that lifted their revenue baselines (see Table 4).

Table 4. Materials Sector Companies Among the Top 100 HK Stock Gainers in H1 2025 (Source: Wind)

17 'Hidden Champions' with Strong Fundamentals Poised for Continued Growth in H2

Which companies on the top 100 list are not just the result of short-term capital speculation, but offer genuine medium- to long-term investment potential? Which ones are showing meaningful performance improvements, with their share prices on an upward trajectory and further room for growth in the second half?

The author applied the following three criteria to the top 100 list: 1) Revenue growth in 2024 and 2023; 2) A trailing P/E ratio (as of July 10) below 300; 3) A share price above HK$1 as of July 10.

A total of 17 companies meet all three criteria (see Table 5).

Table 5. Companies Selected Based on the Three Criteria (Source: Wind)

As shown in the table, 11 companies have demonstrated accelerating revenue growth over the past two years. These include Laopu Gold, Pop Mart, Chia Tai Enterprises, Shanghai Chicmax, Newborn Town, Yixin Group, Dekon Food and Agriculture Group, Biocytogen-B, Harbin Electric, 3SBio Inc., and Lingbao Gold.

Among them, Laopu Gold specializes in the sale of gold products. Founded in 2009, it was the first heritage gold jewelry brand in China to promote the concept of 'heritage gold,' reshaping the landscape of China's gold jewelry market.

Pop Mart specializes in the design and sale of designer toy collections. By the end of 2024, it had 13 IPs, each generating over RMB 100 million in revenue.

In 2024, THE MONSTERS, MOLLY, SKULLPANDA, and CRYBABY recorded revenues of RMB 3.04 billion, RMB 2.09 billion, RMB 1.31 billion, and RMB 1.16 billion, respectively.

Chia Tai Enterprises focuses on animal health products, chlortetracycline, and industrial businesses. For the year ended December 31, 2024, the Group’s revenue increased by 76.9% to USD 307.7 million (2023: USD 174 million), reflecting the successful execution of its key strategy to expand sales to major customers.

Shanghai Chicmax specializes in the manufacturing and sale of skincare, maternity and childcare, washing and personal care, and makeup products. Its portfolio includes brands such as Kans, One Leaf, Baby Elephant, and newpage. This multibrand approach has consistently enabled the company to seize market opportunities and stand out from competitors.

Newborn Town is a global social entertainment company with a diversified, 'bush-like' apps portfolio across the MENA region, Southeast Asia, Europe, the Americas, Japan, and Korea. As of December 31, 2024, its flagship products, MICO and YoHo, continued to generate steady profits as reliable cash cows, while newer products like TopTop and SUGO saw year-on-year revenue growth of 100% and 200%, respectively, providing additional earnings momentum.

Newborn Town continues to upgrade its AI middle-platform engine to enhance social matching, content recommendations, and content ecosystem operations, further improving monetization efficiency. Looking ahead, with a vision of 'creating positive emotional value,' the company will continue advancing in the global social entertainment space, exploring user needs, strengthening business barriers, and building a heartwarming and valuable product ecosystem.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.