Tech Review: The Worst Punishing Of "Missing Out" Since 2022

From $Meta Platforms, Inc.(META)$ Adds to $Alphabet(GOOGL)$ Rebounds, AI Sentiment Revisited in 2025.Despite high market valuations and approaching seasonal headwinds, fundamental investments and structural trends in AI are accelerating.

Meta announced plans for several gigawatt-level AI computing clusters, such as "Prometheus" (1GW) and "Hyperion" (target 5GW), which not only reflects its strategic determination in the AI field, but is also regarded as a "tens of billions of dollars order signal" to chip makers such as NVIDIA by the market.It is also regarded as a "tens of billions of dollars order signal" to NVIDIA and other chip makers.

Combined with Oracle's new investment in Germany and CRWV's massive AI power investment in Pennsylvania, the logic of arithmetic as infrastructure is becoming more and more mainstream, and these trends are an important support for the medium- to long-term valuation revaluation of hardware vendors such as $NVIDIA(NVDA)$ .

On the other hand, although the hardware side ushered in the good, but the market has gradually realized that the traditional semiconductor sector is facing short-term pullback pressure.On the one hand, August and September are the traditional weak period for the semiconductor sector, and the historical performance of the SOX index shows that this period is prone to volatility.On the other hand, the U.S. 232 tariff policy will be implemented on August 1, although the current only about 45 billion U.S. dollars of raw chip imports, but Bernstein pointed out that if changed to the "component-level tariffs", it may have a more far-reaching impact on the global supply chain.Therefore, although the long-term logic remains unchanged, but in the short term semiconductor stocks may face the reality of increased volatility, investors need to find a balance between trend and rhythm.

Software industry, the market in May refocused on AI infrastructure-related software companies, focusing on betting on $Microsoft(MSFT)$ $Snowflake(SNOW)$ $Palantir Technologies Inc.(PLTR)$ $Oracle(ORCL)$ , and other "platform-basedPlatform-based" companies.The persistent run-off in application software such as CRM, WDAY, TEAM, etc. confirms the existence of structural divergence.Barclays' view is noteworthy: current market concerns about the application software segment (e.g., low-threshold substitutions and declining seating capacity) may be overstated.Enterprise software is deeply integrated into business processes, and GenAI, even if it brings efficiency gains, will struggle to reshape entire industries quickly.Especially in the field of finance, logistics and other highly repetitive work, AI may become a new way of cash for software vendors, rather than a pure source of risk.

However, not everyone is so optimistic. ubs points out that at the SaaS level, model providers are gradually eating into the space of traditional software companies.Whether the rise of the model layer will reverse the compression of the pricing power and survival space of existing software vendors is still a question to be solved.Therefore, in the short term, the platform type AI software is still the main line, but in the future, if the GenAI application gradually civilianization, the application layer may be able to usher in a wave of complementary rise or revaluation opportunities.Concerned about the software sector investors, should be from the "substitution risk" and "function repricing ability" two dimensions to assess the value of the underlying.

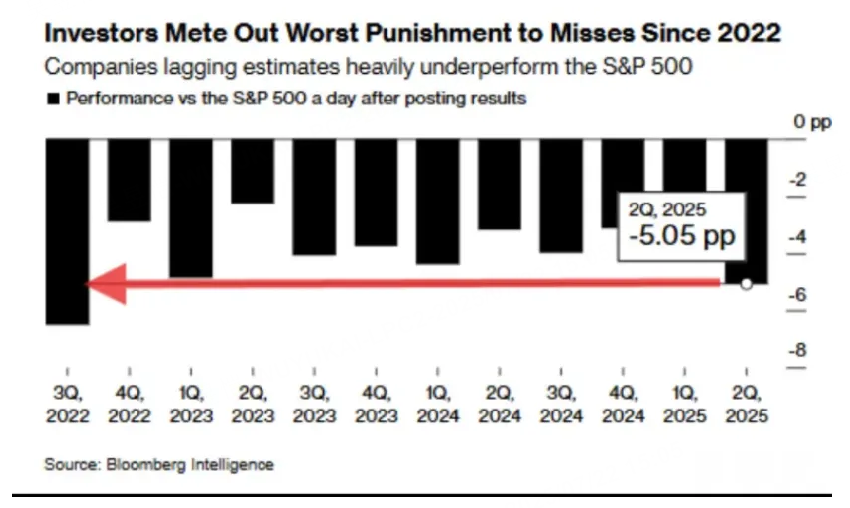

In terms of earnings reports, the market has entered the stage of valuation bias and performance verification.

$Taiwan Semiconductor Manufacturing(TSM)$ raised its full-year guidance sharply, but the share price reaction was muted;

The pullbacks in $ASML Holding NV(ASML)$ and $Netflix(NFLX)$ eflect investors' higher demand for "expectation fulfillment".The current market is not a "good news will rise, bad news does not fall" market stage, the market has switched to "fine pricing, pay attention to the margins" mode.Therefore, investors in the earnings season should pay more attention to the discrepancy between market expectations and actual data, rather than just focusing on the financial indicators themselves.For investors with heavy positions in technology, the importance of the ability to choose stocks will once again be highlighted.

It is worth mentioning GOOGL, a veteran whose recent rally may signal another opportunity. performance enhancement of Gemini 2.5, rebound in ad revenue, and strong growth in cloud GCP have fueled its fundamental repair.Third-party data shows that search ad revenue growth has reached a new high in recent years (~+20%), while the Street's expectations for Q3 are relatively conservative.In addition, its valuation is much lower than similar tech stocks (less than 15x 2027E EPS), and there is significant room for valuation repair if expectations are met.Of course, the upcoming DOJ antitrust ruling in August remains a potential risk that needs to be tracked closely.But in the AI revenue to cover the slow decline in search share, GOOGL may be in a short-term "sweet spot" stage.

Overall, this round of AI market has entered the "deep water", but the continued investment in infrastructure, the market's structural perception of software adjustments, as well as the valuation of individual underestimated leaders to repair, still provide support for the long.In the traditional August and September unfavorable time window is about to open, investors can appropriate layout, waiting for fluctuations in the buying opportunities.A subsequent pullback of 5-10% would likely be nothing more than the starting point for the next upward swing.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- WalterD·07-22It's fascinating to see how AI investments are shifting market dynamics.LikeReport

- JeromeErnest·07-22Incredible insights, really appreciate this! [Great]LikeReport