U.S. stocks have repeatedly hit new highs, how to hedge risks with vertical spreads?

Despite the significant risks faced by the market, the U.S. stock market has repeatedly hit new highs, which has puzzled many veteran investors.

At the beginning of April this year, US President Trump introduced the so-called "reciprocal tariff" and imposed tariffs on almost all trading partners. This move once caused a huge shock on Wall Street, but with Trump's easing of trade policy, U.S. stocks not only recovered all lost ground, but also once again embarked on the road of continuous new highs.

This round of rebound surprised analysts, especially in the context of many macroeconomic risks facing the world. However, investors are still pouring into the market, even if many are ready to withdraw at any time.

"In many ways, this is a rally that not many people are really confident to participate in," said Andrew Pease, head of Asia Pacific investment at Russell Investments.

He pointed out that the company's analysis shows that the current investor sentiment is neutral, not excited. "Everyone is actually wary of this wave of gains," Pease added.

Wall Street veterans have spent months warning that investors may be underestimating risks.

"Unfortunately, I think there is really complacency in the market," Jamie Dimon, CEO of JPMorgan Chase, said in early July when talking about tariffs.

This fear may soon face a reality test. Trump's tariffs could disrupt supply chains and push up inflation, thus dragging down global economic growth.

It's not just the tariff issue that deserves vigilance. Factors such as tensions in the Middle East and weaker economic data in the United States all indicate that potential trouble is brewing.

Although the risks remain, traders don't want to miss the market. This sentiment drives a phenomenon of "FOMO + MOMO"-that is, the combination of "Fear of Missing Out" and "Momentum Trading".

Retail investors re-enter the market, even if they miss the previous gains, they must chase the rise and enter the market.

"FOMO and MOMO will dominate the market in the short term," Steve Sosnick, chief strategist at Securities, wrote in a June 30 note.

He added: "Newton's first law also applies to markets. An object (market) in motion will remain in motion until external forces intervene."

Russell Investments' Pease also said that the rally could unravel quickly under macro shocks, but until then, momentum will be maintained.

But at this time, investors can also use appropriate methods to hedge market risks, such as considering using the vertical spread strategy to short the market index.

S&P 500 Vertical Spread Hedging Strategy

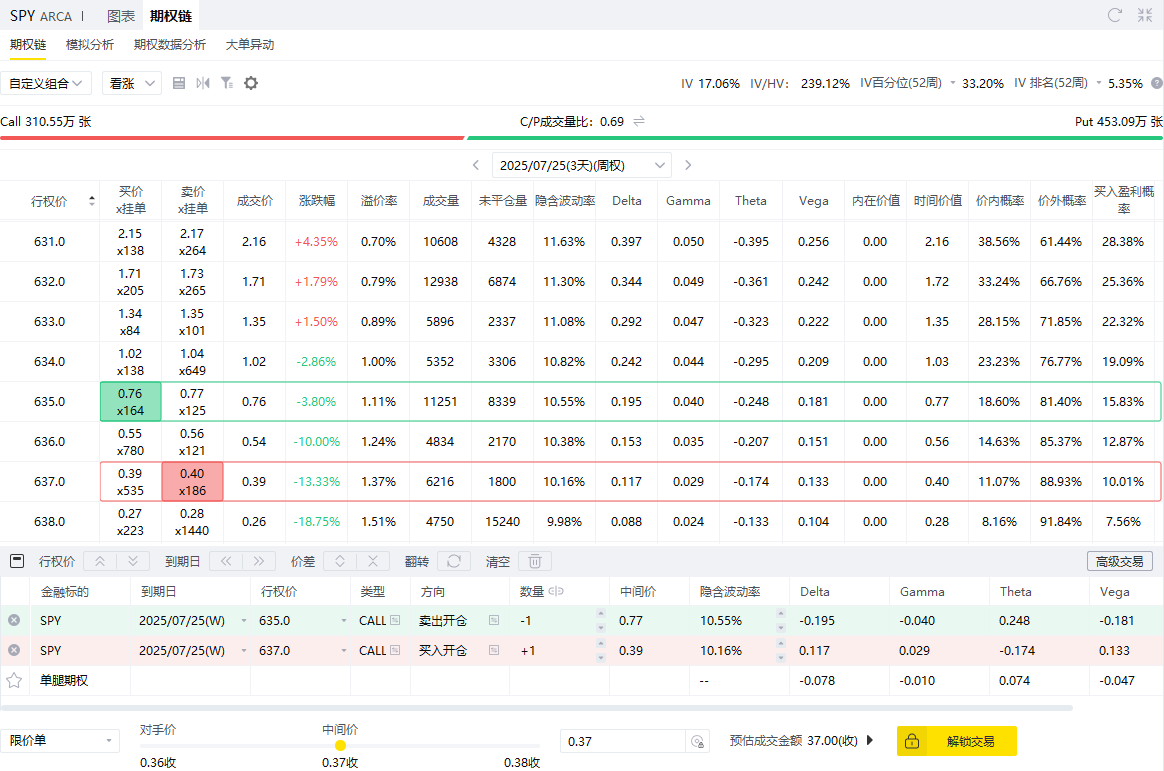

The current price of SPY is 629, and we want to short SPY in the short term with a weekly time period. We can use the bear market call spread strategy.

In the first step, sell the call option with the strike price of 635 and get $76.

The second step is to buy a call option with an exercise price of 637, control the maximum risk, spend $39, and the bear market call spread strategy is established.

Underlying assets: SPY (current price: $629)

Strategic direction: Short-term bearish, time period is1 week

Policy Type: Bear Call Spread

Operation steps:

SellThe exercise price is635Call options, obtain premium$76

BUYThe exercise price is637Call options, paying premium$39

Net income:

Premium Net Income = 76-39 =US $37 (per contract)

Maximum benefit:

When SPY is at expirationLess than or equal to $635, neither leg option is executed

Investors retain all premium rights

Maximum gain = $37

Maximum loss:

The spread between the legs is $2

Maximum loss = 2-Net income 0.37 =$1.63 × 100 = $163

Break-even point:

Breakeven point =635 + 0.37 = $635.37

Strategy Summary:

Maximum benefit: $37

Maximum loss: $163

Profit-loss ratio: about 1: 4.4

Applicable situations: SPY is not expected to break above $635 before expiration

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.