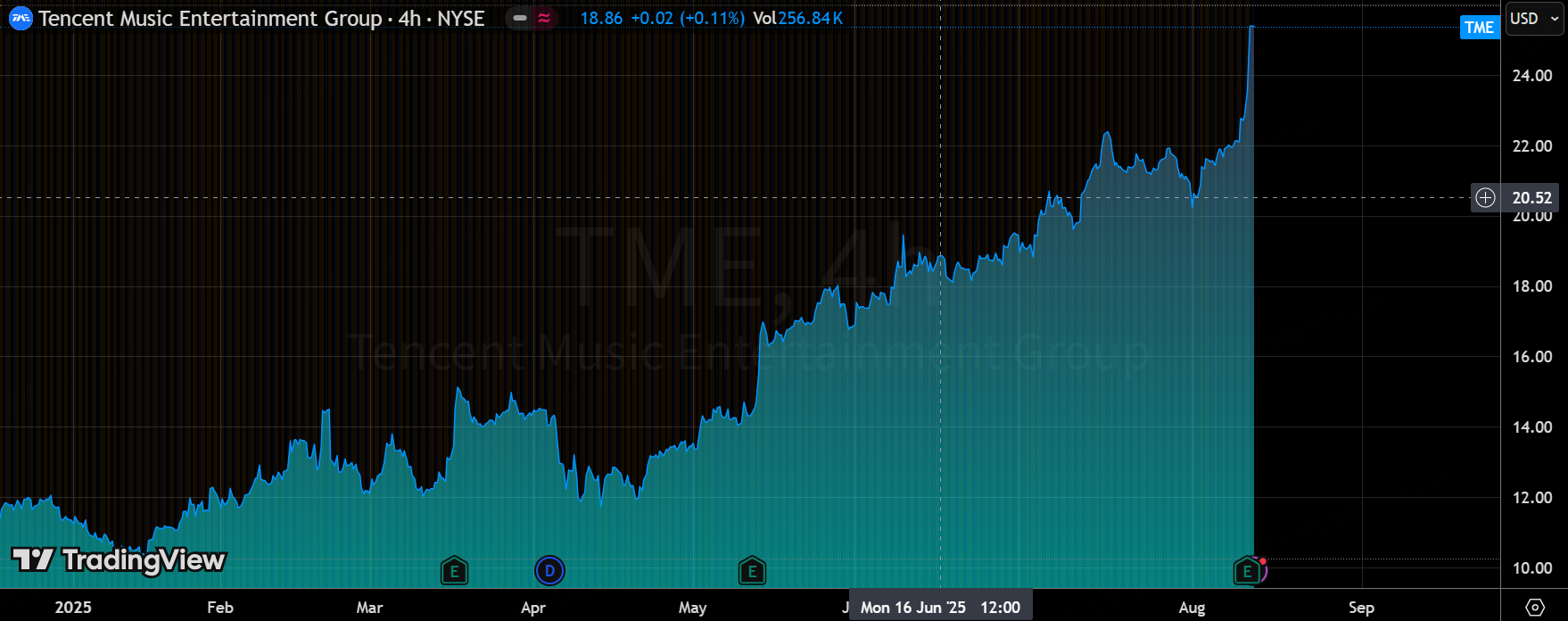

TME Soar 19%, Still Cheap On 26x PE?

$Tencent Music(TME)$ Q2 delivered "high-quality revenue and profit growth": revenue, profit, and gross margin all exceeded the same period last year, driven by double-digit growth in subscriptions and ARPPU. Social entertainment continued to contract but the drag was manageable. Advertising and SVIP contributed incremental growth, while operating cash flow faced pressure quarter-on-quarter and MAU saw a slight decline—two key signals to monitor.

Although the stock price surged by 19% after the earnings report, it remains undervalued from a valuation perspective, with a TTM P/E ratio of around 26 times. Assuming an implied growth rate of 15-20%, the PE ratio for 2026 could reach around 20 times. In comparison, the forward PE ratio for $Spotify Technology S.A.(SPOT)$ is as high as 95 times, and even $NetEase(NTES)$ has a PE ratio of 34 times. Therefore, Tencent Music falls into the category of (high but far from invincible)

Key information from the financial report

Total revenue reached RMB 8.44 billion, representing a year-on-year increase of 18% and a quarter-on-quarter increase of approximately 5%. This growth was primarily driven by the strong performance of online music services, particularly the increased contribution of subscription revenue, which now accounts for approximately 52% of total revenue. Compared to market consensus expectations (approximately RMB 80.4 billion), actual revenue exceeded expectations by approximately 5%, reflecting the effectiveness of the company's content ecosystem optimization and the cultivation of user payment habits. Signs of business structure changes indicate that online music revenue now accounts for over 80% of total revenue, while the social entertainment business share has further contracted, marking the company's structural transition from live streaming dependency to a subscription-driven model.

Online music service revenue: RMB 6.85 billion, up 26.4% year-on-year

Drivers include growth in the number of paying users and an increase in ARPPU (average revenue per paying user), benefiting from AI-assisted content recommendations and exclusive copyright partnerships. Performance exceeded market expectations (analysts generally anticipated growth of around 20%), with business changes indicating further increases in subscription model penetration rates. Compared to the previous quarter, growth momentum has strengthened, resembling Spotify's successful transition from free to paid models.

Music subscription revenue: RMB 4.38 billion, up 17.1% year-on-year

The main logic lies in the promotion of high-end subscription products such as SVIP (Super VIP) and deep integration with the Tencent ecosystem (such as WeChat mini-program entry points). Although slightly lower than the overall growth rate of online music, it still exceeded expectations (market consensus of approximately 15%), indicating an increase in paid user loyalty. In terms of structural changes, the number of subscription users may exceed 100 million (based on historical trends), but social entertainment subscriptions may weaken, and there is a need to be wary of the risk of user churn.

In terms of profitability, the gross margin was 44.4% (42.0% in the same period last year); operating profit was 2.98 billion yuan (+35.5% YoY, with an operating profit margin of approximately 35%); IFRS net profit was 2.41 billion yuan (+43.2% YoY), non-IFRS net profit was 2.57 billion yuan (+26.3% YoY), far exceeding market expectations (consensus net profit of approximately 2 billion yuan), with the expense ratio decreasing to 13.7% (16.0% last year). Business indicators show that the profit margin has risen from approximately 25% last year to over 28%, similar to how Netflix achieved a profit surge through economies of scale.

Guidance

During the conference call, the company emphasized its focus on "product innovation and the SVIP ecosystem," with a 2025 target of "150 million subscribers and an ARPPU of 15 yuan." It also expects that the consolidation of Himalaya in the third quarter will boost MAU and the paid subscription rate. Cussion Pang stated that "music-derived services (advertising, concerts) are a long-term growth area," hinting at increased investment in content co-creation (such as film and music collaborations).

Guidance style: Neutral to conservative—Despite Q2 exceeding expectations, full-year revenue guidance remains at 10-15% growth (lower than Q2 growth rate), reflecting caution regarding competition and macroeconomic conditions. For example, the statement "We need to flexibly adjust the balance between volume and price in a volatile copyright environment" (Pang) implies a defensive tone, aimed at reassuring investors about concerns over declining MAU rather than aggressive expansion.

Key Investment Points

1) Stronger subscription engine: driven by both the number of paying users and ARPPU. In Q2, both the number of new paying users and ARPPU saw significant growth, driving a 26% increase in online music revenue. The company highlighted that the number of SVIP members has surpassed 15 million, and the "ad-based membership" model is driving dual growth in advertising and membership revenue. Combined with the expansion of the music library and the penetration of high-quality packages (Hi-Fi/Dolby), the value per user continues to rise.

2) Social entertainment has entered a stable period following the "de-financialization" of the sector. Q2 social entertainment revenue continued to decline by -8.5% YoY, but the decline narrowed compared to last year. From industry-side evidence, the previous live streaming/tipping models have faced stricter regulatory oversight (anti-gambling feature rectifications), and after the high base was passively deleveraged, the sector's drag on the company's overall performance has weakened. In the long term, the "healthier + content-focused" direction of this business is conducive to improving profit quality.

3) The improvement in profit margins has both "internal" and "structural" attributes. The increase in gross profit margin came from: (1) a higher proportion of subscriptions, (2) optimization of copyright cost efficiency, and (3) recovery of advertising revenue. At the same time, the period expense ratio fell to 13.7%, significantly improving operational efficiency. Even considering changes in other income items, the overall operating profit elasticity of +35.5% shows the magnifying effect of structural improvements.

4) User metrics and growth quality. While the 3.2% year-on-year decline in MAU is indeed lower than the subscription metric, it aligns with the industry-wide trend of short-form video content diversion becoming "normalized." The company's strategy is to enhance "the value of each user" through stronger membership tiers (including SVIP/Hi-Fi/Dolby) and scenario expansion (in-car, smart hardware), rather than blindly chasing overall platform activity.

5) Cash flow and capital allocation. Q2 operating cash flow slowed primarily due to working capital timing; the company holds 34.9 billion yuan in net cash/short-term investments, providing ample resources for content copyright acquisition, AI productization, and potential mergers/acquisitions. Notably, media reports indicate that the acquisition of Himalaya (valued at approximately 2.4 billion USD) is still progressing; if finalized, it would strengthen the long-form audio ecosystem, but integration timing and regulatory approvals remain variables.

Valuation Analysis

The current valuation (TTM PE of 27x, forward P/E of approximately 20x) implies an expected annual growth rate of 15%-20%. Given the better-than-expected performance in Q2, the market pricing appears to be fairly adequate, but the potential for further growth in subscription penetration may be underestimated.

Compared to comparable companies such as Spotify (P/E ratio of approximately 96 times, with slowing growth) and NetEase Cloud Music (forward P/E ratio of approximately 34 times, with subscription growth of 25.5% but smaller scale), TME's valuation is more attractive. The potential undervaluation lies in its AI-driven content ecosystem, and if advertising recovery exceeds expectations, it may trigger a revaluation. However, if the social media business continues to decline, market divergence may widen, leading to short-term volatility.

The management's current strategy focuses on optimizing subscriptions without any obvious missteps, but it could amplify its focus on AI content generation and international expansion (such as linking with Tencent's overseas ecosystem) to offset the risk of domestic saturation. There are signs that the company is moving toward platformization, such as attracting third-party developers through open APIs or expanding horizontally into short video and music licensing, similar to Airbnb's expansion from accommodation to experience services. Management should be cautious about over-reliance on Tencent's parent company traffic and strengthen independent brand building.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- BartonBecky·2025-08-13Sounds like there's significant potential hereLikeReport