UNH Is Not Buffett (BRK)'s Surprise, REAL ESTATE Is!

Every time Berkshire Hathaway's 13F filing is released, the market's first reaction is to look for "who Buffett has bought." This quarter, the media spotlight has been almost entirely on his new investment in $UnitedHealth(UNH)$ —after all, the healthcare industry boasts stable cash flow and strong cyclical resilience, and after being hit by multiple events, the stock price has fallen by 70% from its peak. This bottom-fishing move seems very Buffett-like (though his cost basis is at $411, which is essentially "buying at the bottom"). This cost may be relatively higher than that of many investors, but he may continue to bottom-fish in Q3 and further reduce his cost basis.

But if you look closely, you will find that the real highlight is not in healthcare, but in the real estate chain.

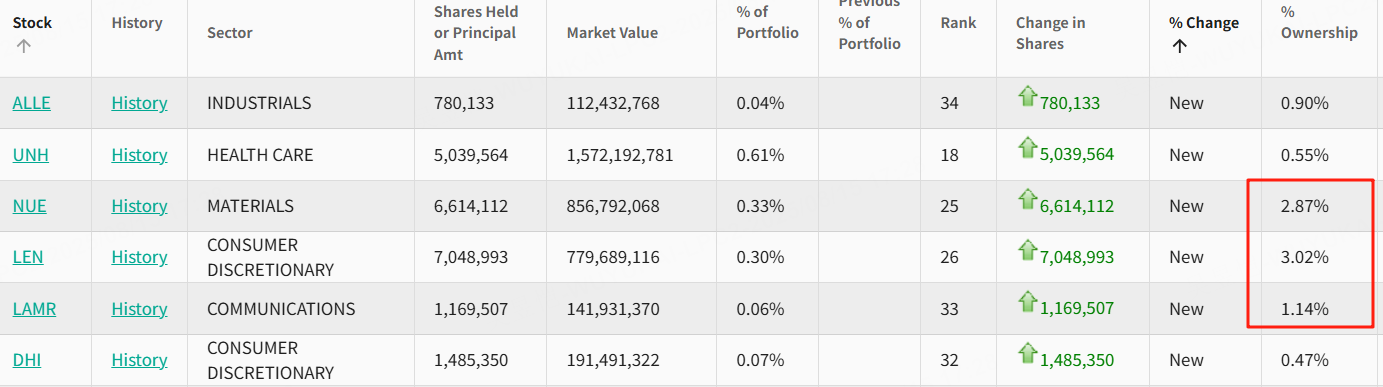

Newly established $D.R. Horton(DHI)$ (a leading real estate developer in the United States), with a market value of nearly $200 million.

Newly added $Lamar Advertising(LAMR)$ a leading outdoor advertising company in the US with core clients including real estate and commercial properties). Although the position is not large, this is a typical "real estate chain supporting" asset.

In addition, new positions were established in $Lennar(LEN)$ and additional holdings were added in certain construction-related assets, paired with the steel leader $Nucor(NUE)$ to form a complete real estate-infrastructure-advertising chain layout.

Many people may ask, is it still worth buying U.S. real estate at rock-bottom prices? It is important to note that while the Federal Reserve has signaled potential interest rate cuts, the lingering effects of high interest rates have not yet fully subsided, and mortgage costs continue to suppress transaction volumes. However, Warren Buffett's approach is "contrarian"—when the market is at a cyclical low and sentiment is pessimistic, he begins to accumulate positions in real estate developers and related services. Clearly, he is not focused on short-term transaction data but rather on the future supply-demand balance and inventory pressure relief over the next 2–3 years.

Even more interesting is Lamar Advertising. This company mainly does outdoor advertising such as highway billboards and large screens in commercial areas, which seems to have little direct connection with real estate. However, real estate and commercial operators account for a very high proportion of its advertising client structure. In other words, if real estate projects start to recover and commercial retail becomes active, Lamar's advertising business will directly benefit. This type of "peripheral rebound + low valuation" target is precisely what Buffett's secondary team excels at.

In contrast, UnitedHealth is undoubtedly a high-quality blue chip stock, but it serves more as a "cash cow" in the portfolio, used to balance volatility and stabilize cash flow. The real estate sector allocation, on the other hand, is more like a preemptive bet on a macroeconomic inflection point—this may reflect his optimistic assessment of continued fiscal stimulus, infrastructure investment, and population migration trends in the United States.

Of course, we cannot overlook his reduction of holdings in $Apple(AAPL)$ and $Bank of America(BAC)$ which were significant positions. One is due to valuation pressure and profit-taking, while the other reflects caution toward the financial cycle. This strategy of selling high and buying low not only recovers cash but also redirects funds toward industries at the bottom of the cycle.

The signals from the secondary market are clear:

Focus on the bottom reversal of the real estate chain—from developers to building materials to advertising services, Buffett may be laying the groundwork for a 2–3-year recovery.

Combined defense and offense—medical care and energy are defense; real estate and infrastructure are offense.

Reducing holdings in high-valuation leaders may be a trend signal — Apple's reduction in holdings should be a warning sign for tech stock investors.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Brando741319·08-16GoodLikeReport