⚠️Core Business Implosion: Meituan Q2 Worse Than Targets, Competition Spirals

$MEITUAN-W(03690)$ Q2 2025 results still surprised a market that had already braced for pessimism. On the surface, the recent slump in the stock price already hinted at investors' simmering discontent, as they waited for management to address the situation.

Q2 revenue saw double-digit growth but still fell short of market expectations; on the profit side, the company lagged significantly due to cutthroat competition, with operating efficiency deteriorating sharply and falling far below analysts' already-revised pessimistic forecasts. The subsidy war in the food delivery battle has spread across the board, forcing the core local services business to "self-deplete" its competitive moat. While management emphasizes long-term strategy and platform ecosystem development, the short-term financial report reflects the reality that current performance is poor, and competition is deteriorating faster than anticipated. A profitability inflection point remains elusive in the near term.

At current price levels, Meituan still needs to await signals of "subsidy wars cooling down + core profitability recovery". Before its growth trajectory becomes clear, it is unwise to hastily increase positions.

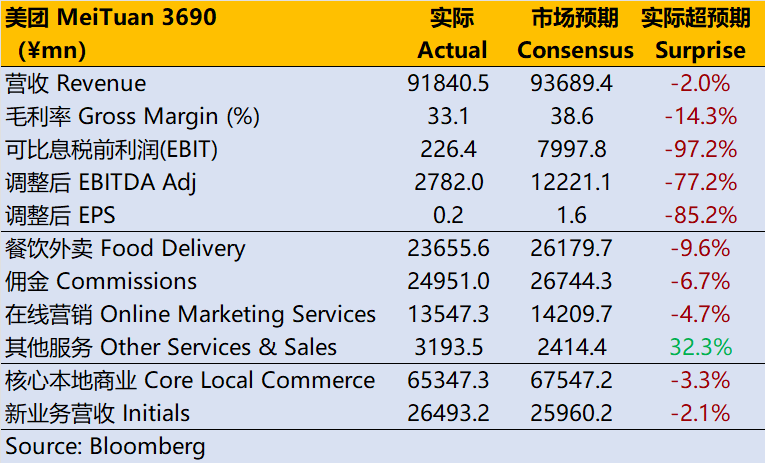

Core Financial Information

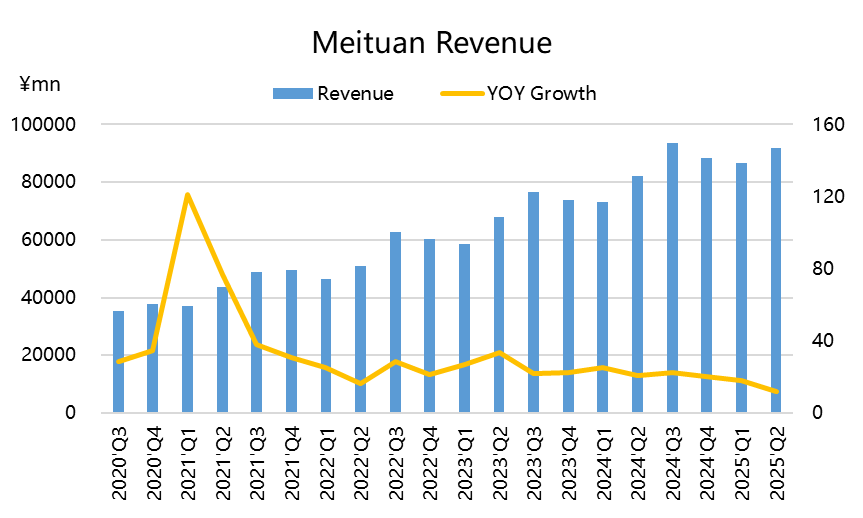

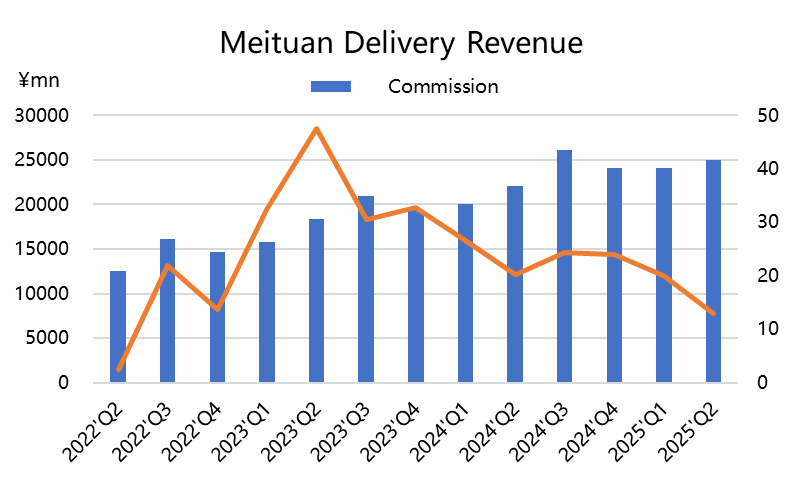

Revenue reached 91.84 billion yuan, up 11.7% year-on-year, falling short of market expectations of 93.69 billion yuan. While overall domestic food delivery order volume continued to grow, average order revenue and commission rates faced pressure due to subsidy-driven competition. The "volume up, prices down" trend accurately characterized Q2 performance. Amidst intense competitive pressures, revenue growth momentum remained challenging to boost.

Other operational metrics include GMV of RMB 115 billion (first half of the year), up 13.1% year-over-year, and 694 million annual active users, up 14.3% year-over-year. AI algorithm optimizations enhanced user experience and marketing efficiency, with outperforming results suggesting increased user stickiness. Within the business structure, high-frequency consumption (e.g., food delivery) maintained stable contribution, while low-frequency segments (e.g., travel) saw rising contributions, indicating diversification.

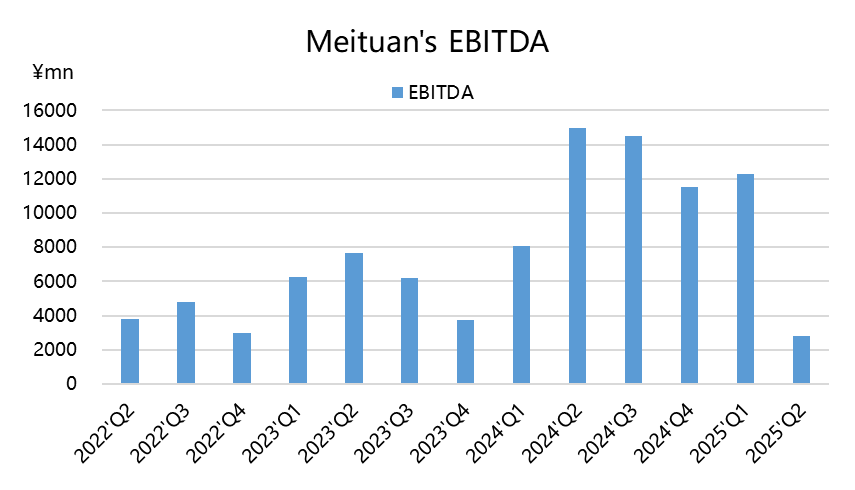

Adjusted net profit came in at just 1.49 billion yuan, significantly below market expectations of 9.85 billion yuan. Of course, market forecasts were neither precise nor fully updated, and Meituan's profit margins have historically been highly volatile. The subsidy war drove soaring customer acquisition and retention costs, with marketing expenses surging 51.8% year-over-year to RMB 22.5 billion. This represented a significant increase in the percentage of revenue allocated to marketing, rising from 18.0% to 24.5%. Profitability has nearly "hit rock bottom," proving far worse than anticipated. This extreme underperformance reflects the core profit model being severely impacted.

Key Investment Considerations

"Preserving market share" but at the cost of "profit destruction"

Revenue +11.7%, but operating profit nearly wiped out, with adjusted metrics plummeting. This trend may persist not only in Q2 but also into Q3, as the food delivery war rages on. Q2 saw intense competition primarily with JD.com, while Q3 marks the onset of aggressive subsidies from Taobao Flash Sale. (Previous reports indicated Q3 Flash Sale weekly order volumes would reach approximately 67-68 million). The relentless pursuit of market share through subsidies will erode cash recovery periods and unit economics over the long term. While Meituan's Q2 profits were nearly wiped out, Q3 could potentially see losses.

Short-term GMV/order growth cannot replace the necessity of profit recovery.

Competitive Landscape in the "Burn Phase": Uncertainty Surges

Beyond food delivery, commission and advertising revenue in the local services segment also saw slower growth, both falling short of market expectations. This indicates that as competitors captured a portion of order volume, related advertising businesses were similarly impacted—not to mention the in-store services segment, which was already facing competition from Douyin. Of course, the food delivery business inherently competes with in-store services as well.

Overseas and new business segments continued to see increased investment (new business revenue +22.8%, but losses widened). External markets (such as Brazil and Saudi Arabia) require high capital outlays and face regulatory challenges/local competition, resulting in significant uncertainty regarding return on capital.

The instant retail sector has entered

Multiple players in the industry continue to subsidize their delivery radius and fulfillment networks to gain market share. This practice depresses industry profit margins and heightens user sensitivity to low prices, creating a difficult-to-recover "price anchor." Should Meituan choose to counter competitive promotions, it risks becoming trapped in a state of low profitability over the long term.

Concerns over the deteriorating efficiency of capital utilization

Although cash and short-term investments remain ample (cash ≈ ¥101.7 billion, short-term investments ¥69.4 billion), substantial operating cash is being allocated to subsidies, infrastructure fulfillment, and overseas expansion. This will prolong the return cycle and increase future capital requirements or the inevitability of external financing (with heightened risks of rising financing costs should market conditions deteriorate). The key question for Meituan now is: "Should it spend its cash reserves?"

Structural risks from rising regulatory and labor costs

The company has increased expenditures on rider protections and occupational injury compensation. Should future legislation or local government regulations further enhance rider benefits or impose restrictions on algorithmic dispatch, unit labor and fulfillment costs will rise further—this poses a long-term negative impact on the unit economics of instant food delivery. The scenario where Meituan is compelled to shoulder greater compliance costs cannot be overlooked.

Mismatch between valuation and market expectations

If the market had previously anticipated "platformization and a return to high profit margins," the collapse in Q2 profits would trigger a revaluation. Reuters reports have already signaled revenue falling short of expectations, increasing short-term stock price pressure and liquidity sell-off risks. Should the company fail to provide a clear profit recovery path in the next quarter, the downside valuation risk becomes significant.

Key points to note are as follows:

Unit fulfillment cost (per-order fulfillment cost) and subsidy rate: If no significant decline occurs within three months, profit recovery is unlikely.

Core Local Business Operating Margin Recovery Timeline: Has management provided clear milestones for bottleneck resolution (e.g., subsidy reduction levels, fulfillment efficiency improvement percentages)?

Monthly/Quarterly Loss Variation in New Business Segments (Instant Retail/Overseas): Monitor whether losses are showing a sustained contraction.

Cash Utilization Plan and Capital Expenditure Rhythm: Whether to initiate capital contraction or optimization for overseas expansion or Lightning Warehouses.

Policy Changes Related to Regulatory Oversight and Rider Costs: Should regulations be further strengthened, the unit economics will be permanently altered.

(If three or more of the above items show no improvement, prepare to reduce positions or cut exposure.)

Scenario Testing

Moderately Pessimistic: Competition persists for 2–3 quarters; companies maintain subsidies to preserve market share → Core operating margins hover within a narrow range of 3–6%, with adjusted EBITDA remaining at low levels → Valuations may continue to compress by 10–20%.

Severe Pessimism: Intensifying industry price wars coupled with regulatory mandates for universal rider welfare improvements → Permanent 10–20% increase in per-unit fulfillment costs; Persistent losses in new business lines → Requiring greater cash burn/financing, leading to equity dilution or higher leverage, with valuation re-rating declining over 20%.

Both scenarios hinge critically on guidance following Q3 (regarding when subsidies will end). Should management fail to provide a clear and quantifiable path to profit recovery in the next fiscal quarter, the probability of the pessimistic scenario increases significantly.

To reiterate, the core issue with Meituan's Q2 performance isn't "growth concerns," but rather "how long the erosion of profits and cash burn will persist." Domestic food delivery revenue is declining, while overseas operations continue to expand—yet these efforts are being swallowed up by heavy subsidies and expansion-driven losses.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- JayToddie·2025-08-28Hmm, seems like Meituan will be down long term. Crawling back up should be difficult- I don’t see any clear long-term plan. It’s hard to fathom that it’s relying on anything else other than a temporary stronghold that’s slipping up.LikeReport

- huuou·2025-08-27This sounds like a tough situation for Meituan.LikeReport