October's U.S. Stock Market Downturn Pattern in Effect: Will the Adjustment Surpass April's?

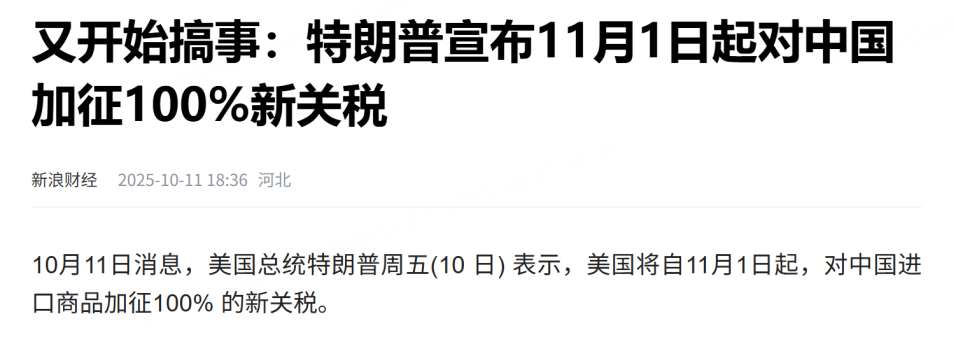

The October time window has arrived again. During the National Day period, we already reminded everyone to pay attention to the special news that often occurs at this time, as it tends to trigger significant volatility in the U.S. stock market. Since the tariff war began, most of the top ten countries and regions trading with the U.S. have reached framework agreements with the United States (though actual implementation details remain unclear). However, the most critical issue—the China-U.S. tariff dispute—has had many positive signals but little substantive progress (such as China restarting purchases of U.S. agricultural products and tariffs on fentanyl). Therefore, when President Trump announced on Friday evening to double tariffs on Chinese goods, it was not too surprising, as the parties had, in reality, merely "held a few talks." It is foreseeable that the U.S. stock market's October trajectory will be directly linked to developments in the China-U.S. tariff issue, to the extent that even the Federal Reserve's interest rate meeting may become less important. With talks still scheduled before tariffs come into effect on November 1, many uncertainties remain. If a deal is reached, everyone will celebrate and continue to hype expectations for further Federal Reserve rate cuts; if talks fail, current market adjustments will only be the beginning.

If negotiations fail, the extent of the U.S. stock market correction will likely be influenced by the ongoing mixed and intermittent nature of the China-U.S. discussions. Here, we focus only on the technical possibilities should talks break down, to help set psychological expectations. Fundamentally, compared to the situation in April, the damage inflicted now would likely be less severe. In April, the U.S. applied tariffs globally to many trading partners with a much broader scope, and the impact was still unclear in the short term. The worst-case scenario now would be a complete trade decoupling between China and the U.S., but this scenario has already been rehearsed multiple times by the market. Hence, market sentiment is unlikely to become overly aggressive. Furthermore, in April, U.S. economic data was still decent, and the Federal Reserve was reluctant to cut rates; however, the Fed has since resumed a path toward rate cuts, and a looser monetary policy is providing some cushion against stock market declines. Therefore, the market drop in October should be less severe than that in April. However, if the conflict escalates to broader areas such as financial warfare, then policies would need to be reassessed accordingly.

Technically, the long-term bull market lifeline for the U.S. stock indices remains the 20-month moving average. Current levels hover around 5,900 on the S&P 500, and a rapid drop to this level often encounters strong support. The situation is similar to that in April, so it is advisable for investors to prepare psychologically for this. Given the back-and-forth nature of the news, it is wise to let market uncertainties "linger" a bit longer, as attitudes may shift again in a few days. Additionally, it is worth noting that if risks continue to rise, the market may seek cheaper safe-haven assets. Since gold prices are already relatively high, the market might shift towards holding cash or currencies, which could lead to a faster risk-off rise in the U.S. dollar index—a development worth monitoring.

$E-mini Nasdaq 100 - main 2512(NQmain)$ $E-mini S&P 500 - main 2512(ESmain)$ $Micro E-mini Dow Jones - main 2512(MYMmain)$ $Gold - main 2512(GCmain)$ $WTI Crude Oil - main 2511(CLmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- IreneWells·10-14It's crucial to stay vigilant during October's volatility.LikeReport