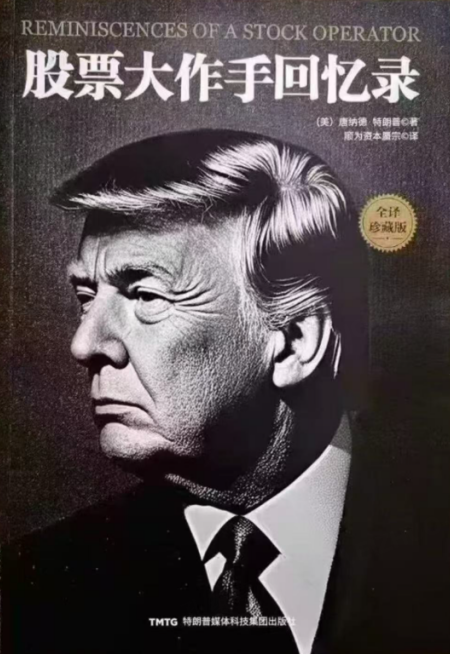

“The Market Operator" Trump Acts Again: Will He Mess Up This Time?

The president who most enjoys disrupting markets, Trump, has made a move again this past weekend. As the saying goes, his actions were fierce and fast, and he seems to read the market’s rise and fall like a true master. After stirring turmoil—especially in the cryptocurrency space—with his provocative tweets, he then reassured the market by saying "it’s nothing," which helped trigger a rebound. After several rounds of toying with market sentiment, the question now is: can this tactic still work this time?

We have previously emphasized two main factors likely to influence the market: one is Trump’s own health condition and the internal uncertainties it brings to the US; the other is the evolving relationship between China and the US. Of course, the trigger for the China-US relationship changes also depends on decisions made by Trump himself. Hence, after seeing the potential start of a new tariff war last weekend, both the stock market and the crypto market experienced shocks. But whether this will lead to a sustained decline or even a trend reversal depends on concrete actions, since Trump is famously known for his talk rather than action.

To be more specific, we can judge from both the news and market trends. On the news front, the focus naturally is on the APEC meeting scheduled for the end of this month or early next month. Whether the two major country leaders will meet and the developments from this will clarify how China-US relations will unfold towards the year-end and into next year. If they continue to be hostile, then prepare for tough times ahead. If Trump shows some tact and softens his stance, then the market’s joyful momentum may continue.

From a market trend perspective, the reference points remain unchanged. First is the crypto market: both BTC and ETH closed weak weekly last week. If a similar pattern persists this month, it at least signals a short-term peak, which combined with news could signify a major top. Continued weakness after a rebound is also a negative sign. Next, watch silver's movements. Continuous new highs suggest the overall market preference is still solid; if silver fails to break new highs and reverses, that will be an early bearish indicator. Notably, if silver hits a peak in past cycles, its subsequent declines have been swift and severe, making this an important direction to watch closely.

Finally, consider the market leader Nvidia. Last week’s candlestick showed a surge followed by a drop but not enough to disturb the bullish market structure. We need to see a break below 164 before declaring this rally over and the broader equity risks clearly emerging. Naturally, the performance of these assets is closely tied to Trump’s attitude and choices. It wouldn’t be an exaggeration to say he alone can roil the market with a single word.

For our own approach, we continue to follow our established practice: do not chase highs, only buy on dips after sufficient declines; choose to go long on relatively strong stocks while hedging weaker ones; for range-bound stocks without clear trends, buy low and sell high around key support and resistance levels. In summary, adopt a relatively conservative stance given how easily this market is affected by news and sentiment shifts. Once it is clear that China-US relations have deteriorated irreparably or if Trump’s condition suddenly worsens, then consider a broad strategy of selling into rallies. Until then, respect the prevailing trends.

$E-mini Nasdaq 100 - main 2512(NQmain)$ $E-mini S&P 500 - main 2512(ESmain)$ $Micro E-mini Dow Jones - main 2512(MYMmain)$ $Gold - main 2512(GCmain)$ $WTI Crude Oil - main 2511(CLmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- JackPowell·10-15It’s wise to stay cautious; Trump’s unpredictability can really shake things up at any moment.LikeReport

- JimmyHua·10-16TACO manLikeReport