Walmart Stock Hits a Record High! How to buy the bottom with the Buy Write strategy?

Walmart U.S. stocks rose nearly 5% on Tuesday to close at a record high of $107.21 as the company became the latest company to announce a partnership with OpenAI. Walmart said customers will be able to shop and purchase items directly through the ChatGPT platform using the "instant checkout" feature. In addition, on Walmart's main website and Sam's Club website, customers can also engage in conversational interaction with ChatGPT through the search bar.

CEO Doug McMillon said in a press release: "For many years, the e-commerce shopping experience mainly consisted of a search bar and a long list of product results. This is about to change. In the future, there will be a native AI shopping experience that is multimedia, personalized, and context-aware." For his part, OpenAI co-founder and CEO Sam Altman said the AI startup is "very excited" about working with Walmart and wants to "make everyday shopping a little easier."

$Walmart (WMT) $The amount of the deal was not disclosed, but the partnership is part of the company's broader AI strategy. Doug McMillon said the company is rapidly moving towards a "more enjoyable and convenient future" through its AI shopping assistant "Sparky" and collaborations like this one. Wal-Mart is also continuing to expand its e-commerce and delivery business. The profitability of Wal-Mart's e-commerce business in the United States further improved in the second quarter, and the business achieved profitability in the first quarter.

Recently, OpenAI has frequently reached cooperation transactions. The startup has formed partnerships with AI infrastructure vendors and chipmakers including AMD (AMD.US) and Broadcom (AVGO.US). Nvidia (NVDA.US) also announced plans to invest up to $100 billion in OpenAI at the end of September.

OpenAI's partners aren't limited to chipmakers. The company is also piloting app and e-commerce platform integration projects with enterprises including Etsy (ETSY.US) and Shopify (SHOP.US).

Investors who are bullish on Walmart can consider using the Buy-Write strategy.

Policy Structure: Buy-Write Policy

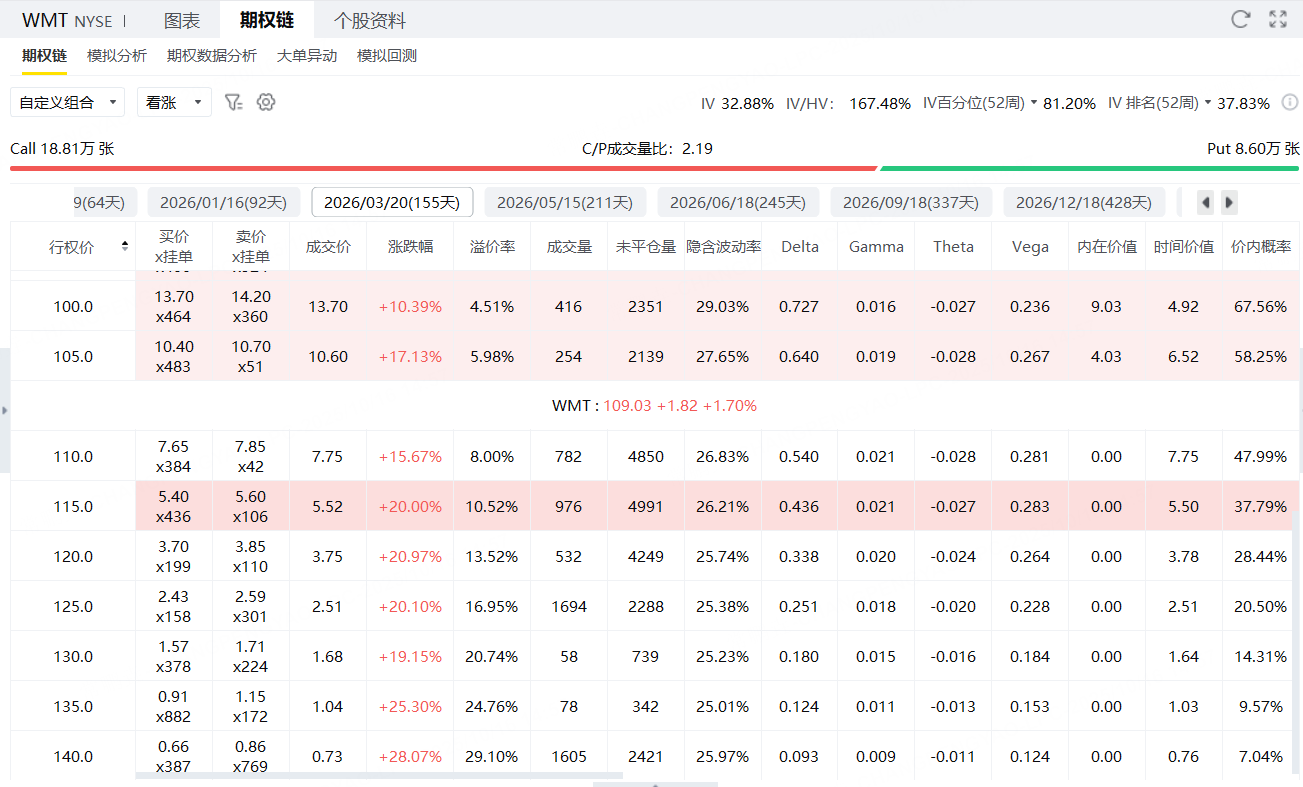

Walmart's stock price is $109, buy 100 shares, and sell the call option with an expiration date of March 20, 26, and 155 days to expire, with an exercise price of 115 and premium 552.

Underlying Asset: Walmart (WMT)

Current stock price: $109

Position: Buy 100 shares

Put option: Call option (Call)

Strike price: $115

Expiration date: March 20, 2026 (approximately 155 days away)

Premium received: $552 (100 shares per contract)

Cost of building a position and initial cash flow

Cost of buying 100 shares: 109 × 100 =US $10,900Income from selling options:+552 USDNet investment: 10,900-552 =US $10,348

Possible outcome at expiration

1. Stock price ≤ $115 (option not exercised)

Investors keep the stock and receive the full premium gains:

Stock market value: stock price × 100

Total income = premium + (stock price-109) × 100

If the stock price remains at $109: total return = $552 (about 5.3% return, held for 155 days) converted annualized rate of return ≈12.5%

2. Stock price > $115 (option exercised)

Investors need to sell the stock at $115. Gross revenue due = 115 × 100 + 552 =US $11,552Initial input = $10,348Maximum gain = 11,552-10,348 = $1,204

Corresponding return = 1,204/10,348 =11.6%Converted annualized rate of return ≈27.3%(This is the upper income limit of this strategy)

3. Break-even point

= Stock purchase price-premium per share = 109-(552 ÷ 100) =$103.48

When WMT fell below $103.48, the overall loss started.

sum up

This deal is typicalBuy WritingStrategy, with an overall investment of US $10,348.

At expiration, if Wal-Mart's stock price is below $115, the option will not be exercised, and the investor keeps the stock and gets a premium gain of $552, a return of about 5.3%, which translates to an annualized rate of about 12.5%.

If the stock price exceeds $115, the stock will be exercised and sold, resulting in a total return of $1,204, corresponding to an 11.6% yield, which is about 27.3% annualized, which is the highest return of this strategy.

When the stock price falls below $103.48 (that is, the bid price minus premium), the overall loss begins.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.