Sea's Q3 Growth-First Strategy: Bold Vision or Reckless Bet?

Southeast Asian tech giant $Sea Ltd(SE)$ released its third-quarter financial results for the period ending September 30, 2025, on November 11 (pre-market) Eastern Time.

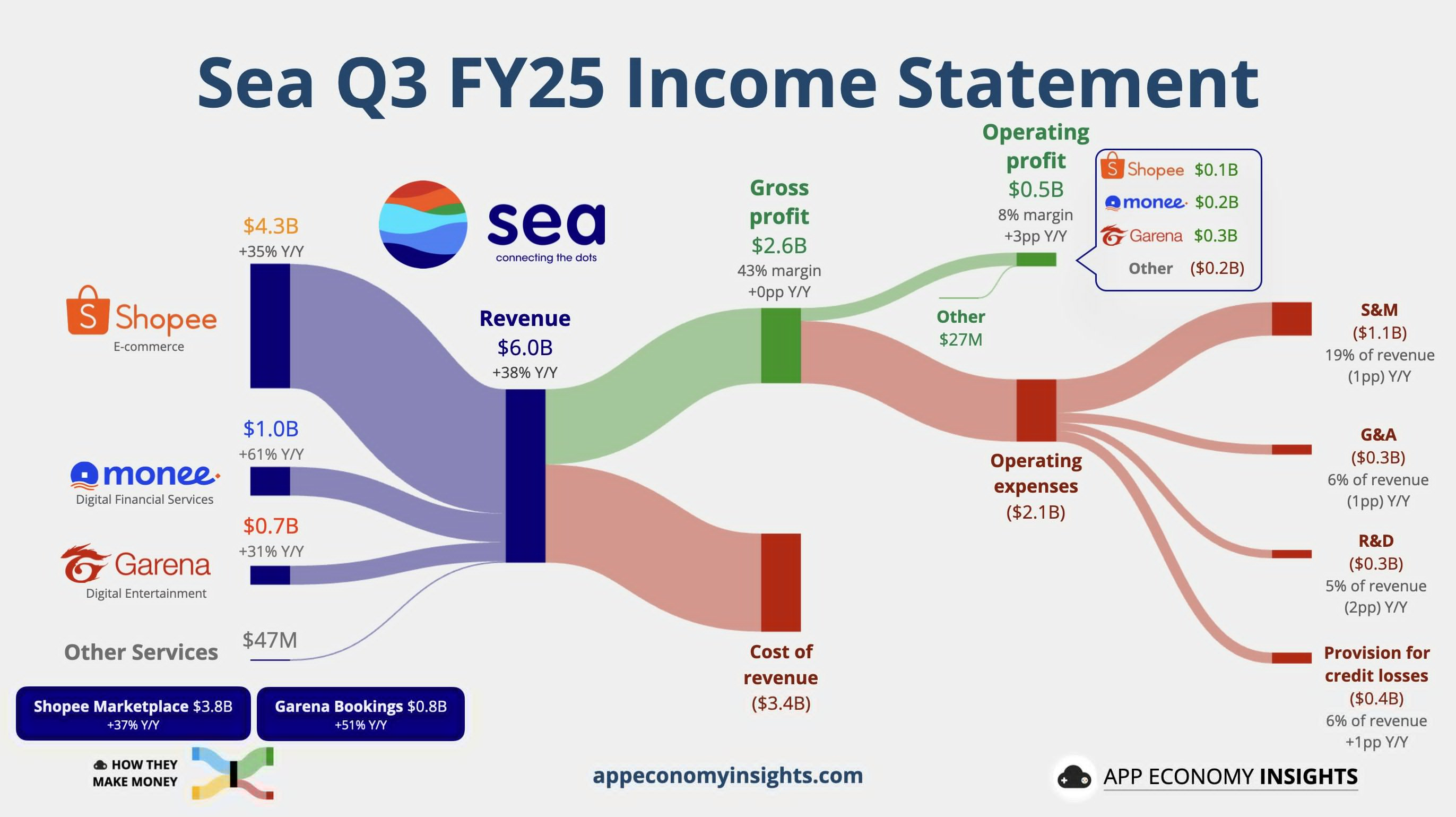

Overall, this earnings report presents a stark sense of dichotomy: On one hand, all three major business segments are surging ahead, with total revenue significantly exceeding expectations and both core e-commerce GMV and game bookings achieving robust growth. On the other hand, GAAP earnings per share (EPS) unexpectedly fell well below market consensus, triggering an over 8% drop in the stock price.

Sea's latest pivot between "growth" and "short-term profits" appears to leverage the robust recovery in gaming and financial services to fund larger investments in e-commerce—particularly logistics and new markets—while also raising concerns among market investors currently more sensitive to profit margins and monetization levels.

Earnings Review

1. E-commerce (Shopee): Strong GMV growth, but profit margins under pressure

Shopee's operational metrics remained robust this quarter. Its GMV (Gross Merchandise Value) grew 28.4% year-over-year to reach $32.2 billion, while total order volume also increased by 28.4% to 3.6 billion orders. On the revenue front, Shopee's GAAP revenue reached $4.3 billion, up 34.9% year-over-year, reflecting a sustained improvement in its take rate. This growth was primarily driven by contributions from advertising and value-added services.

However, this robust growth is not without underlying concerns. Despite impressive revenue figures, data indicates that the e-commerce segment's adjusted EBITDA ($186 million) surged year-over-year but fell short of some analysts' expectations. This suggests that Shopee's profit margins are under pressure as it grapples with intensifying market competition—particularly in Southeast Asia and Brazil—and substantial investments in its self-operated logistics network (SPX), which now handles over 50% of its orders.

2. Games (Garena): Strong recovery, with bookings returning to high growth

Garena undoubtedly stands out as the biggest highlight in this season's financial report. After several quarters of adjustment, Garena has achieved its "best quarter since 2021."

Bookings surged 51.1% year-over-year to $841 million, significantly exceeding market expectations. This growth was primarily driven by Free Fire's successful activation of its user base through collaborations with renowned IPs such as Squid Game and Naruto. Garena's quarterly active users (QAU) remained stable at 671 million this quarter, while quarterly paying users (QPU) surged 31.2% year-over-year to 65.9 million. The paying user ratio increased from 8.0% to 9.8% compared to the same period last year, and ARPU (average revenue per user) rose from $0.89 to $1.25, demonstrating a healthy recovery with both volume and pricing improving.

3. Finance (SeaMoney): Loan volume surged while risk control remained stable.

As the Group's second growth curve, SeaMoney continues its rapid expansion. GAAP revenue surged 61% year-over-year this quarter, reaching $990 million.

The core driver of its growth stems from its lending business, with loans outstanding surging to $7.9 billion at quarter-end—a 70% year-over-year increase. Despite this rapid expansion in loan volume, the company's risk management appears effective, maintaining a low non-performing loan (NPL) ratio of 1.1% for loans over 90 days past due, unchanged from the previous quarter. This indicates that SeaMoney's risk control model has not yet shown significant flaws as it expands its financial services footprint.

4. Overall Profitability: Total revenue significantly exceeded expectations, but EPS fell far short of projections.

From a group-wide financial perspective, total GAAP revenue grew 38.3% year-over-year to $6 billion, significantly exceeding market expectations of $5.6 billion to $5.7 billion. Adjusted EBITDA also reached $874 million, up 68% year-over-year, similarly surpassing projections.

However, the market's focus has shifted to GAAP EPS. This quarter's EPS came in at just $0.59, representing a significant increase from $0.24 in the same period last year, yet falling well below the market's consensus estimate of $1.02 (with some forecasts as low as $0.74).

This situation of "revenue growth without corresponding profit growth" is primarily attributable to the company's aggressive growth strategy in its e-commerce business, ongoing investments in logistics, and intensifying market competition.

Earnings Guidance: E-commerce Forecast Raised; Management Reiterates "Growth First" Approach

During the earnings conference call, management conveyed a relatively optimistic outlook and reiterated its "growth-first" strategy.

Shopee: The company has raised its full-year 2025 GMV growth guidance from the previous "20%" to "over 25%."

Garena: Maintains its full-year guidance for bookings growth of "over 30%."

Management stated during the conference call: "We will continue to prioritize growth... Expanding our addressable market and market share will pave the way for maximizing our long-term profitability."

We believe this statement confirms market speculation: Sea is leveraging Garena's recovery and SeaMoney's profitability to fuel Shopee's "next battle," while short-term EPS fluctuations represent a strategic cost the company has consciously chosen to bear.

Key Investment Considerations

Overall, Sea's Q3 2025 earnings report mirrors the previous quarter: growth exceeded expectations (particularly in e-commerce and gaming), but profits faced pressure due to high investment. While the performance itself shows no fundamental change, market sentiment has clearly shifted.

I. Shifting Market Preferences

Last quarter, the market responded positively to the "high investment + high growth" strategy, driving a significant surge in stock prices as it was interpreted as "the company increasing investment due to optimistic outlook." This quarter, however, the same combination has led to stock price volatility, with the market interpreting it as "declining profit certainty." This reflects the current macroeconomic environment, where overall market preference for uncertain long-term prospects is diminishing, while preference for immediately visible profit certainty is increasing.

II. Shopee: With the Battle in Brazil Raging, Is Logistics a "Painful Transition" or a "Moat"?

The market's core concerns about Shopee's profit margins were confirmed this quarter.

Intensifying Competition: While Southeast Asia's local competitive landscape remains relatively cooperative (with coordinated price hikes), the Brazilian market—contributing roughly 15% of GMV—is becoming exceptionally fierce. Local leader Mercado is actively countering by lowering tax-exempt thresholds and subsidizing low-priced products (Shopee's stronghold) to reclaim market share, with initial success already evident (as evidenced by MELI's accelerated Q3 order volume and GMV growth).

Logistics Investment: To counter competitive pressures and solidify its long-term competitive edge, Shopee must increase investment in its self-operated logistics network. While fulfillment investments may suppress short-term profits, they are essential for building competitive barriers in the e-commerce business over the long term. As long as monetization rates don't decline due to vicious competition, medium-to-long-term prospects remain sound.

Flawed Signal: However, the fact that "order volume growth failed to accelerate" this quarter is indeed a less-than-ideal signal. Close attention must be paid to whether "price and volume" can return to equilibrium going forward.

III. Garena and SeaMoney: Solid Foundations, Untapped Potential

Garena: Although the fundamental issue of lacking new blockbuster games remains unresolved, two successful IP collaborations this year demonstrate the company's exceptional operational capabilities. This proves its ability to ensure the longevity of its flagship game Free Fire, enabling it to consistently generate cash flow.

SeaMoney: Continues to deliver robust growth exceeding expectations and maintains stable non-performing loan levels. While expanding into new markets and customer segments (potentially with lower interest rates) may temporarily compress profit margins, we believe SeaMoney's profitability and market potential remain underestimated and undervalued by the market.

IV. Valuation Analysis: Value Anchors Under the SOTP Model

Before the earnings release, Sea's P/E ratio stood at around 73 times. Such a high valuation clearly reflects the market's near-perfect growth expectations. Using the previous SOTP (Sum-of-the-Parts valuation) approach, assuming current growth rates and profitability levels are maintained, the gaming segment would be valued at 13 times adjusted net profit, the e-commerce segment at 20 times EV/EBITDA, and the financial services segment at around 20 times adjusted net profit. After excluding headquarters costs and adding back net cash, the neutral valuation is estimated to be approximately $160 per share.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Venus Reade·2025-11-12Closed below 200 DMA in a heavy volume, never a good sign. I do believe this will find support around 120 and hopefully make a base there for an upside more in January… fongers crossed1Report

- Enid Bertha·2025-11-12Average PT from 36 analyst is $195 Analysts defend amid post earnings slide - represents a 25% upsideLikeReport