First Post‑Shutdown Nonfarm Report: A Decisive Moment for Markets

The most important event this week is the release of the first nonfarm payrolls report following the shutdown of the U.S. government. This September nonfarm payrolls report was originally scheduled for release in early October, but due to the U.S. government shutdown it has been postponed to 21:30 Beijing time on November 20.

At this stage, the market is unable to fully anticipate this report; after all, with a report coming after a 40‑day shutdown, nobody knows the path of the data from here or how much impact it will have on the Federal Reserve’s rate‑cutting process.

According to probability data from CME’s FedWatch tool, the odds of a rate cut versus no cut in December have already narrowed to roughly fifty‑fifty, and the public statements by Federal Reserve officials are also highly divided.

If the Fed does not cut rates in December, that would significantly upend the market’s expectation of continued rate cuts, reversing the earlier optimism and triggering substantial volatility.

As a result, market swings next week are likely to be large in either direction.

Hedging strategies for U.S. equity indices.

Although it is still unclear whether the nonfarm payrolls data will prove positive or negative for the market, it is always right to prepare for risk.

In last Thursday night’s live stream, a strategy was explained for using equity index futures to hedge risk, with the core idea being to use the relative strength and weakness among different indices to offset losses.

When risk events hit, all four major U.S. equity indices tend to fall together, but there will usually be one index that falls more and rises less, and by shorting that weaker index it is possible to protect one’s securities portfolio during the decline while keeping losses relatively smaller during any rebound.

The four major U.S. equity indices are the Nasdaq, the S&P, the Dow, and the Russell 2000, and each of these indices has its own futures contracts. In the live stream it was suggested that when the Nasdaq breaks below 25,200, a short position in Russell 2000 index futures should be taken as a hedge.

After the live stream, U.S. equity indices promptly slumped on Thursday night; although some ground was bought back on Friday night, the moves were still enough to leave everyone quite worried.

Once the hedge has been implemented, there is no need in the short term to rush decisions on increasing or reducing the stock portfolio, which leaves ample time to observe how the indices move before making any adjustments.

At present, the weakest of the U.S. equity indices is the Russell 2000 index (the method of making this assessment was explained in detail during the live stream).

From a technical standpoint, the Russell 2000 index fits very well with the head‑and‑shoulders top pattern described in Dow Theory, and the measured‑move calculation suggests there is still about 7.5% downside remaining.

What is the outlook for precious metals?

The Federal Reserve’s stance on rate cuts has a direct impact on the trend in precious metals. Last week precious metals staged a violent rebound but then quickly pulled back again, making trading more challenging; in this Thursday’s 8 p.m. live stream, the corresponding trading strategies will be analyzed together with everyone.

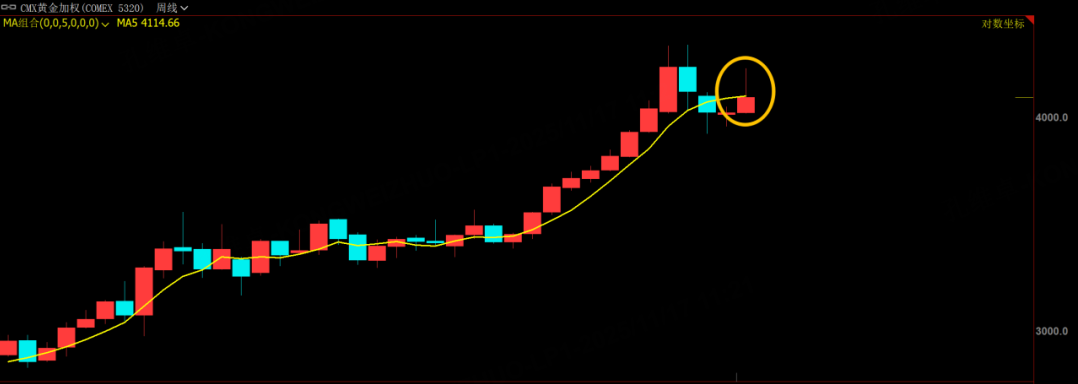

As for the current trend in precious metals, taking gold as the benchmark, its price has not yet moved convincingly above the 5‑week moving average (the 20‑day moving average).

It will therefore be necessary to watch how things develop next week; if, after Thursday’s nonfarm payrolls release, the market reaction is negative, that would indicate that this round of correction in precious metals is still not complete, and the next important support level would be around 3,700. For friends who are hoping to buy the dip, the advice is to stay patient for now and wait until after Thursday’s nonfarm payrolls data are released to decide on trades based on the situation—there is no rush。

$E-mini Nasdaq 100 - main 2512(NQmain)$ $E-mini S&P 500 - main 2512(ESmain)$ $E-mini Dow Jones - main 2512(YMmain)$ $Gold - main 2512(GCmain)$ $WTI Crude Oil - main 2601(CLmain)$

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- FrankRebecca·2025-11-20Nonfarm data crucial for gold's next move. Mind the support at 3700 [吃瓜]LikeReport