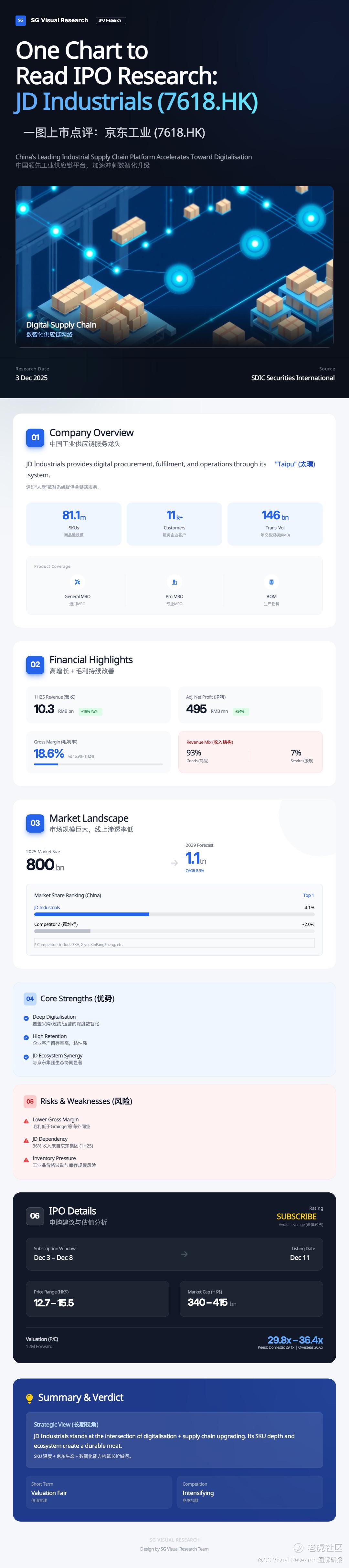

JD Industrials IPO: China’s No.1 Industrial Supply Chain Platform — Worth Subscribing?

JD Industrials (7618.HK) — often called “China’s No.1 industrial supply chain platform” — is finally coming to market.

Here are the key takeaways from the latest IPO review:

🔹 Huge Market Opportunity

China’s industrial supply chain market is heading toward RMB 1.1 trillion by 2029, with low digital penetration.

🔹 Strong Platform Fundamentals

Over 81 million SKUs, 11,000+ enterprise clients, and the largest share in China’s MRO/B2B industrial segment.

🔹 Solid Growth Trend

1H25 revenue +19%, improving gross margin (18.6%), and rising adjusted profit.

🔹 JD Ecosystem Advantage

Integrated logistics + supply chain + fulfillment give JD Industrials a real moat.

But there are risks:

⚠ Gross margin still lower vs global peers

⚠ Heavy reliance on JD Group (36% of revenue)

⚠ IPO valuation at ~30–36× PE isn’t cheap

Bottom line:

It’s a long-term structural story with a strong ecosystem behind it —

but the IPO pricing isn’t a bargain.

Analysts’ verdict: Subscribe, but avoid leverage.

Would you join the IPO?

Or wait for a better entry point?

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.