Summary

In the past two days, there was an unexpected accumulation of long positions, resulting in a stampede and mass sell-off.

The market's expectations for advertising revenue were too high, and it couldn't make up for the losses caused by cracking down on shared accounts.

Profit unexpectedly increased, but the valuation still remains far higher than the industry average.

There is still a favorable factor in quite near future that can bring in a massive amount of inflows.

On July 19th, after-market trading, $Netflix(NFLX)$ as the first major tech company to announce its Q2 financial results during the "Earnings Month," got off to a bad start, tumbled more than 8% during the after-hours volatility, erasing the gains made by optimistic investors in the three days leading up to the financial report.

Q2 Earnings Overview

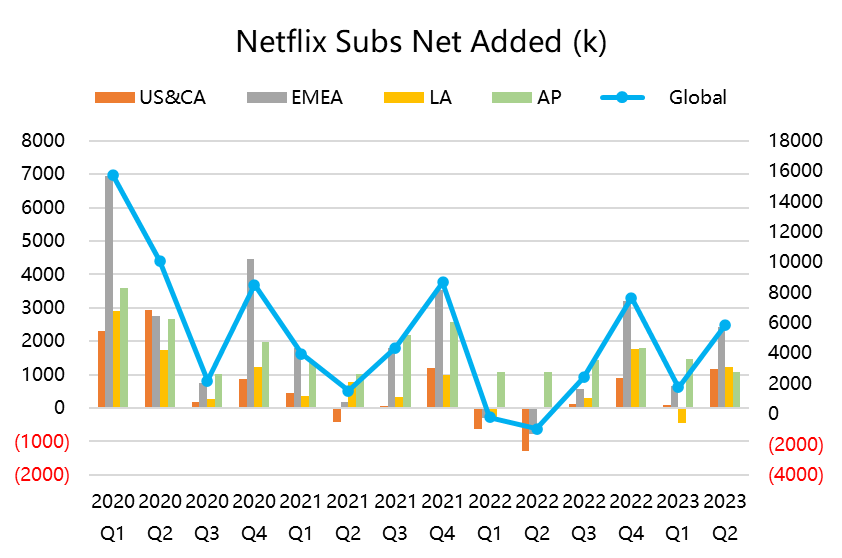

In terms of users, the global number of streaming paid subscribers reached 238 million, with a year-on-year growth of 8%. The number of new paid subscribers was 5.89 million, significantly higher than Q2 and far exceeding the market's expectation of 2.07 million. This growth rate was the second best since the outbreak of the pandemic and marked the fourth consecutive quarter of sequential growth since the unexpected sharp decline in Q1 last year.

Among them, the United States and Canada added 1.17 million new subscribers, Europe, Middle East, and Africa added 2.43 million, Latin America added 1.22 million, and the Asia-Pacific region added 1.07 million.

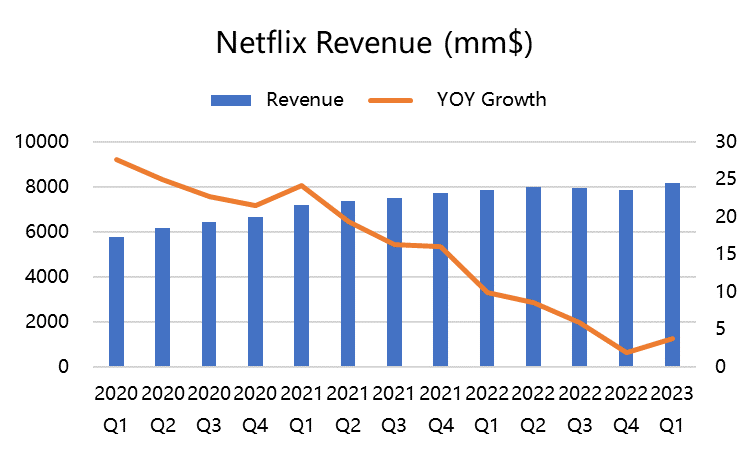

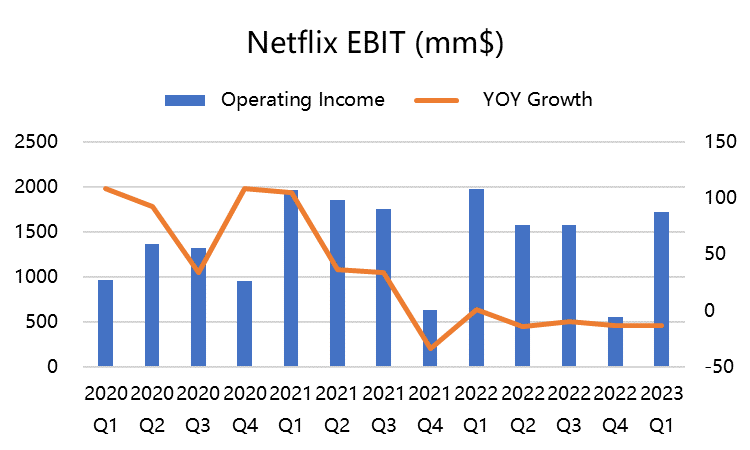

In terms of Income sheet, the revenue was $8.187 billion, with a year-on-year growth of 2.7%, which was lower than the market's expectation of $8.3 billion. The company's costs and expenses were optimized, and the gross margin increased from 41.1% in Q1 to 42.9%, and the operating profit margin rose from 21% in Q1 to 22.3%.

The operating profit was $1.83 billion, with a year-on-year growth of 22.3%, higher than the 21% of the previous quarter and above the market's expectation of $1.59 billion. The net profit was $1.488 billion, and the diluted EPS was $3.29, exceeding the expected $2.86.

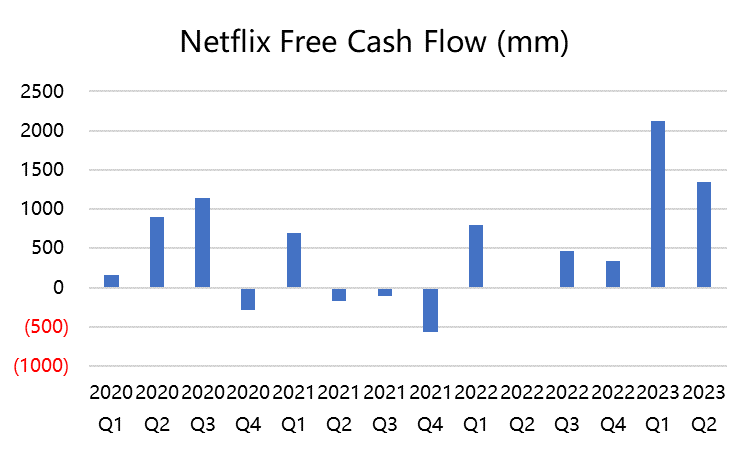

As for assets, the cash used for operating activities was $1.44 billion, down from $2.179 billion in Q1; the free cash flow also decreased from $2.117 billion in Q1 to $1.339 billion. In Q2, Netflix repurchased 1.8 million shares, costing $645 million, with $3.4 billion remaining for buybacks.

Guidance of Q3

Specific numbers for the number of subscription users were not provided, only mentioning that it would be similar to the growth in Q2, which is around 5.8 million subscribers. The company has downplayed the significance of this number, and the market is no longer as sensitive to it.

Meanwhile, the company expects Q3 revenue to grow substantially by 7.5% year-on-year to $8.52 billion, but it is still lower than the market's expectation of $8.67 billion; the operating profit is expected to grow by 22.2% year-on-year to $1.89 billion, and the net profit will increase to $1.58 billion, with diluted EPS of $3.52, higher than the market's expected $3.23.

Investment Highlights

Netflix's 8% post-market decline was not a one-time event but rather occurred gradually during several hours of after-hours trading. Therefore, the information shared during the conference call is crucial.

Firstly, the unexpected success in surpassing the number of subscription users is closely linked to the crackdown on shared accounts and has achieved good results. Although restricting account sharing might lead to some users canceling their subscriptions, the foundation of the subscriber base remains relatively stable.

What truly disappointed investors was the weak revenue, which was lower than expected.

On one hand, it might be due to the advertising revenue not meeting the market's high expectations. However, Netflix has not yet disclosed its advertising business separately, making it difficult for outsiders to observe the growth trend of its advertising business.

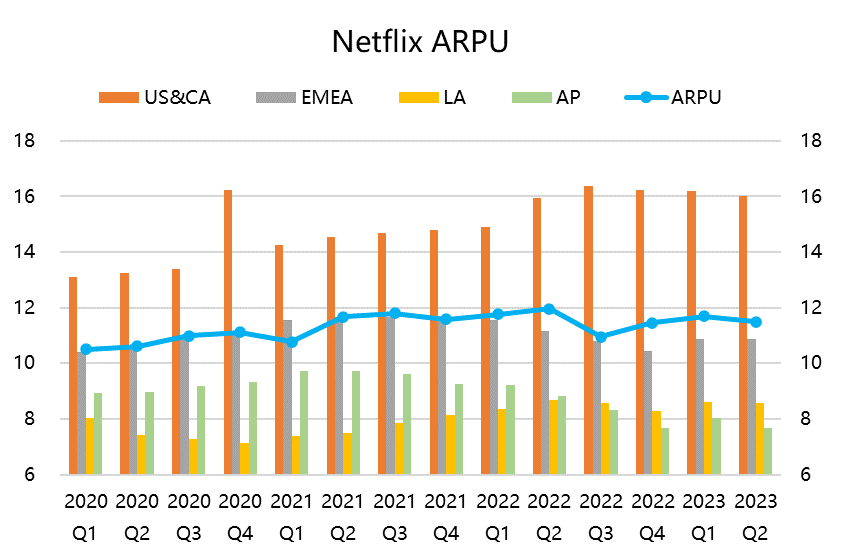

On the other hand, more users opted for lower-priced plans, leading to a decline in overall ARPU. The Q2 ARPU was below expectations in every market, especially in the Asia-Pacific region where lower-priced plans were introduced.

Netflix's announcement after the financial report that it would cancel the $9.99 basic account also reflects this issue. The management may no longer be focused on adding new users and might instead prioritize the quality of revenue. Therefore, there may be a rebound or recovery in the second half of the year.

In addition, the Hollywood screenwriters' strike could negatively affect continuous content creation and consequently impact subscriber stickiness in the next few quarters. The current strike has frozen film and TV series production, which could delay the release of new shows in the autumn season. $Walt Disney(DIS)$ $Comcast(CMCSA)$

However, Q2 is typically a peak season for content, and according to Nielsen's survey data, Netflix's market share increased slightly during the three months of Q2, indicating that its streaming content is still highly popular among viewers.

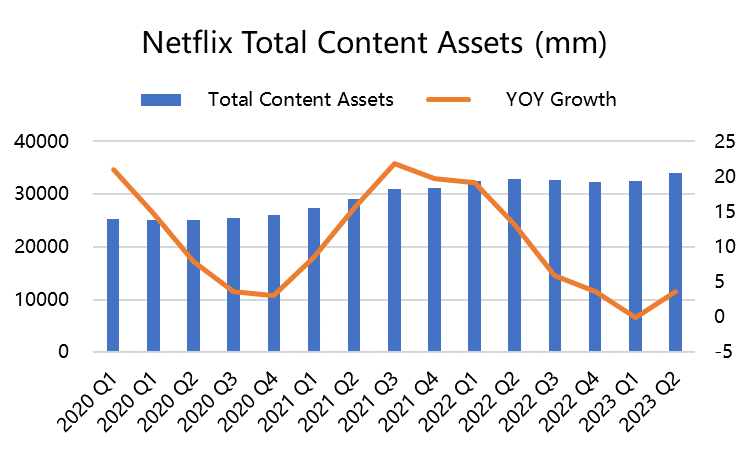

Due to the industry's "cost-cutting and efficiency improvement" trend in recent years, Netflix has shifted its focus from heavy investment in content to profitability and cash flow responsibility. As a result, content expenses have declined year on year, and the content assets have rebounded from negative growth in the previous two quarters, while content expenses continue to decline.

With the maturation of its advertising business, Netflix is expected to generate more cash flow in the second half of the year.

Valuation and Price

The 8% post-market decline might be due to investors being overly optimistic about Netflix in the past two days. On July 17th, the single-day increase of 5.5% was clearly too aggressive before the financial report.

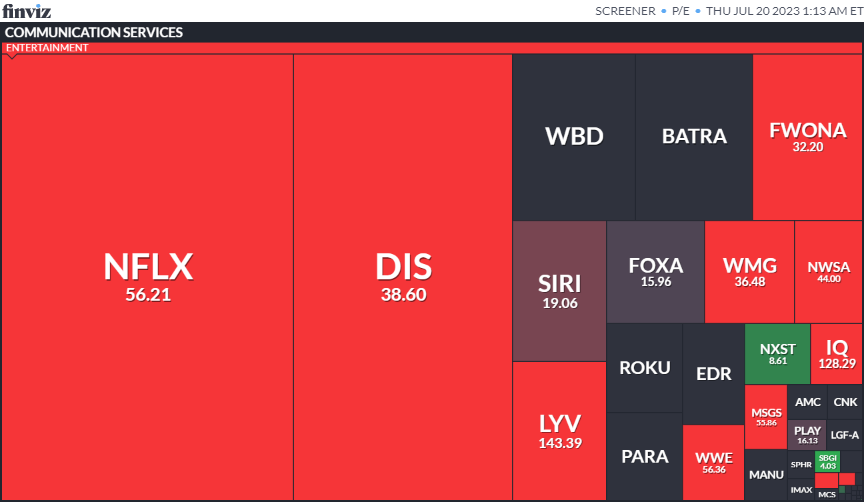

Looking at the valuation, despite the continuous improvement in profits, Netflix's trailing twelve-month P/E ratio has reached more than 50 times. Based on the market's expected profits for the 2023 fiscal year, the P/E ratio is around 42 times, which is far higher than the industry average of 25 times. This figure appears to be excessively high even among major tech companies.

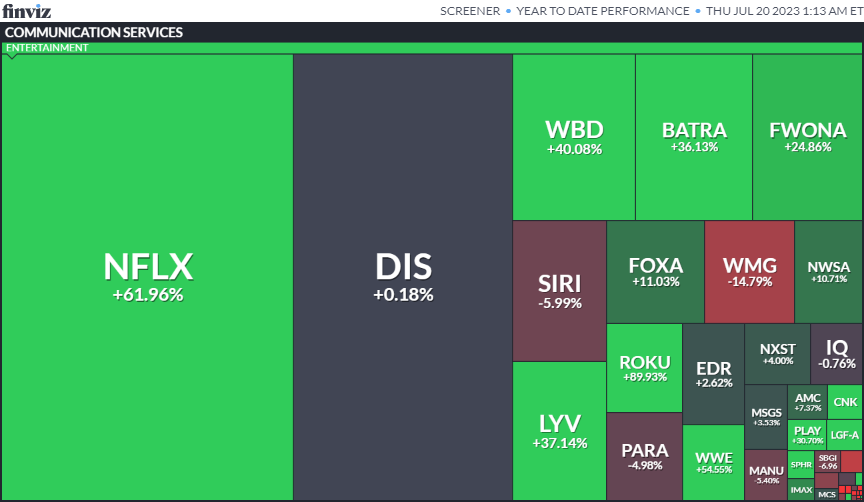

Netflix's stock price has also risen by 62% since the beginning of the year, making it among the top performers among major tech companies.

However, the "special rebalance" of the $NASDAQ 100(NDX)$ before the opening of the market on July 24th might lead to passive capital inflows for Netflix because it is not one of the "Magnificent Seven" and will not have its weighting adjusted.

Moreover, the market value on July 14th has increased significantly compared to the last adjustment on May 30th. We expect there will be a passive capital inflow of over 50% after the adjustment.

Comments

Next week will be the perfect buy - Nasdaq rebalance and fed hikes, once take effect it will push price down but will rebound and rally Q4/ Q1 2024.

Can't believe NFLX triggered the entire Nasdaq stocks to go down and NFLX itself only down 8.5% while other are down so much more

Disney doesn’t have near the potential as Netflix (with their ad tier and paid sharing) to accelerate growth and revenue.

here is still space to go down. This stock may be of ~$300 value.

Don’t have any long or short positions on NFLX and traded options.