Gold prices have entered a short squeeze cycle following Donald Trump's new tariffs and the Federal Reserve's less hawkish stance, closing higher for seven consecutive weeks. With prices rapidly approaching the critical 3,000 threshold, investors should adopt distinct strategies:

Existing holders: Maintain positions to ride the upward momentum.

New buyers: Wait for significant retracements before entering.

Short sellers: Avoid premature bets against the rally due to high volatility risks.

I. Fundamental Drivers

Tariff-induced inflation: Trump's tariff hikes have amplified inflation expectations, despite temporary policy adjustments. Market focus remains on sustained price pressures.

Monetary policy shift: The Fed's cessation of balance sheet reduction have expanded monetary liquidity.

Arbitrage dynamics: Potential U.S. precious metal import tariffs have created a premium for American gold futures, mirroring China's 2023 experience when RMB depreciation fears caused domestic premiums. This led to cross-border gold smuggling , until market corrections erased the spread.

II. Technical Considerations

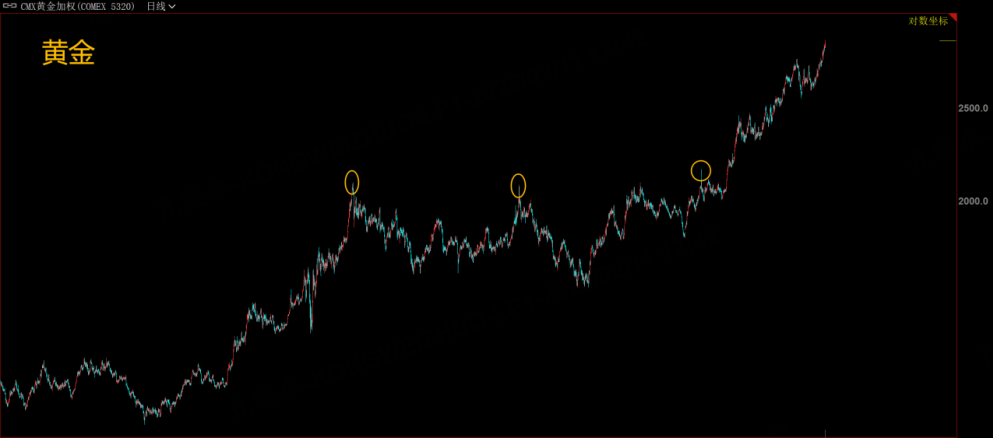

Gold typically forms major tops through parabolic rallies followed by sharp declines. Current conditions mirror historical patterns:

Overcrowded long positions

Abundant bullish catalysts vs absent bearish triggers

Accelerating momentum toward 3,000

Critical timeline: March-April 2025 marks a high-probability reversal window.

Investors should:

Avoid guessing peak prices

Implement profit-taking strategies near 3,000

Prepare for swift, deep corrections triggered by unforeseen events.

Comments