Don't All in.

After the tariffs landed, the U.S. stock market is a little bit back to the soul of the meaning of fluctuations, a lot of people began to get excited, think the opportunity to come.But I'll be honest, don't get too excited, now this wave of rebound, more like a technical repair, not a trend reversal, at best, is a "dead cat jump".

Simply put, the fundamentals did not keep up.The S&P 500 earnings per share estimate (EPS) for the coming year has been cut by Wall Street from +14.1% at the beginning of the year to +10.5%.That's not the worst of it, if U.S. GDP does fall between 0 and 1% as many now expect, then EPS will have to continue to be chopped to less than 5% to be reasonable, and right now the market isn't even reflecting that pessimism.

A lot of people think, "It's okay, we were scared of a recession in 2022, and it didn't come in the end."But the 2022 round was scared, and in the end it was a false alarm.But when you look back at the trend, the stock market was falling all the way down then, revising earnings estimates all the way down, and only started to rally when the panic was pretty much released.This time, it's probably going to have to go through the same process.Now what?Expectations haven't fully corrected and sentiment is more like "pick up a bargain when you see one", but is it really a bargain?

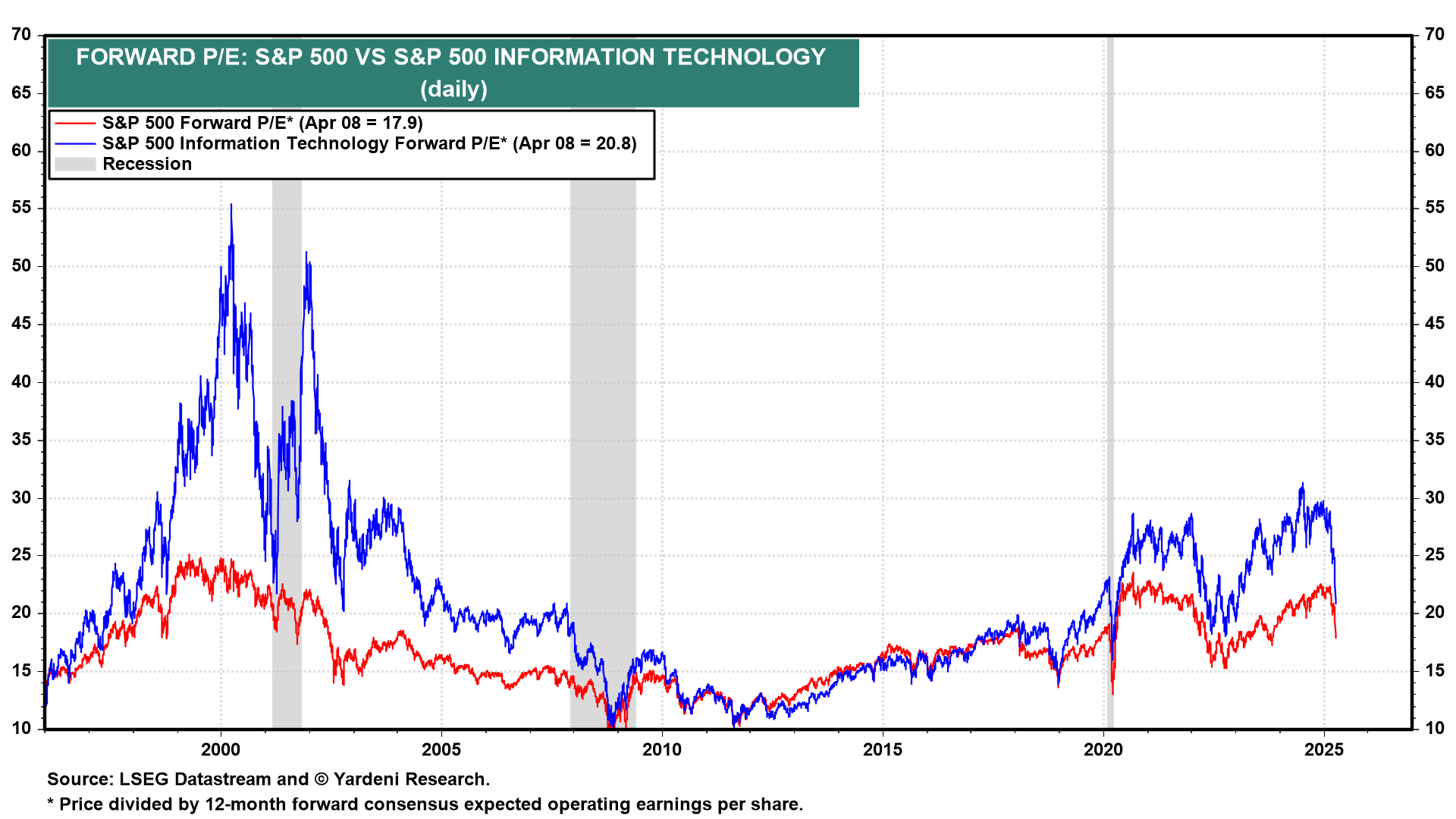

Besides valuation, after the recent S&P pullback, the NTM PE is down to 18x.Doesn't sound high does it?But the average over the last 20 years is 16x and the median is 15.5x.Now this valuation stands at more than 80% of the historical score, still expensive. 2022 bear market, the lowest dry to below 16.So if you enter the market now, you are buying "more expensive than average" stocks, and as I said earlier, the fundamentals have not stabilized.

And then there are the U.S. bonds.Theoretically, U.S. bonds can hedge against recession, counting defense assets.But recently the geopolitical variable is too big, China and the United States are now arm wrestling with each other more and more heavy flavor, China's hands more than 700 billion U.S. debt, if the real bar, who dare to guarantee that they will not take this thing to do?Once the sell-off, U.S. bond rates to soar, the price will have to dive.Even if the Fed out to take over, that also has to be the market first shock.So now do more U.S. bonds need to be cautious.If you really want to engage, you can consider hedging, such as shorting junk bonds at the same time, to hedge the risk.

In a word, the market now, the rally has, but the logical support is still very weak.If you want to fight a short-term rebound, I do not stop you.

But if you plan to lay out a heavy position and hold it for a long time, then I advise you to wait, the market has not seen the bottom of the flavor.

$S&P 500 (.SPX) $Nasdaq (.IXIC) $Nasdaq 100 ETF (QQQ) $S&P 500 ETF (SPY) $ <a10>$Nasdaq Triple Long ETF (TQQQ)$ $ $S&P 500 Volatility Index (VIX)$ $20+ Year+ U.S. Treasury Bond ETF-iShares (TLT)$

Comments