Over the past few weeks, the U.S. stock market as a whole has been extremely sensitive, and the market's reaction to surprises has been "amplified". The $S&P 500(.SPX)$ has swung more than 10% in a single day, and $NASDAQ(.IXIC)$ has rallied more than 12%.

With expectations surrounding Trump's tariffs recurring, the week's action could be described as a "collection of risk events" from years past.

Looking at the timeline of the overall U.S. stock market pullback in 2025.

The initial decline was triggered by a rapid pullback in a group of 2024 overbought momentum stocks ( $AppLovin Corporation(APP)$ $Palantir Technologies Inc.(PLTR)$ $Tempus AI(TEM)$ ), among others, which triggered a market deleveraging operations;

At the beginning of the period, investors underestimated the tariffs and considered them "more symbolic", but after Trump's announcement on 4.2, which exceeded expectations, the market suddenly became worried and had a black Monday.Then the market rebounded briefly, the market expected Trump's tariffs to be announced are "reciprocal" measures, the final negotiation results may be in the range of 10-20%.

On April 3, Trump announced the actual policy, tariffs on Chinese goods, Vietnam also synchronized with the increase, the market expected to be seriously broken, U.S. stocks in the after-hours briefly rose and then quickly turned down.The next two days, the major stock indexes cumulative decline of nearly 10%, at the same time Sellside began to lower corporate earnings estimates, the market into the "recession" expected narrative.

At the same time, there has been a two-tiered reversal in U.S. bonds, with the "safe-haven" attribute disappearing and the market moving from optimism (10Y yield once below 4.1%) to a sharp reversal on tariff risk. $iShares 20+ Year Treasury Bond ETF(TLT)$

On Monday, there was unconfirmed news that Trump would hold off on tariffs except for China, which was later denied, but the subsequent developments suggest that this policy direction is not empty.

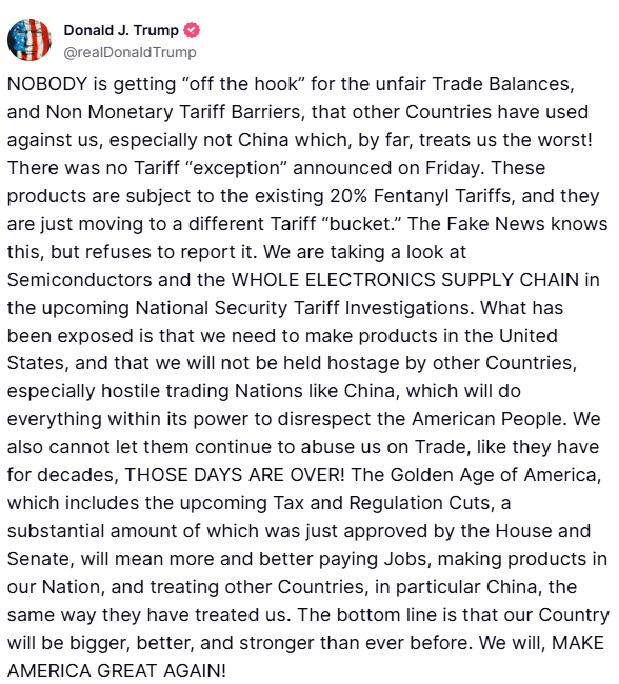

Wednesday, the market ushered in a strong rally, Trump tweeted before the bell that "now is a good time to buy", and then announced a 90-day moratorium on tariffs, except for China and some other countries, only to maintain the basic rate of 10%, and to open a new round of trade negotiations.This statement led Sellside to quickly withdraw some of its previous pessimistic expectations.

The market pulled back again on Thursday.On the one hand, funds took advantage of the rally to adjust their positions, while on the other hand, investment banks started to reassess the impact of the new tariffs on S&P earnings, giving wider judgments on the valuation range.Market volatility remains inevitable as earnings expectations are unclear and policy uncertainty remains high.

During the weekend, tariff policy was again recurring.On the one hand, news of exemptions for semiconductors, laptops, and other products emerged, while on the other hand, there were rumors of possible Section 232 tariffs on semiconductors.

Overall, the market's concern about extreme high tariffs has eased, and the marginal policy impact may have peaked, but uncertainty remains.

Looking at Trump's modus operandi, the logic of his behavior is not entirely based on long-term economic considerations, but is closer to a high-pressure negotiation strategy.Whether the goal is realistic or not, he tends to start from a highly aggressive posture, through the creation of uncertainty to pressure the negotiation opponent, and finally land a relatively acceptable program.In this process, the definition of "winning" is highly elastic and can be dynamically modified through social media.

In fact, from a trader's perspective, this set of ideas is not new.

The book "The Art of the Deal" has a similar description.In essence, Trump does not care whether his policies ultimately solve the deficit problem completely, but is more concerned about whether the feeling of "winning" is received by the public.As long as the social mood that he won, that is a political victory.

Comments