Big-Tech’s Performance

Weekly macro storyline: Trump to fire Powell? Earnings season coming with tariff desensitization!

Although the Trump administration is still in the tariffs from time to time "demon", but the market after last week's volatility has been desensitized, but now trading is more "recession expectations", or the extent of the blow to corporate profits, consumer confidence.

In the face of the worsening economic outlook, the European Central Bank on April 17 to complete the seventh round of interest rate cuts, and warned that the escalation of international trade tensions is a serious drag on the eurozone recovery process.The Fed showed a very different rhythm, Powell reiterated the need to judge the policy path based on sufficient data, triggering a harsh rebuke from Trump.Previously we discussed, Powell and Trump's "cooperation", the most important way is to "lower interest rates", reduce the burden of interest on the U.S. debt is even better than tariffs.No Fed chair has ever been fired by a president in history.

Earnings season kicked off,2025Q1 of $Taiwan Semiconductor Manufacturing(TSM)$ , a key source for the tech industry, still exceeded expectations with revenue of NT$839.25bn (+41.6% YoY) and net profit of NT$361.56bn (+60.3% YoY).Despite seasonal smartphone weakness and earthquake impact, N7 and below advanced process contributes 73% revenue, HPC platform accounts for 59% as core growth point. q2 guidance revenue +5%~8% YoY, mainly benefited from AI gas pedal, HPC demand and pre- tariff waiver order rush, gross margin 57%-59%, tech premium and price adjustment offset the U.S. AZ fab Capacity creep impact; the company maintains full-year capex of $38-42 billion, additional $100 billion investment, plans to build six wafer fabs and two advanced packaging fabs, targeting 30% of 2nm capacity layout locally. ai related revenues are expected to double in 2025, with a CAGR of nearly 45% over the next five years, but the overseas expansion of production may dilute gross margins by 3%-4% over the next five years.

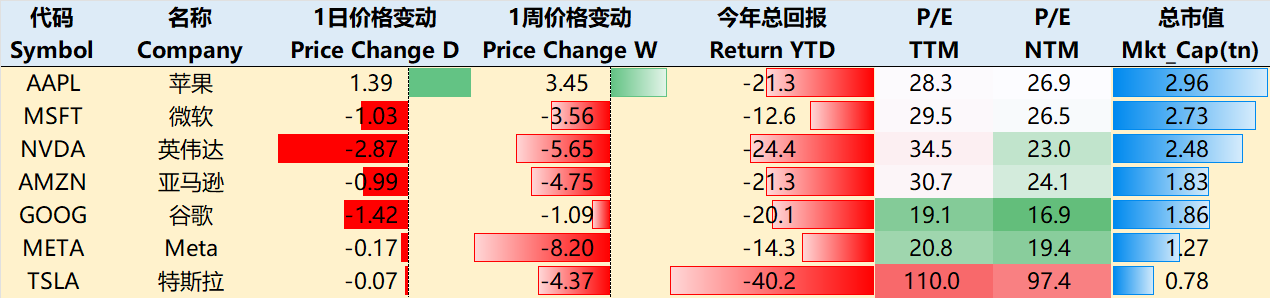

Big tech companies also rallied this week, but there is still a subsequent pullback, advertising business accounted for the main META and GOOGL pullback a little more.

Through the close of trading on April 17, most of the big tech companies rallied over the past week.Among them $Apple(AAPL)$ +3.45%, $NVIDIA(NVDA)$ -5.65%, $Microsoft(MSFT)$ -3.56%, $Amazon.com(AMZN)$ -4.75%, $Alphabet(GOOG)$ -1.09%, $Meta Platforms, Inc.(META)$ -8.20%, $Tesla Motors(TSLA)$ -4.37%。

Big-Tech’s Key Strategy

META is under attack

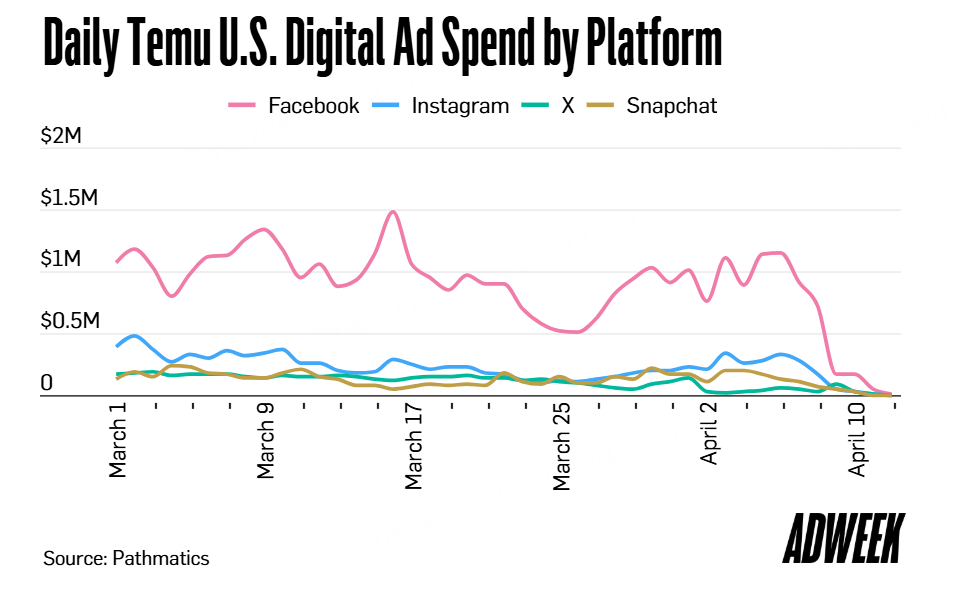

Tariff fears prompt Chinese e-commerce firm to cut ad spend

In the first two weeks of April, Temu's ad spending on major ad platforms such as Meta, X and YouTube (Google) was cut by an average of 31% from the previous month.Meanwhile, average daily ad spend on these platforms was down 19% sequentially and even more so 50% year-over-year, with the drop in YouTube ad spend being particularly pronounced.

Tariffs, as well as the termination of the de minimis exemption that allowed for duty-free imports under $800, were the main reasons for this, with the U.S. levying ad valorem taxes on said goods at a rate of 90% starting May 2, a significant hike from the previous rate of 30%.As both Temu and have amassed millions of customers on the basis of price advantage, the dominant position in the digital space.

For META, Chinese e-commerce contributed $18.4 billion in revenue, or 10%+ of total revenue, and e-commerce ad retreats could have a more pronounced impact on revenue in Q2 and beyond, with detailed attention to guidance on next week's META earnings call.

Potential split of Instagram and WhatsApp

The FTC filed an antitrust lawsuit against Meta in 2020, and the trial began on April 11 and is expected to last two months; the FTC argues that Meta gained an unlawful social media monopoly by acquiring Instagram and WhatsApp.

One of the FTC's key points is that when it acquired Instagram in 2012, Mark Zuckerberg acknowledged in an email that Facebook was less than Instagram at that time, and that it was a serious monopolistic acquisition; while META argued that there was intense competition with TikTok, Snapchat, YouTube, and a variety of other platforms, the FTC did not stop the acquisition atThe FTC did not stop the acquisition at the time and should not pursue it now.

If it is eventually forced to split, META will undo years of integration, disrupting the social media platform and adding huge costs, while Instagram, while it can operate independently, also relies heavily on the META platform's big data for its advertising efficiency.

In addition, META was the subject of a class action lawsuit by customers on April 15, alleging that since 2013, Facebook has priced ads through a flawed "blended-price" auction process, rather than the "second-price" auction process it claims to have used, causing advertisers to pay approximately $4 billion more than they should have.Advertisers overpaid by about $4 billion.Where most of these cases end up settling is the question of the impact of eventual legal fees on profits.

AI platform commercialization conflict?

Meta AI VP of Research Joelle Pineau, who led the Llama open source series and the PyTorch project, claimed in an in-person post that she would be leaving on May 30th.She has not nominated a successor, and there may be a certain vacuum.

This also reflects META's trend of AI brain drain in recent years, in which more than half of the Llama team left the company

Her departure comes just weeks before the company's new Llama Conference, and has sparked market speculation about META's commitment to the open-source community, with open-source Mark Zuckerberg currently leaning toward reducing the size of models open-sourced to prioritize commercial applications.

Big Tech Options Strategy

Jensen Huang dances on a tightrope.

Jensen Huang has been in the spotlight a lot lately, both at Mar-a-Lago and Beijing, which is full of contradictions but pragmatic: on the other side of the commitment to invest 50 billion U.S. dollars to build factories (actually landed 5 billion), in exchange for Blackwell chip production licenses and possible more exemptions; on this side of the side to maintain a team of 4,000 engineers, through the edge of the computing chip (Jetson series, Q1 sales in China surged 210%) to expand the non-sensitive areas such as smart manufacturing, and at the same time, committed to "spare no effort to serve the Chinese market".Spare no effort to serve the Chinese market."

This week's $5.5 billion inventory impairment charge also came on news of a possible H20 embargo, and NVDA stock has fallen back to near 100 again.

The recent Short Iron Condor strategy (short volatility) may be cost-effective for NVDA, as NVDA is under considerable pressure to the upside, and a decline would usher in more money to the bottom, and the strategy could be profitable as long as the stock stays within or breaks out of a specific range.The relatively straightforward Short Strangle, which may be done on lower margins, and the bilateral portfolios, which actually charge only one-sided margins, are also more cost-effective than the Spread.

Big-tech Portfolio

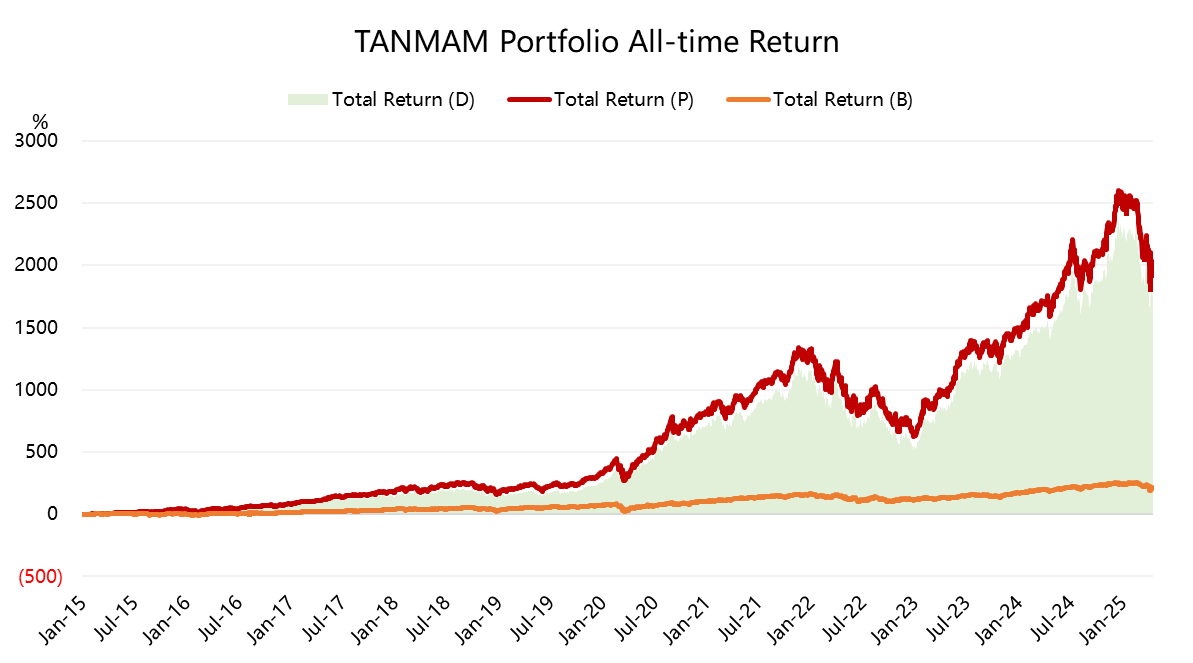

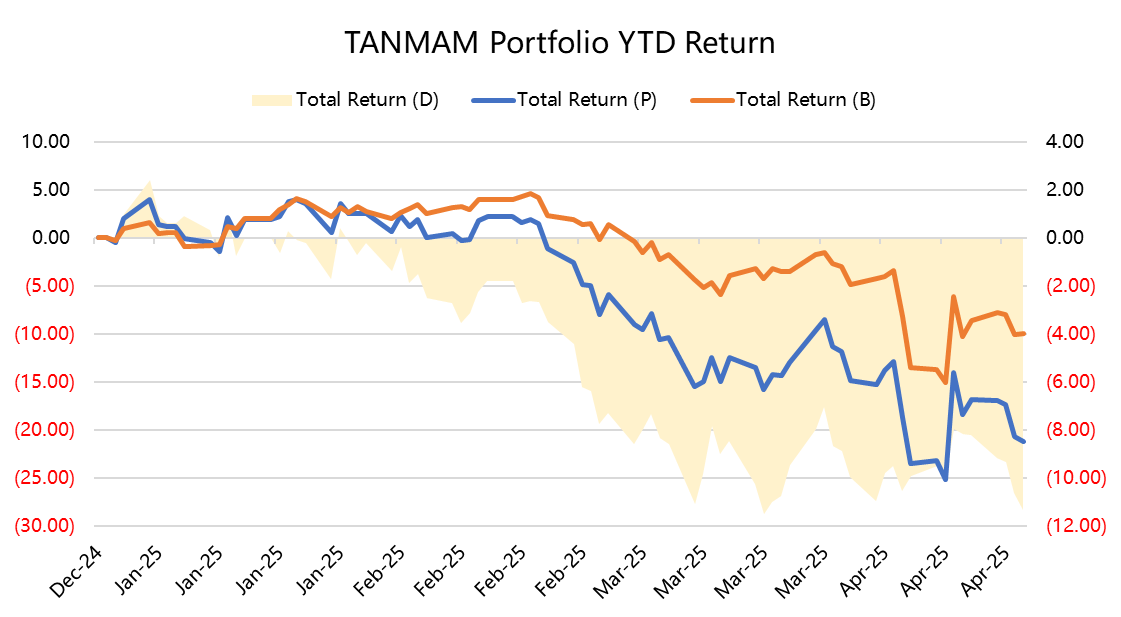

The Magnificent Seven form a portfolio (the "TANMAMG" portfolio) that is equally weighted and reweighted quarterly.The backtest results are far outperforming $S&P 500(.SPX)$ since 2015, with a total return of 1,916.37%, while $SPDR S&P 500 ETF Trust(SPY)$ has returned 206.03% over the same period, for an excess return of 1,710%.

Comments