Last week, easing tariff tensions between the US and China boosted market risk appetite, while Fed Chair Powell’s continued hawkishness had little impact on metals. Gold prices hit new highs and copper stabilized, both benefiting from inflationary pressures and improved tariff expectations.

Market Performance Overview

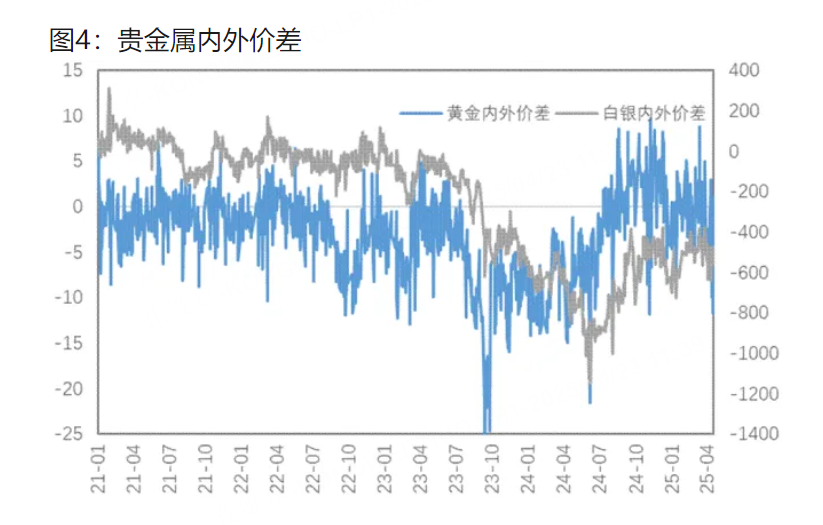

Precious metals saw strong gains: COMEX gold rose 2.65% and silver 1.09%. Industrial metals also performed well, with COMEX copper up 3.35% and SHFE copper up 1.33%. Notably, the domestic Chinese gold market outpaced global gains, highlighting robust local investment demand.

Copper Market Insights

After sharp previous swings, copper prices steadied last week. Easing US-China tariff rhetoric supported market sentiment, even though substantial action is pending. Interestingly, Powell’s hawkish remarks hit US equities but did not rattle copper, suggesting it could remain a favored asset if inflation resurges.

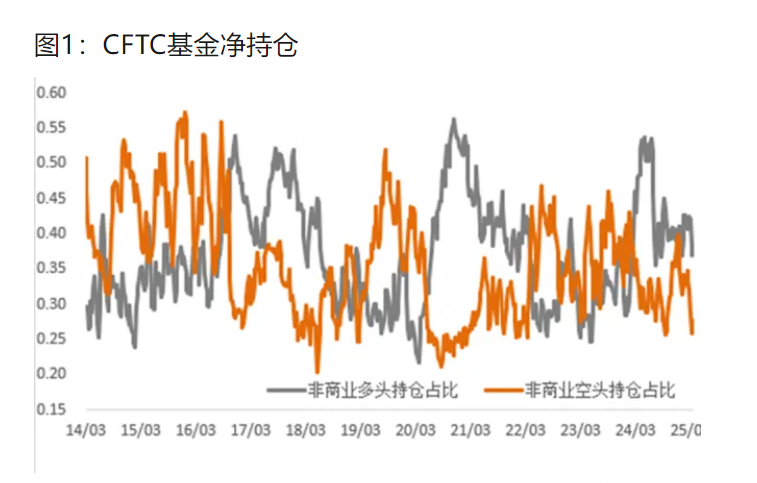

Structurally, the COMEX copper curve remains in contango, limited by price differentials and uncertainty over US refined copper tariffs. SHFE copper’s curve steepened, especially at the front end, pointing to near-term supply tightness. Market participants continue favoring calendar spreads in longer-term contracts. CFTC data shows non-commercial short positions near historic lows, implying potential for further copper rebounds but highlighting the need for fresh bullish interest.

Precious Metals Analysis

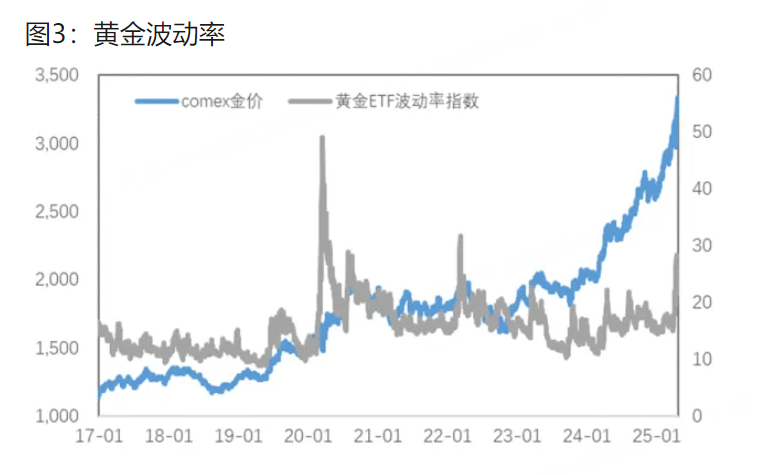

Gold surged to record highs, with COMEX gold trading between $3,208-$3,372/oz and silver between $31.6-$33.2/oz. Despite a softer US tariff stance, persistent uncertainty and Powell’s cautious tone drove demand, though some profit-taking led to a pullback after the peak.

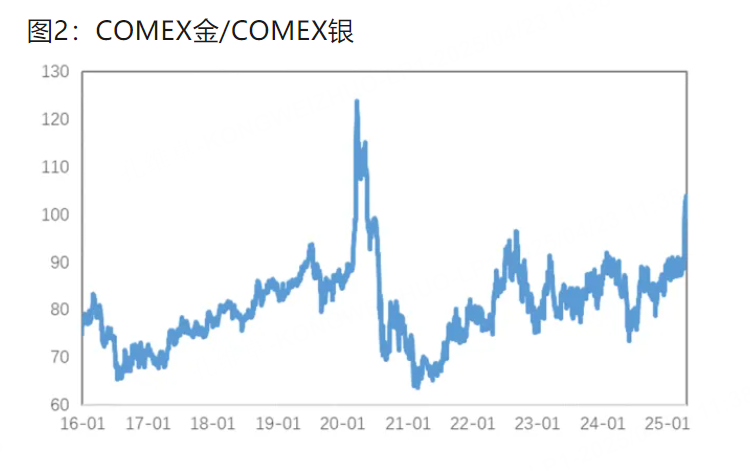

Across major exchanges, all tracked precious metals posted solid advances, with SHFE gold up a striking 8.6%. Silver lagged gold, pushing the gold/silver ratio higher; copper also underperformed gold. Meanwhile, oil’s rebound nudged the gold/oil ratio lower. Gold volatility (VIX) fell as trade risks eased and risk appetite returned, causing a notable drop in gold’s implied volatility.

Market Outlook

Domestic copper demand in China remained resilient, with rising withdrawals and strong downstream orders. However, as prices climb, downstream buying enthusiasm may lessen, shifting spot demand from a price driver to a support factor.

On gold, further short-term gains may be limited, yet medium- to long-term prospects remain supported by sustained geopolitical uncertainty and doubts about dollar strength. Although gold continues to reach new all-time highs, investors should closely monitor for potential shifts in trend.

$E-mini Nasdaq 100 - main 2506(NQmain)$ $E-mini S&P 500 - main 2506(ESmain)$ $E-mini Dow Jones - main 2506(YMmain)$ $Gold - main 2506(GCmain)$ $WTI Crude Oil - main 2506(CLmain)$

Comments