Q4 overall: fundamentals stable, growth anxiety remains, AI strategy landing is key

$Alibaba(BABA)$ announced its FY2025 Q1 earnings (for the year ending March 31, 2025) in the pre-market on the 15th, with shares down 5% at one point.The market reaction was predominantly negative, reflecting a strong expectation gap.The whole point is that, despite the Amoy days to support the core earnings, still reveals the lack of growth highlights, the lack of profitability elasticity of the problem, ali and tencent, facing the "old and new kinetic energy" transition strategy transition period. $BABA-W(09988)$

The market's short-term pullback reflects a revision of expectations, but of course, the medium- to long-term value is reflected in the recovery of consumption, AI landing, efficiency improvement and loss reduction of other non-core businesses.

In the long run, if Cloud Intelligence can achieve a reversal of profitability in 2025-2026, and the completion of the strategic focus of Caijiao, international businesses and positive cash flow, Ali still has the potential to restore valuation elasticity.

The current adjustment may be a "return to reality" stage, and the future value will find a balance between "growth landing speed" and "capital investment pace".

Performance and market feedback

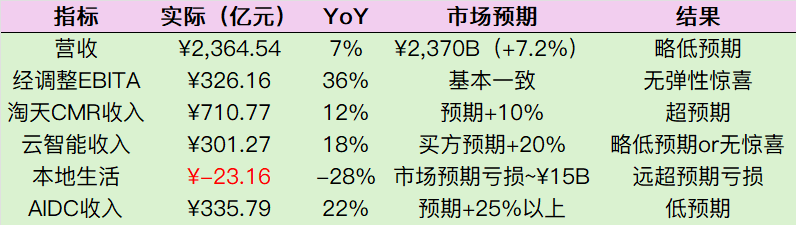

Core Financials vs Market Expectations

Ali released Q4 results, the pre-market share price fell more than 4%, reflecting the market's dual concerns about the lack of growth momentum and weak profit release.However, the stock had rebounded from a low of around $90 to $130+ in the pre-earnings period, and the market had high expectations for AI-driven growth and consumer recovery, and this earnings report failed to meet those optimistic expectations, leading to a pullback in sentiment.

Investment highlights

Core e-commerce is solid, fundamentals support valuation bottom line

Amoy Group performed well:

CMR revenue +12% yoy, higher than expected, reflecting significant advertising and commission rate improvement (Take Rate increase).

88VIP membership exceeded 50 million, a double-digit growth year-on-year, enhancing platform stickiness and high ARPU user contribution.

EBITA margin remained high at 41.2%, demonstrating strong realization and profitability.

Taotian business continued to maintain its position as a profit pillar of the Group under the dual impetus of "retail recovery + member economy drive", providing a stable bottom line for Ali's valuation.

Cloud business growth fell short of expectations, and AI commercialization is still at an early stage.

Cloud revenue +18% yoy, although higher than the overall group, but lower than the market buyers' psychological expectation of AI cloud "high growth rate" of 20% or more.

AI-related product revenue achieved triple-digit growth (7 consecutive quarters), but AI computing power, data centers and other Capex expenses increased by about 50% year-on-year, which also dealt a blow to margins.

Earnings report contradictory points:

Outstanding progress in technology, such as Tongyi Ling code, Qwen3 open source, etc., but the commercial transformation has not released profits in time.

Investors expect AI to drive "explosive growth + profitability elasticity", which has not yet been met at this stage.

The status of cloud business as the "second growth curve" remains unchanged, and the key lies in whether AI business closure can be realized in the medium term, such as the accelerated penetration of enterprise-level AI solutions.

Emerging business under pressure, slowing down the process of loss reduction

Ali International (AIDC)

Revenue +22% yoy, fell short of expectations and the Choice model's expectation of "high growth + significant loss reduction" did not materialize.

Actual EBITA loss only narrowed by 13%, much lower than the market's expectation of more than 20%.

Competitive pressures were significant (e.g. Temu strategy to press prices), and inputs such as logistics construction in the Middle East pulled up cost rates.

Cainiao Group

Revenue -12% yoy due to e-commerce logistics integration and business divestment.EBITA loss narrowed to ¥6.06B (-55%) but short-term value is yet to be seen.

Local Life

Revenue +10%, but EBITA loss expanded to ¥ -2.32B, much higher than expected, the market originally hoped that the industry cost-cutting logic loss further narrowed.

Hungry subsidies increased, high ecological construction pushed up marketing investment.Meanwhile, the recent takeaway war may further increase subsidies, and new businesses generally lack "marginal improvement" highlights, and have yet to get rid of their dependence on the Group's subsidies.

Future Concerns and Long-Term Key Drivers

Short-term observation points:

Cloud intelligence commercialization: whether Qwen3 series products can form a closed loop of revenue growth in the second half of the year.

Local life loss slope: whether it can be effectively narrowed, especially in the takeaway business.

AIDC regional performance: whether Europe & Middle East market can stabilize its share.

Long-term key

AI closed-loop capability: can we establish a positive cycle of "open source model → enterprise application → revenue and profit"?

Organizational and cost optimization: the number of employees has dropped 35% year-on-year, but can it continue to release efficiency dividends?

Shareholder return strategy: annual buyback has reached $11.9B, can it continue to strengthen market confidence.

Comments