In May, as progress was made in China-U.S. trade negotiations, international crude oil prices experienced a rebound. The rebound for NYMEX WTI crude and ICE Brent crude approached 5%, while INE’s RMB-denominated crude rose by nearly 4%. Since the beginning of the year, international crude oil prices have continued to decline, mainly due to a global pattern of “increasing supply and decreasing demand,” with persistent concerns about oversupply.

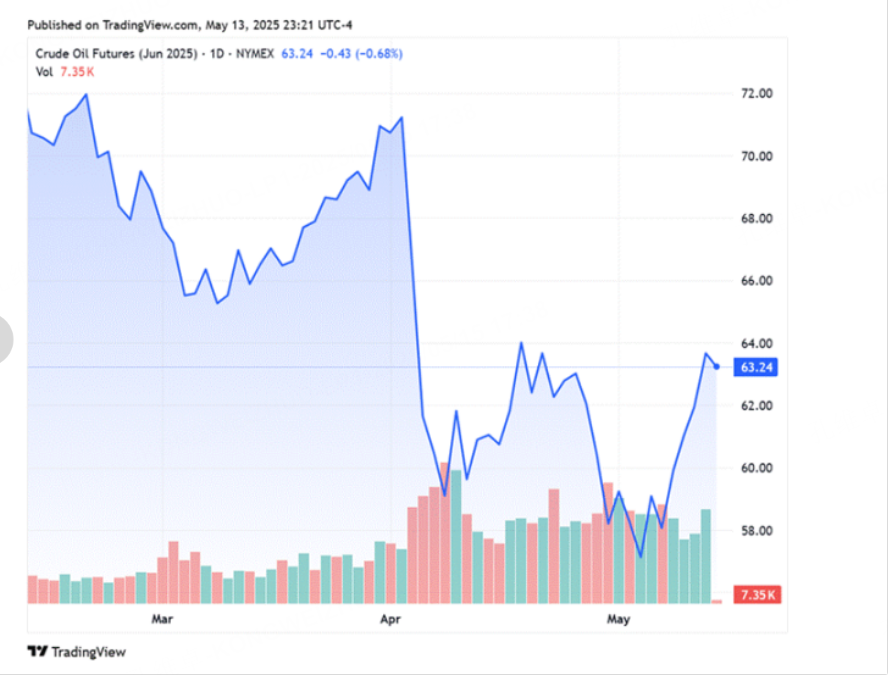

The following chart shows the trend of NYMEX WTI crude oil futures prices.

Looking ahead, the progress in China-U.S. trade talks, the substantial reduction of the high tariffs imposed on each other in April, a slight easing of global economic downside risks, and the upcoming peak driving season in the U.S. are expected to provide short-term momentum for a crude oil rebound.

However, future China-U.S. negotiations remain challenging. The Trump administration’s demands to reduce the trade deficit and bring manufacturing back to the U.S. are difficult to reconcile with non-U.S. countries’ demands for lower tariffs, making it unlikely that tariffs will return to 2024 levels. In addition, issues such as U.S. debt and fiscal sustainability remain unresolved, and the risk of a U.S. economic recession has not been eliminated. Meanwhile, China’s economic growth faces tariff pressures, and the crude oil oversupply situation may not have reversed.

Crude Oil Production Increase Trend Remains Unchanged

On the supply side, global oil supply is both diversified and concentrated. The previous pattern of OPEC+ production cuts supporting oil prices is difficult to maintain. The Middle East, as the world’s largest oil reserve region, has long been a key force in global oil supply. Additionally, South America, Russia, and Africa also have abundant oil reserves, and non-OPEC+ oil output has grown significantly. This means the trend of rising global crude oil production will not be reversed by OPEC+ production cuts.

Moreover, in 2025, OPEC+ will end production cuts and announce a resumption of production, accelerating supply growth unless a sharp drop in oil prices makes it difficult for producers to cover costs. After several delays, OPEC+ and its partners began this month to restore production that had been suspended in recent years. According to an OPEC statement released on April 3, OPEC+ agreed to increase oil supply to the market by 411,000 barrels per day in May, an adjustment that covers three months’ worth of incremental increases, including the planned increase for May and additional increments for the next two months.

Although the global oil market remains fragile amid rising trade tensions, and many OPEC+ member countries need higher oil prices to balance their national budgets, for oil-producing countries or producers, increasing supply to maximize revenue may be the best strategy.

Despite U.S. efforts to suppress Iranian oil exports through sanctions, Iran’s output in April actually rose by 150,000 barrels per day, thanks to expanded “non-dollar settlement” transactions with China and India. This “sanctions failure” has forced OPEC+ to adjust its strategy. Saudi Arabia’s decision to maintain production levels is, in effect, tacit approval of Iran’s “production breakout,” reflecting divergent responses within OPEC to U.S. policy.

Non-OPEC oil output growth will outpace that of OPEC+. U.S. shale oil producers have accelerated production after the price recovery, with April output rebounding to 13.2 million barrels per day, close to historic highs. Non-allied countries such as Norway and Brazil are also expanding capacity, and the focus of the international energy sector has shifted from “supply-side coordination” to “efficiency competition.”

Progress in Tariff Negotiations Only Eases the Decline in Demand

From the demand perspective, if tariffs between China and the U.S. are lowered, the risk of a U.S. economic recession will decrease, and the decline in U.S. crude oil demand in 2025 will be kept within 10%, or about 24.6 million barrels per day. China’s crude oil demand decline will also slow. According to our calculations, assuming this year’s exports are affected for three quarters, the 30% U.S. tariff will drag down 2025 GDP by about 0.3 percentage points, reducing oil demand by only 50,000 barrels per day.

In summary, the fundamental oversupply in global crude oil means that oil prices in 2025 are more likely to fall than rise, especially with OPEC+ resuming production and non-OPEC countries increasing output, accelerating supply growth.

On the demand side, there are few growth drivers; both the energy transition and slowing global economic growth mean that oil demand is unlikely to exceed expectations. The progress in China-U.S. tariff negotiations may only moderate the depth and slope of the global economic downturn, leading to a short-term rebound in crude oil prices, but it is unlikely to reverse the oversupply situation.

$E-mini Nasdaq 100 - main 2506(NQmain)$ $E-mini Dow Jones - main 2506(YMmain)$ $E-mini S&P 500 - main 2506(ESmain)$ $WTI Crude Oil - main 2507(CLmain)$ $Gold - main 2506(GCmain)$

Comments