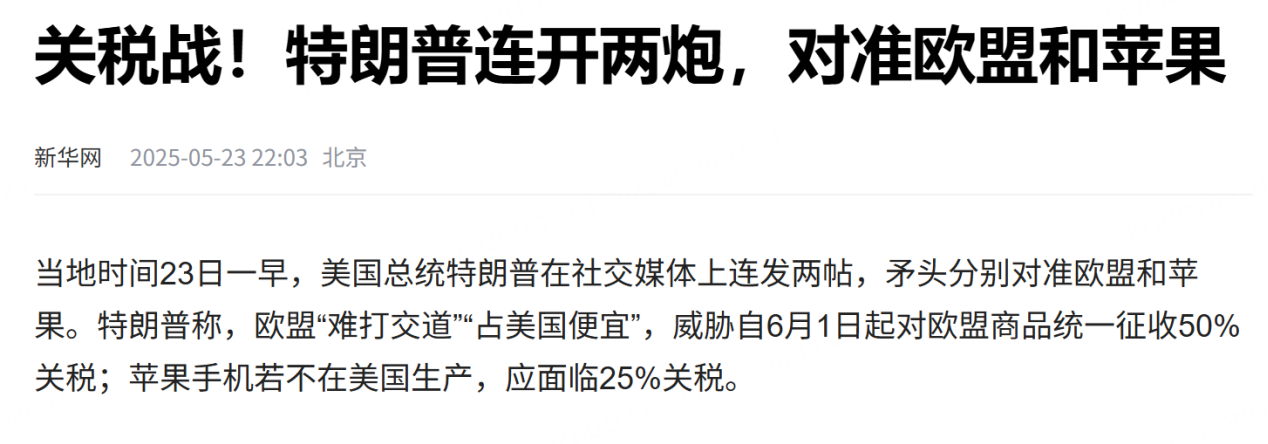

Last Friday, Trump escalated pressure on the European Union by proposing an additional 50% tariff on EU goods. Although the EU responded by expressing its willingness to negotiate, it also signaled that as the 90-day tariff truce draws to a close, such failed negotiations might become increasingly common. This suggests that the market is likely to remain highly volatile for now.

1. Impact of Increased Tariffs on the S&P 500

During the tariff truce, as long as the EU doesn’t respond too aggressively, the overall impact on U.S. stock indices should be limited. Ultimately, it all comes down to the outcome of ongoing negotiations. Trump clearly felt the EU’s response since the truce was too slow, so he is using the “maximum pressure” tactic to push for a speedy agreement. Typically, such news leads to short-term market reactions but doesn’t determine the broader direction. From a technical perspective, the gap formed after the tariff truce with China still provides strong support for the index, and the 5600 level on the S&P 500 remains the crucial dividing line for bullish and bearish sentiment regarding tariffs. As long as the index stays above this level, volatility will continue to be the main theme.

2. Will There Be a U.S. Treasury Bombshell? It’s a Key Concern, But Panic Is Unwarranted

Recently, rumors have emerged suggesting a possible U.S. Treasury “blow-up” in June. While it’s true that the U.S. is facing massive debt, with some maturities coming due soon, the amounts are not all concentrated in a single month. Some months see larger maturities, but in reality, about $2 trillion in Treasuries mature almost every month lately. Typically, maturing Treasuries are rolled over with new issuances. As long as new auctions are successful, the so-called “bombshell” is unlikely to materialize. Currently, short-term yields are more attractive, so refinancing longer-term debt with short-term instruments is becoming the norm. This means the amount of debt coming due will likely seem ever more alarming, but unless an auction fails to find buyers, there’s no real cause for panic. Sometimes, hyping up concerns about massive maturities may serve other undisclosed purposes.

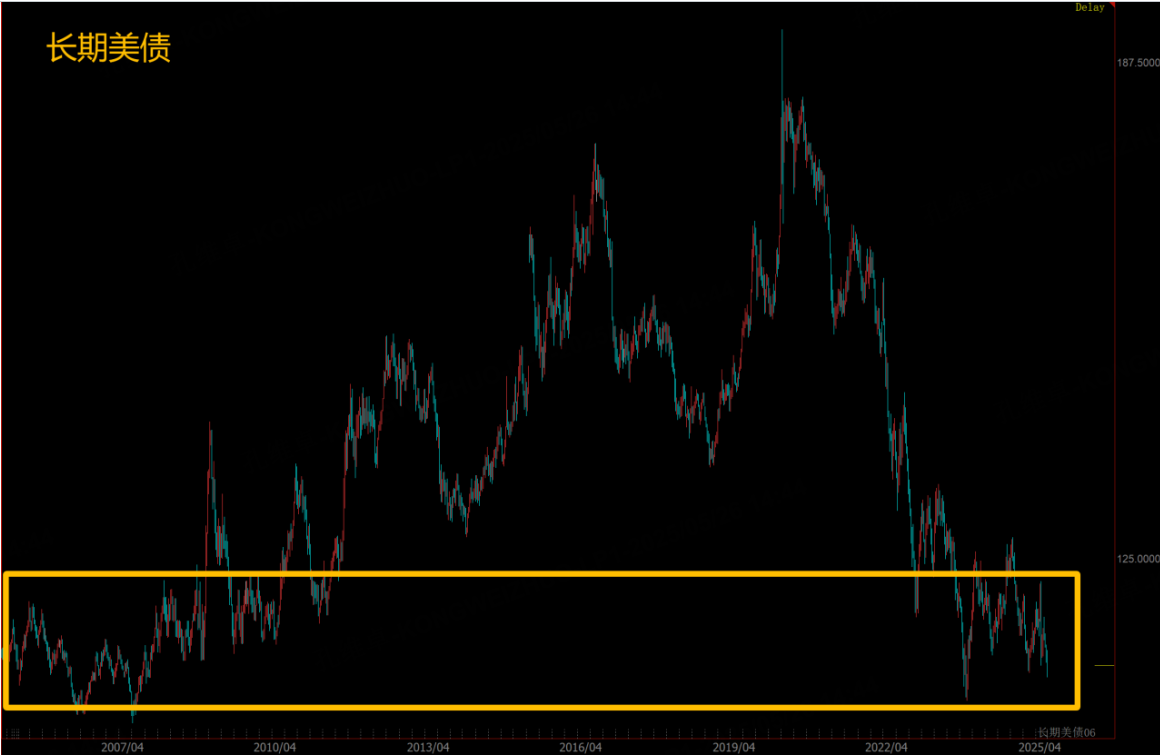

Technically, although long-term Treasury prices have underperformed, they remain within a trading range near the lows last seen in 2007-2008. Back then, after the financial crisis hit, the Fed cut rates and bond prices rallied for years. While it’s unclear when the current Fed will cut rates again, a rate cut is inevitable (Powell’s term ends next year at the latest, and Trump is still in office). At that point, Treasuries will again become a key investment focus.

$E-mini Nasdaq 100 - main 2506(NQmain)$ $E-mini S&P 500 - main 2506(ESmain)$ $E-mini Dow Jones - main 2506(YMmain)$ $Gold - main 2506(GCmain)$ $WTI Crude Oil - main 2507(CLmain)$

Comments