1. Recent Review of Oil Price Trends

At the beginning of April, the international crude oil market suffered a significant drop, with Brent crude and WTI crude both falling below key support levels of $68 and $64 respectively. This decline was primarily triggered by the dual pressures of a tariff shock initiated by the United States and an unexpectedly large production increase by OPEC+. Over the following month and a half, oil prices oscillated within a range of roughly $10, with WTI fluctuating between $55 and $65, while Brent traded between $58 and $68. In the absence of any major systematic risk events, prices are likely to continue fluctuating within this range; however, in the medium term, there remains a genuine risk of a further breakdown.

The daily candlestick chart for WTI main contract 2507 shows prices at $61.27 (+0.38, +0.62%), with moving averages at MA5: $61.25, MA20: $60.69, and MA200: $69.29. Since the early April plunge, WTI futures have been consolidating at the lower end of the range, with highs and lows clearly constrained by this band.

2. Analysis of Short-Term Support Factors for Oil Prices

(1) Tariff War Impact and Policy Reversal

The principal driver behind this sharp decline in oil prices was the U.S. government's launch of a tariff war. The market broadly anticipated this would have severe negative effects on the global economy, including both a short-term reduction in trade flows and longer-term damage to industry and consumption, all of which would significantly dampen crude oil demand. At the same time, OPEC+ production cuts had been a main source of price support in recent years, but the abrupt policy shift triggered a far more bearish impact on prices than the tariff war itself.

When these two forces combined in early April to drive prices sharply lower, their subsequent short-term, temporary reversals also helped cushion the decline. On April 9, President Trump announced an emergency 90-day suspension of tariffs for certain countries and regions, directly reversing the market's pessimism. This led to a strong rebound in U.S. equities and crude oil, with both rebounding nearly 12% off recent lows. Later, in mid-May, positive progress in U.S.-China tariff negotiations further boosted market sentiment.

(2) OPEC+ Supply Dynamics

At the same time, OPEC’s actual crude output did not rise in April but rather decreased. Increased U.S. sanctions on Venezuela further reduced supply. Other OPEC members such as Saudi Arabia and the UAE did not take the opportunity to boost production, leading to market speculation that Saudi Arabia was being “tough in words, soft in action” and was still shouldering the main burden of production cuts.

(3) Geopolitical and Demand Factors

Tensions in geopolitics continue to weigh on oil prices. The market is closely watching U.S.-Iran nuclear negotiations, which remain a focal point for Israel. Although the fifth round of nuclear talks between Iran and the U.S. in late May made some progress, no decisive outcome was achieved, which eroded investor confidence and allowed prices to recover some of the losses triggered by Trump’s proposal to impose tariffs on the EU.

On the demand side, the U.S. is about to enter the summer driving season, typically the peak period for automotive fuel consumption. Meanwhile, though U.S. crude inventories have edged up in recent weeks, they remain at multi-year lows, providing support for oil prices.

3. Rising Risks of a Medium-Term Breakdown

(1) Possible Further Production Increases by OPEC+

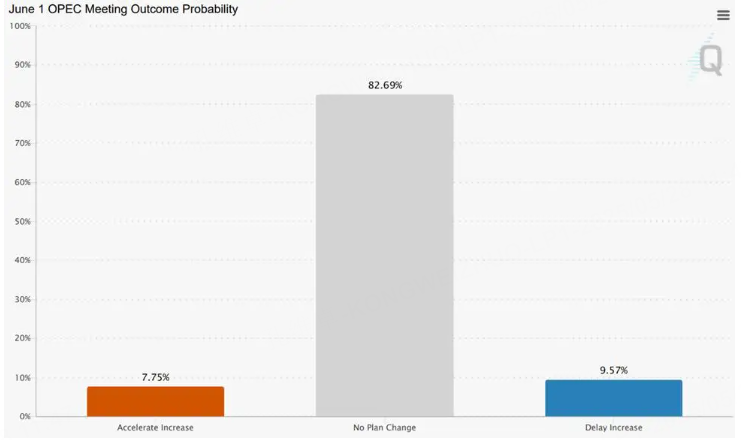

Despite the CME OPEC Watch Tool indicating an 80% probability that OPEC+ will keep production unchanged at its June 1 monthly meeting, media reports suggest that OPEC+ is considering approving another significant increase of 411,000 barrels per day in July. Should this plan be implemented, it would mark the third consecutive month of major output hikes by OPEC+. With Kazakhstan’s May production still rising, the market worries that Saudi Arabia may ultimately lose patience and also increase production, which would deal a heavy blow to oil prices.

As of May 26, the market was highly focused on expectations of unchanged output from OPEC+, but external expectations of a production increase are building.

(2) OPEC Market Share and Competition with U.S. Shale

OPEC’s dominance in the global oil market has continued to weaken. A decade ago, its market share stood at 40%, but this year it has fallen to below 25%. In contrast, the U.S. share of oil production has risen from 14% to 20% over the same period. Over the past ten years, the U.S. global oil output share has increased from 15% to 22%, while that of Russia and Saudi Arabia has gradually shrunk.

Some media outlets have interpreted the latest OPEC+ production increases not just as a punishment for members who exceeded their quotas, but as an attempt to compete with U.S. shale producers. The most productive U.S. shale blocks have already been heavily exploited, forcing producers to shift to less optimal areas, resulting in higher costs and exacerbating inflation. As U.S. shale companies grow more pessimistic about future oil prices and with prices currently trending lower, early signs of production cutbacks are already appearing. According to Baker Hughes data from May 24, the number of U.S. oil and gas rigs fell by 10 in the latest week, hitting the lowest level since November 2021.

(3) Downside Thresholds and Expectations

According to institutional research, if oil prices fall to around $50 per barrel, broad-based output cuts—including by large corporations—could be triggered. In theory, such cutbacks would eventually help stabilize prices, but before that, the market is likely to face another round of downward pressure.

$E-mini Nasdaq 100 - main 2506(NQmain)$ $E-mini S&P 500 - main 2506(ESmain)$ $E-mini Dow Jones - main 2506(YMmain)$ $Gold - main 2508(GCmain)$ $WTI Crude Oil - main 2507(CLmain)$

Comments