I. Performance and Valuation of Global Equity Indices

Data Sources: Bloomberg, Tiger Asset Management

Last week, global stock markets continued to experience volatility. Affected by factors such as the U.S. Treasury auctions, the three major U.S. indices pulled back slightly, with the S&P 500$, Nasdaq$, and Russell$ indices all falling more than 2% for the week. Data shows that although the yield on the 20-year U.S. Treasury surpassed 5% in the latest auction, the bid-to-cover ratio and foreign demand remained relatively solid. We believe that neither monetary nor fiscal policies currently provide support for U.S. Treasuries, and the U.S. government’s debt risk remains a concern.

Last week, U.S.-EU trade talks faced setbacks as Trump threatened to impose a 50% tariff on the European Union. Markets initially fell sharply but rebounded quickly after a calming response from Bessent. In our view, the market has almost entirely priced in a smooth outcome of the tariff negotiations. The key going forward will be the U.S. macro data for May and June. Weak data could not only dampen market sentiment but also hinder negotiation progress.

This week’s key events include NVIDIA’s earnings report, the second estimate of Q1 GDP, and macro data such as April’s PCE.

II. Key Market Themes

U.S. Stocks: Continued Volatility, Direction Becoming Clearer

Over the past week, U.S. equities opened with continued choppiness, with Google’s new model announcement briefly reviving the AI narrative. By Wednesday, the auction of 20-year U.S. Treasuries shocked markets as the highest accepted yield surged to a new two-year high of 5%. On that day, both stock and bond prices fell sharply, reflecting increased concern over U.S. Treasury risk.

Objectively, this Treasury auction was mediocre, but not disastrous. The bid-to-cover ratio was only 2.46x—down from April but still within the acceptable range of 2.3–2.7. Moreover, the share of foreign demand reached 69%, slightly above this year’s average, indicating that foreign buying interest remained intact. Therefore, the panic only lasted a day, and U.S. equities largely stabilized the following day.

That said, we believe U.S. Treasuries will remain a major challenge for the Trump administration. As mentioned earlier, long-term Treasury yields above 5% could pressure Trump into making concessions. Yet from both monetary and fiscal perspectives, there are currently no tailwinds for Treasuries. On one hand, the Fed remains hawkish, with no signs of imminent rate cuts—some investment banks have even begun pricing in a “no cut” scenario for the entire year. On the other hand, Trump’s tax cut bill just passed the House, and Bessent also reiterated last week that the U.S. government will fully stimulate the economy.

Coupled with a lack of progress in tariff talks, we expect the U.S. fiscal deficit to continue expanding, further increasing debt pressure. There is no effective resolution in sight for this contradictory situation, which runs counter to Trump’s goal of reducing debt. For investors, even though this auction wasn’t the breaking point, the U.S. government’s debt issues remain a key source of uncertainty for both stocks and bonds moving forward.

At the same time, Trump’s tariff negotiations encountered fresh obstacles. Last Friday, Trump tweeted that trade talks with the EU were not going well and threatened a 50% tariff as punishment. The market reacted with immediate caution—Nasdaq plunged nearly 2% intraday. Fortunately, Bessent quickly intervened, stating that Trump’s remarks were a negotiation tactic. Trump also later walked back his statement, delaying the tariff implementation to July, which helped markets rebound. This episode reveals several points:

-

First, market anxiety over tariffs persists but has decreased compared to April. Similar comments from Trump last month would have triggered a much larger selloff.

-

Second, more investors now believe that Trump’s tariff stance is fully disclosed, with a 10% rate seen as the final outcome for most countries. As we mentioned last week, the market has already priced in this optimistic expectation. Any deviation or failure from this outcome would be bad news.

At present, we’re halfway through the 90-day waiver period since Trump’s April 9 announcement. Based on prior U.S.-China dynamics, many countries and regions are likely adopting a wait-and-see approach—hoping U.S. macro data will deteriorate, giving them more leverage in negotiations. Starting next week, key U.S. data will be released, including April PCE, May PMI, and non-farm payrolls. These will be the first real tests since the tariffs were imposed. If the data remains strong across economic growth, inflation, and employment, we believe it will not only boost market sentiment but also accelerate progress in trade talks. Conversely, if the data disappoints, U.S. equities may face another significant correction.

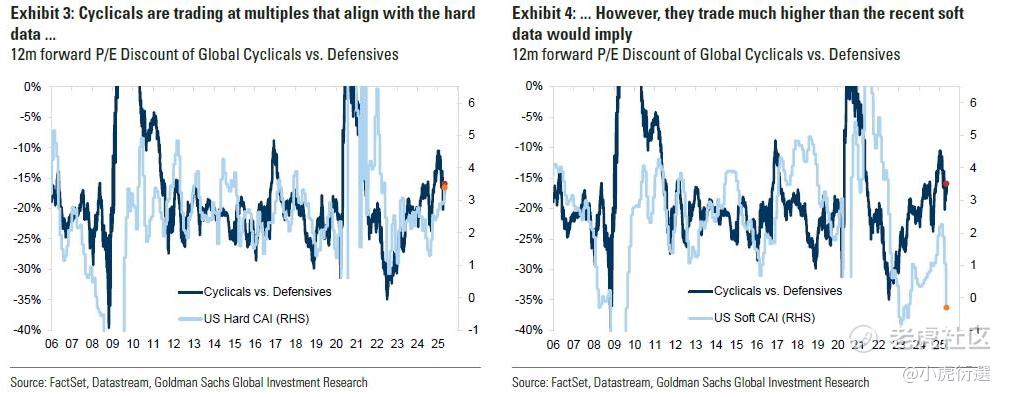

In short, the current market narrative has essentially reverted to where it stood just before Trump’s inauguration earlier this year. That said, the baseline 10% tariff is already in effect and non-negotiable. Market sentiment is overly optimistic, largely ignoring downside risks. According to Goldman Sachs, recession risks are not priced in at all. The relative valuation of cyclicals vs. defensives aligns with hard data, but diverges sharply from soft data. Whether investors are underestimating risks or surveys are overestimating tariffs—we’ll know the answer soon.

-

Disclaimer

1. The information contained in this document is for reference only and does not constitute any financial advice or a transaction offer, solicitation, suggestion, recommendation or any guarantee for any financial product, strategy or service. You should make your own investment decisions and bear the risk of investment responsibility independently.

2. The content of this document is based on reliable data sources that the staff believed to be reliable at the time of production. The Tiger Investment Research team may adjust without prior notice. The Tiger Investment Research team does not guarantee the accuracy, reliability or completeness of the content of this document, and does not assume any responsibility for any transactions arising from the content of this article and its derivative consequences.

3. This document is confidential and non-public and can only be accessed by professionals with corresponding risk-taking capabilities and preferences. Without the prior consent of Tiger, no one may copy or distribute it in any form.

Comments