$Alphabet(GOOG)$ has long been viewed favorably by investors, yet it continues to be undervalued in the market. Despite strong fundamentals and consistent performance, its stock price often lags behind peers in the AI race.

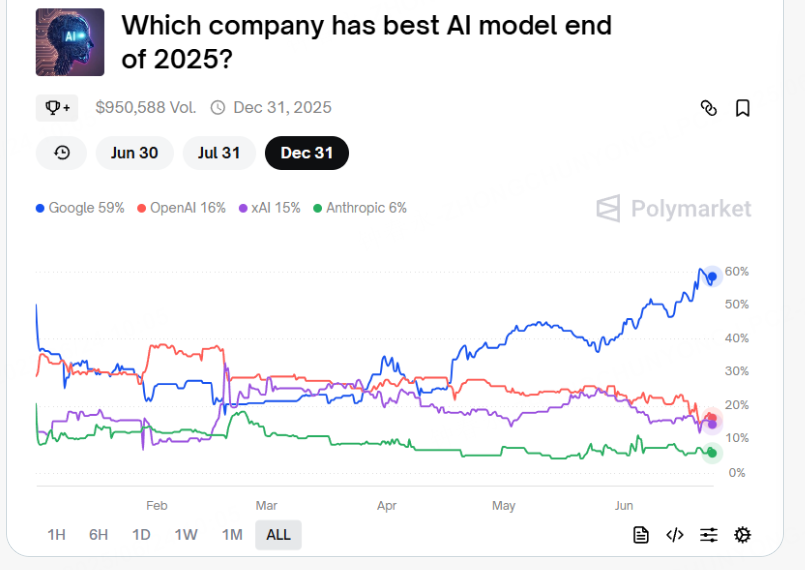

According to predictions on PolyMarket, Google is expected to lead with the best-performing AI model in 2025, securing the top spot in the highly competitive landscape.

Google is also the most profitable among the Big Tech companies, with earnings reaching $111 billion.

How do you view?

Is Google Undervalued?(Maximum3 votes)

Greatly underestimated(17 votes)

Greatly Undervalued(21 votes)

The stock price can rise to 200(22 votes)

Not Undervalued(2 votes)

AI is the first(7 votes)

Google AI is number one(1 votes)

Google AI at the bottom(1 votes)

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Comments

$Alphabet(GOOGL)$ $Alphabet(GOOG)$ ⚡🚀🎯Alphabet’s Double Bottom Breakout🎯🚀⚡

$GOOGL just printed a textbook double bottom at $162.20, igniting fresh buyer energy. The line in the sand is now $166, hold that and the technical roadmap points to $169.90 first, then $172.10.

🚨Why it matters

Cloud is sprinting at a US$50 B run rate, worth roughly US$750 B on a plain 15 × sales lens. YouTube combines about US$60 B in ads and Premium, even a modest 10 × multiple prices it near US$600 B. Those two pillars alone cover most of Alphabet’s US$1.88 T cap, leaving Search, Display, Hardware, DeepMind and Waymo practically on clearance.

🔥Technicals meet fundamentals

The double bottom confirms demand right where value investors see mis-pricing. Momentum indicators have curled up, volume is rising into strength and option flow shows calls clustering above US$170. Chart and valuation finally rhyme.

🎯Trade view

Maintain the bullish bias while price holds above US$166. A decisive close over US$169.90 opens the door to US$172.10, then prior highs come into play. Close below US$166 and the setup cools off, reassess at US$162.20 support.

📢 Don’t miss out! Like, Repost and Follow me for exclusive setups, cutting-edge trends, and insights that move markets 🚀📈 I’m obsessed with hunting down the next big movers and sharing strategies that crush it. Let’s outsmart the market and stack those gains together! 🍀

Trade like a boss! Happy trading ahead, Cheers, BC 📈🚀🍀🍀🍀

@Tiger_comments

@icycrystal @rL @Mig @AuntieAaA @Shyon @koolgal Please join in the discussion and vote for a chance at winning Tiger coins 🐅🪙