At the start of the new year, the drama keeps coming. Over the weekend, the United States launched an operation, directly apprehending Venezuela’s president and bringing him to the U.S. for trial; the speed of the action and the precision of the intelligence once again demonstrated America’s military capabilities.

Although there are rumors that the operation went so smoothly because there was an insider, being able to secure an insider is itself a reflection of military strength. Since the incident both occurred and concluded over the weekend (many recent military operations share this style: short duration, clear objectives, and no sustained escalation in responses from either side), for financial markets it would likely be digested within the few hours from Monday’s open through the Asian session, and observers can watch Monday’s open to judge whether it ultimately reads as bullish or bearish news.

Trump’s Strategic Objective?

This operation is essentially an escalation and continuation of U.S. sanctions on Venezuela. Previously, the U.S. at one point designated the Venezuelan government as an organization engaged in terrorist activities and drug trafficking, and imposed strict restrictions on its crude oil exports.

After this operation, Trump immediately called for major U.S. oil companies to enter Venezuela to invest in damaged oil wells and generate returns for the United States, which is precisely the strategic objective behind this operation.

Why Venezuela Matters for Oil

Venezuela is in fact the country with the world’s largest oil reserves: proven oil (including heavy oil) reserves are 300 billion barrels, ranking first globally. Saudi Arabia, as commonly known, ranks first in oil production, but its reserves are not as large as Venezuela’s. Much of Venezuela’s crude is heavy oil; while it contains many impurities, U.S. refineries can make effective use of this type of crude. In addition, Venezuela is geographically close to the United States, and if properly controlled, it would effectively become a new oil-producing area for the U.S., helping address America’s energy security concerns.

What This Signals About Oil

Given current market oil prices, U.S. domestic shale oil producers lack the incentive to expand crude investment, which makes a future decline in U.S. oil production predictably likely. On top of that, in the past two years, to control inflation, the U.S. sold off a large amount of its Strategic Petroleum Reserve.

If a new controllable source of crude cannot be secured, oil prices may be difficult to keep down in the future. Therefore, this operation further highlights the outlook that the U.S. is short of oil; even if oil prices fall further, there will still be good investment opportunities ahead.

Crude Oil Trading Strategy

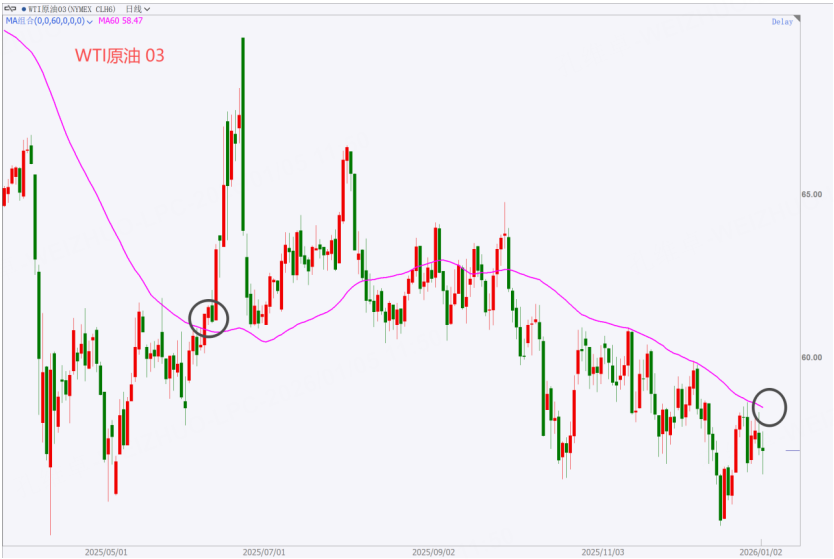

For the short-term strategy, first observe how oil prices behave at Monday’s open; if prices continue to make new lows, there is no need to take any action. If oil prices rise, use the 60-day moving average as the key reference: if oil breaks above the 60-day moving average, follow the bullish move. Use last week’s low of $56 as the stop-loss level, and set an initial take-profit target at $60.

If oil price volatility feels too fast to tolerate, it is also possible to try going long a 3–6 month crude oil calendar spread (near vs. far month arbitrage): if prices rise on the news, it will more easily impact the near-month contract, which would widen the spread between the two contracts; if oil still fails to break above the 60-day moving average after an extended period, then stop-loss and close the position—because the spread loss is smaller than outright price volatility, this approach may be worth considering.

$NQ100指数主连 2603(NQmain)$ $SP500指数主连 2603(ESmain)$ $道琼斯指数主连 2603(YMmain)$ $黄金主连 2602(GCmain)$ $WTI原油主连 2602(CLmain)$ $小原油主连 2602(QMmain)$ $美国原油ETF(USO)$

Comments

MAGA is at the expense of other countries in the guise of upholding security....