The 3-for-1 stock split with the Tesla Inc (TSLA) stock, which went into effect today (Aug. 26) makes it easier to create income by shorting covered calls and cash-secured puts. This is because less money has to be put up as collateral.

To sell a covered call on TSLA stock an investor has to first buy 100 shares and then sell an out-of-the-money (OTM) call option. So, now, at $290.50, the investor purchases $29,050 of shares and then shorts an OTM call. That cost is now one-third less than it used to be.

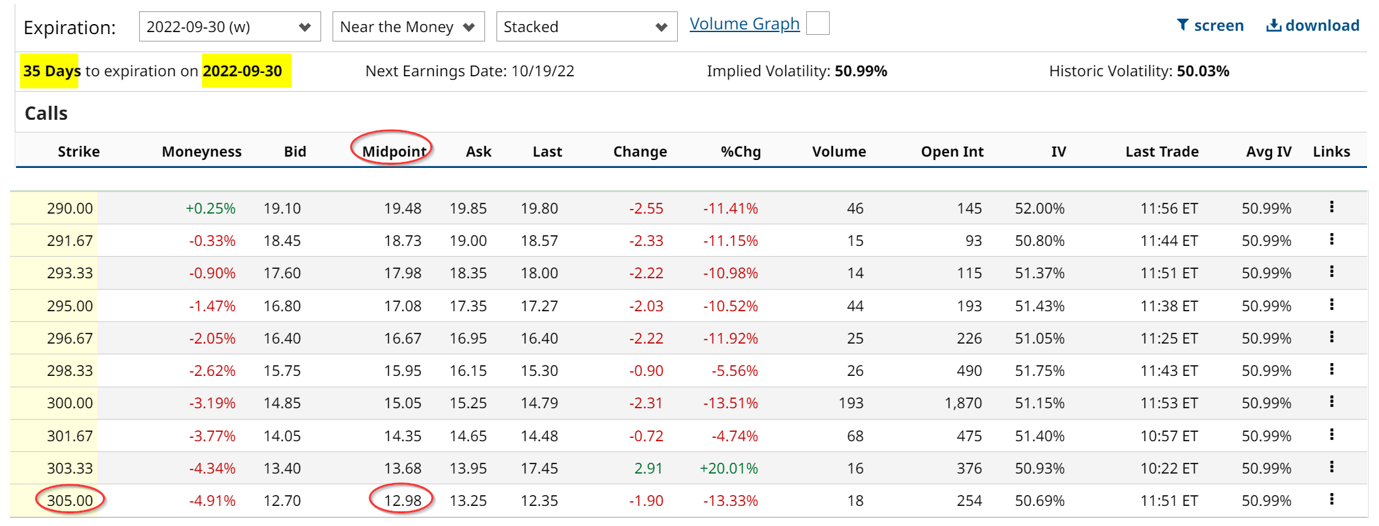

For example, look at the Barchart call option table below.

This shows that the Sept. 30 calls at the $305 strike price, which is 5.0% over today's price will bring in $12.98 per contract. That represents a yield of 4.468% on the cost of the covered call shares of $290.50.

That is a very high yield and implies that the investor could make a return of almost 10% if the stock rises just 5%. Moreover, the investor no longer has to pony up over $90,000 just to make a covered call return. By putting up one-third less capital, the investor now has more flexibility. So, for $29,050, the investor will receive $1,298 when he shorts this covered call.

Moreover, the $12.98 premium provides a good deal of downside protection. TSLA stock would have to fall to $277.52 before the breakeven point is reached. And that has to occur in just 35 days at the end of Sept. 30.

Shorting Cash-Secured Puts Is Even Easier Now

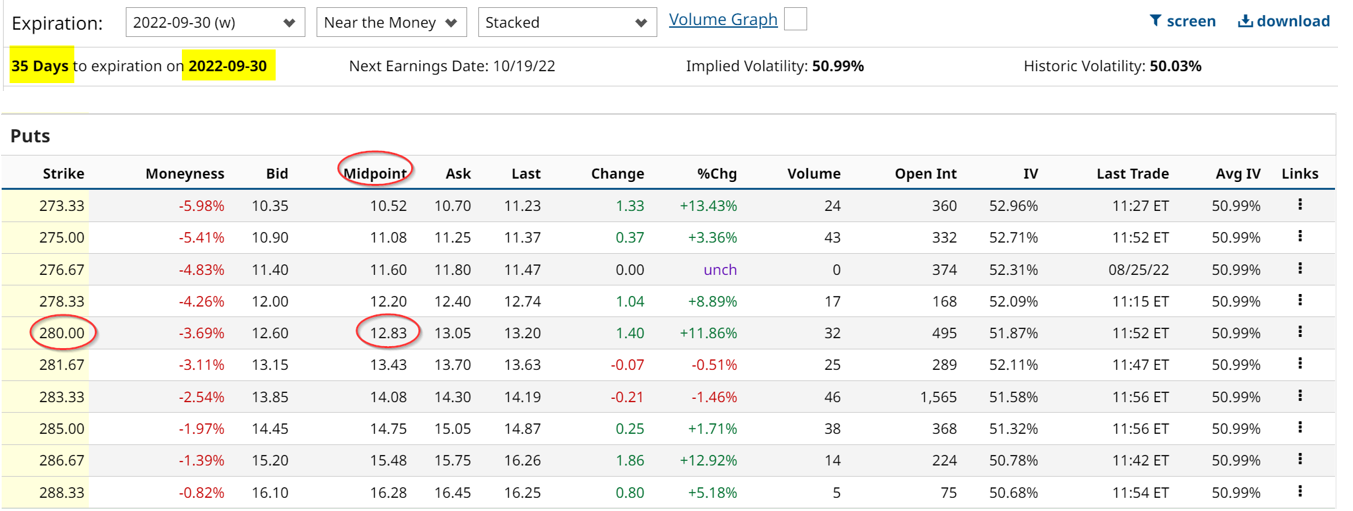

Now it is even easier to short OTM puts to create income. For example, look at the put option chain for Sept. 30 below.

This shows that the investor now has to put up just $28,000 (at the strike price of $280) in order to earn $1,283 in short put income. That is now one-third-less cash that has to be secured at a brokerage firm in order to guarantee that 100 shares (per put contract) can be purchased at $280 per share.

This also represents a 4.58% return on investment (i.e., $1,283 / $28,000) at a strike price which is 3.6% below today's price. It provides a very nice breakeven cushion as well. For example, the stock will have to fall to $267.17, or 8.0% below today's price before the breakeven point is reached.

So by only having to secure one-third less cash for these juicy returns TSLA investors can make good potential income given the recent stock split.