Summary

- IBM has seen sequential revenue declines for 9 out of the last 10 years, and its shareholders over this time have gotten to know pain and disappointment.

- The company now has a plan to spin off the low-growth/declining parts of the business into a new company called Kyndryl, while retaining the high-growth parts (cloud, AI, etc) at IBM.

- IBM is a cheap stock with a heavy debt load, declining revenue and margins, and a high dividend to pay. The spinoff could be their last hope at returning to greatness.

- Of course, the devil will be in the details with the spinoff, which is expected to close before year end.

Can IBM Grow?

IBM(NYSE:IBM), formally known as International Business Machines Corporation, is one of America's oldest and most venerable technology companies. However, over the past couple of decades, the company has struggled to compete with newer tech companies like Amazon(NASDAQ:AMZN). As such, despite a futile decades-long effort to boost earnings per share via layoffs and debt-funded acquisitions and share buybacks, IBM has been unable to escape the reality of its declining revenue. As such, the market has slowly but surely punished IBM with a lower share price.

IBM's management team has a new plan to turn it all around, and this time it just might work. The idea, spin-off the slow-growth parts of the business into a new company called Kyndryl while retaining high-growth divisions like cloud computing, artificial intelligence, and software (including Red Hat) at IBM. Kyndryl is certainly an odd choice for a company name. The name sounds like a cross between some kind of comic book villain and the antihistamine drug Benadryl, but that's the new entity where IBM appears set to dump most of their underperforming businesses into. The deal is expected to close before year-end.

The logic here is that the software and cloud business would be worth more as an independent company without being bogged down by a shrinking legacy business with ~100,000 employees. In other words, the investment bankers behind the deal would surely tell you that the sum should be worth more than the parts, but a lot of whether this deal works depends on the details. For example, how will the debt be split up among the companies? Will unprofitable divisions be closed, retained at IBM, or spun-off to the new company? IBM has said that they intend to maintain the dividend, but AT&T(NYSE:T)was cornered by a lack of cash into breaking a similar promise with their recent spinoff announcement. We'll know more when Kyndryl files its initial Form 10 with the SEC. At least initially, the earnings power of the combined company should equal the sum of the two separate ones. Whether the tactic makes a meaningful change in the overall valuation of IBM will be an interesting case study. With this in mind, let's look at some financial and valuation metrics for IBM.

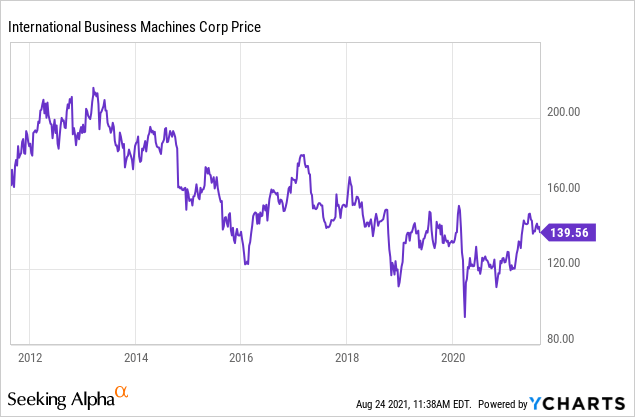

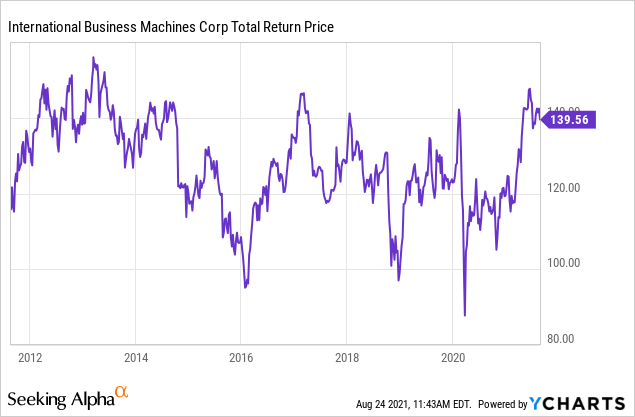

IBM Stock Price

As mentioned earlier, IBM has not been able to grow its share price with financial engineering. The picture improves when you look at IBM from a total return perspective, but companies that pay dividends out of retained earnings while the share price falls like IBM has are simply just machines for turning the return of initial shareholder capital into taxable dividends. This creates unnecessary taxes for shareholders while the company's payout ratio and debt ratios deteriorate—a pointless, lose-lose situation.

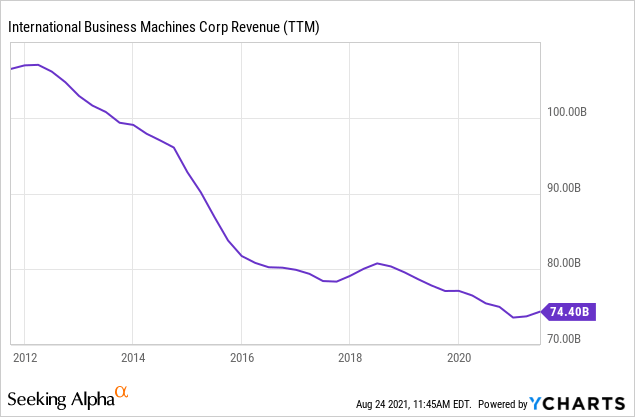

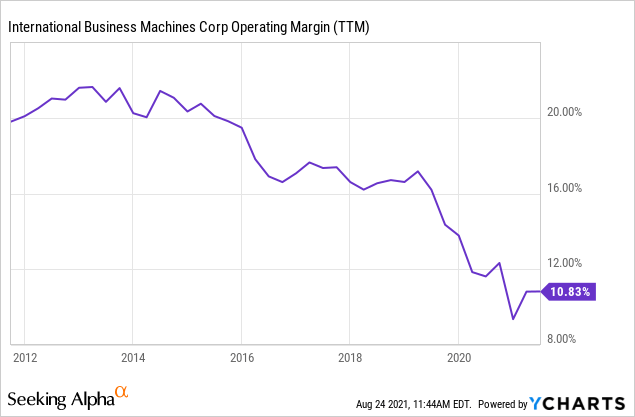

IBM Financials

Here is IBM's revenue, (trailing 12 months by quarter) over the last 10 years.

Now here's a look at IBM's operating margins, again for the last 10 years.

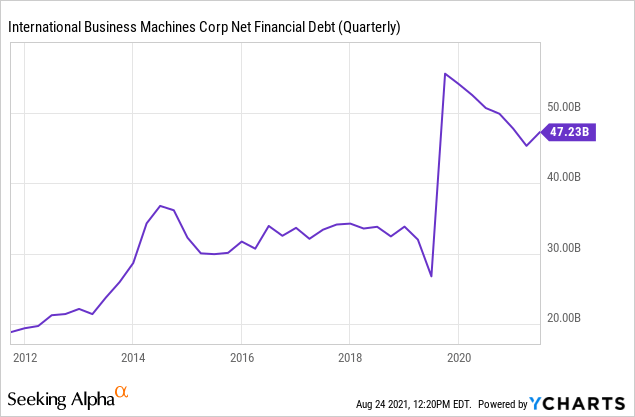

And IBM's debt load.

Looking at IBM's balance sheet and income statement shows an unambiguous picture of a business in decline. This has been known for a long time. It's likely only a matter of time before the 4.7 percent dividend yield comes under pressure. Despite this, there are some signs of a turnaround. The past couple of quarterly earnings came in higher than estimates, and the dividend should be covered by expected earnings of $10.70for this year (the dividend wasn't covered last year).

For next year, analysts expect earnings of nearly $12, but their revenue estimates are far more subdued, calling for about only a two-percent increase. There are a lot of things that companies can do to make earnings temporarily better, but revenue and revenue per share are much harder numbers to smooth out. To this point, I don't love IBM's accounting, the whole thing has a feel to it like they're robbing Peter to pay Paul, every quarter, for years on end.

Where Will IBM Be in 5 Years?

One thing we know is that IBM is highly likely to be two companies instead of one. IBM itself could likely trade for a higher multiple, perhaps in line with the S&P's P/E ratio in the low 20s, while Kyndryl is likely to trade somewhere below 10x earnings. Of the two, IBM is likely to be the better investment. I would expect that the earnings per share would slowly decline for Kyndryl while growing 5-10 percent annually for IBM. One wild card here is how the debt for the two companies is split up. There is going to be a temptation to place more of the debt in Kyndryl to turn the new IBM into a star performer. This is the stuff of corporate law firms who make a lot more money per hour than I do, but my feeling is that the long-term bonds issued by IBM probably are going to have to be guaranteed by both companies going forward in some capacity, depending on the debt covenants. Some recent debt covenant cases with Hewlett Packard(NYSE:HPQ)and Penn National(NASDAQ:PENN)are worth reading.

Just ballparking the combined company and recent earnings, my best estimate for 5-year returns is 0-2 percent annually if you hold both. Kyndryl probably will have to cut its dividend at some point if revenue doesn't start growing, while IBM itself can grow earnings handsomely on the software side and could possibly become a dividend growth stock. After the spinoff, I would expect high-single-digit annual returns for IBM proper and low-single-digit negative returns for Kyndryl. These would be subject to the valuations of both companies, but that's my best estimate at this point. What are your thoughts? Feel free to share your take in the comment section!