Summary

- A deep dive into the e-commerce behemoth Alibaba (BABA) depicts a multi-engine growth machine, at a cyclical low.

- Our analysis of industry tailwinds and normalized earnings points to a huge opportunity for risk-tolerant investors.

- We estimate a market-crushing return of 17% per annum for Alibaba shareholders, indicating a 5x in the decade to come.

Investment Thesis

Dark days have lingered for Alibaba Group Holding (NYSE:BABA), down 65% from its high. The past year has been a true test of investors' fortitude. Over the past year, geopolitical risks have surfaced. Asked why he bought into Alibaba given those risks, Charlie Munger stated, "I was willing to take a little political risk to get into the better companies at the lower prices." As for the recent run-up and steep decline, legendary investor Sir John Templeton had some advice:

Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria.

As pessimism looms, the bull market builds. We caution investors that now is not the time to trade BABA shares, but to own them. In the decade ahead, we estimate a market-crushing return of 17% per annum.

Know What You Own

Peter Lynch once advised, "Know what you own, and know why you own it." Let's take a look at Alibaba's multifaceted business model.

Alibaba is an expansive ecosystem of products. The pieces of Alibaba interact with each other to accomplish the company's mission: To make it easy to do business anywhere.

Core Commerce

The company's core commerce segment accounts for approximately75% of revenue. Alibaba's most important assets are its online shopping platforms Taobao, Tmall, Lazada, andAlibaba.com. Within core commerce, Alibaba makes money from advertising, customer management, subscriptions, and direct sales.

The company owns a collection of fast-growing grocery chains such as Freshippo, Sunart, and Tmall Supermarket. Although grocery has been a drag on margins, it is still an integral part of Alibaba's business empire. The Freshippo (Hema) chain even offers 30-minute delivery using smart logistics.

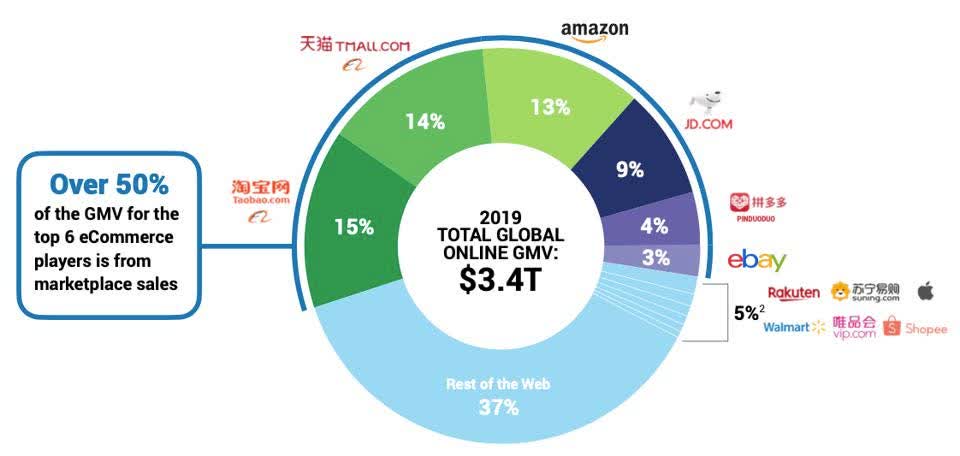

Despite its much smaller market cap, Alibaba is a larger e-commerce player than Amazon (AMZN). In 2020, Alibaba accounted for 29% of the e-commerce goods transacted globally:

Global E-Commerce GMV Share(Forbes)

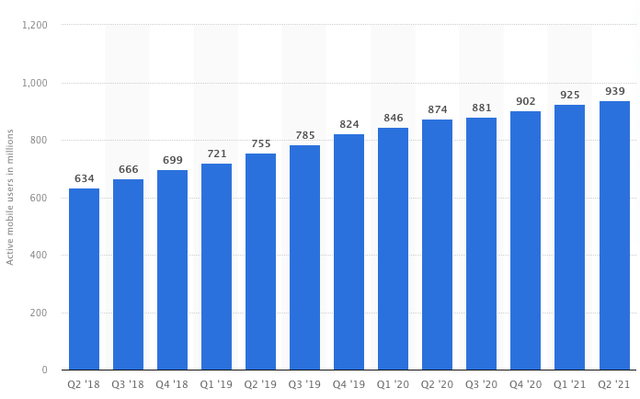

Alibaba's combined business reached1.31 billion consumers across the world over the past year. This number continues to grow despite its scale. In China alone, the company has nearly a billion monthly active consumers on its mobile shopping platforms:

MAU's Across Alibaba's Shopping Platforms(Statista)

An Expansive Ecosystem

Alibaba spawns new businesses where it sees an economic need in society. The company's new businesses, whether acquired or built, always support each other within the Alibaba ecosystem. The ecosystem includes Cainiao smart logistics and a digital payments app, Alipay.

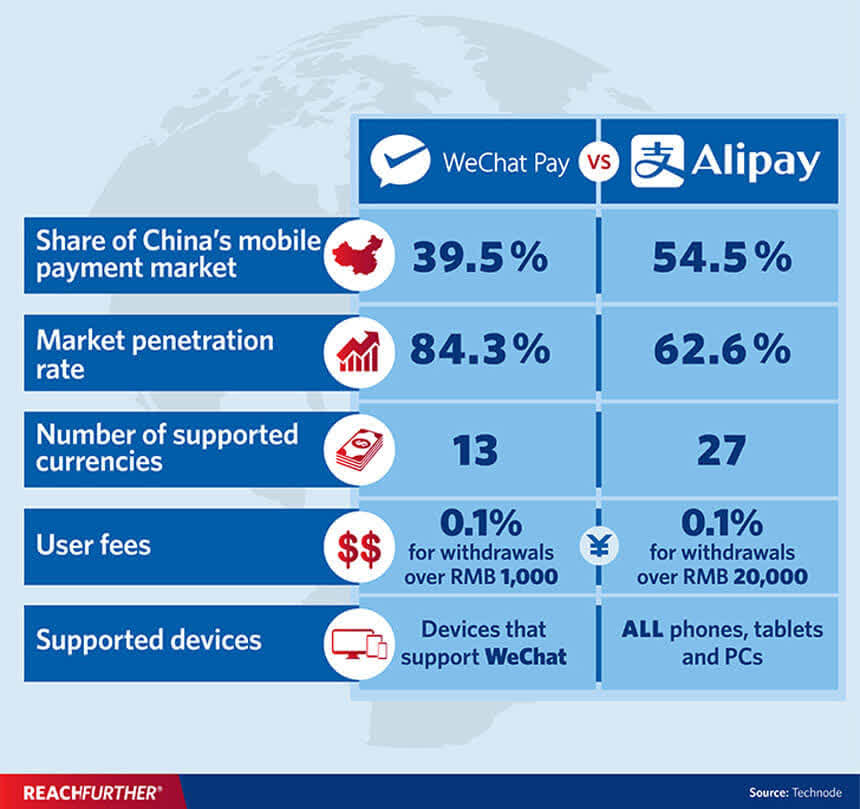

Alibaba started Alipay in 2004 to help build trust between consumers and merchants in online purchases (The company now owns 33% of the FinTech parent company, Ant Group). Fast-forward to today, and mobile payments are the preferred method of payment in China. Alipay has a 54.5% share of the market:

Alipay vs. WeChat Pay Market Share(EastWestBank)

Alibaba's reach is enormous in China. The company plays an integral part in the day-to-day lives of citizens, whether it be through payment, e-commerce, groceries, delivery (Ele.me), streaming (Youku), or navigation (Amap). The company is also the lifeblood of millions and millions of small businesses.

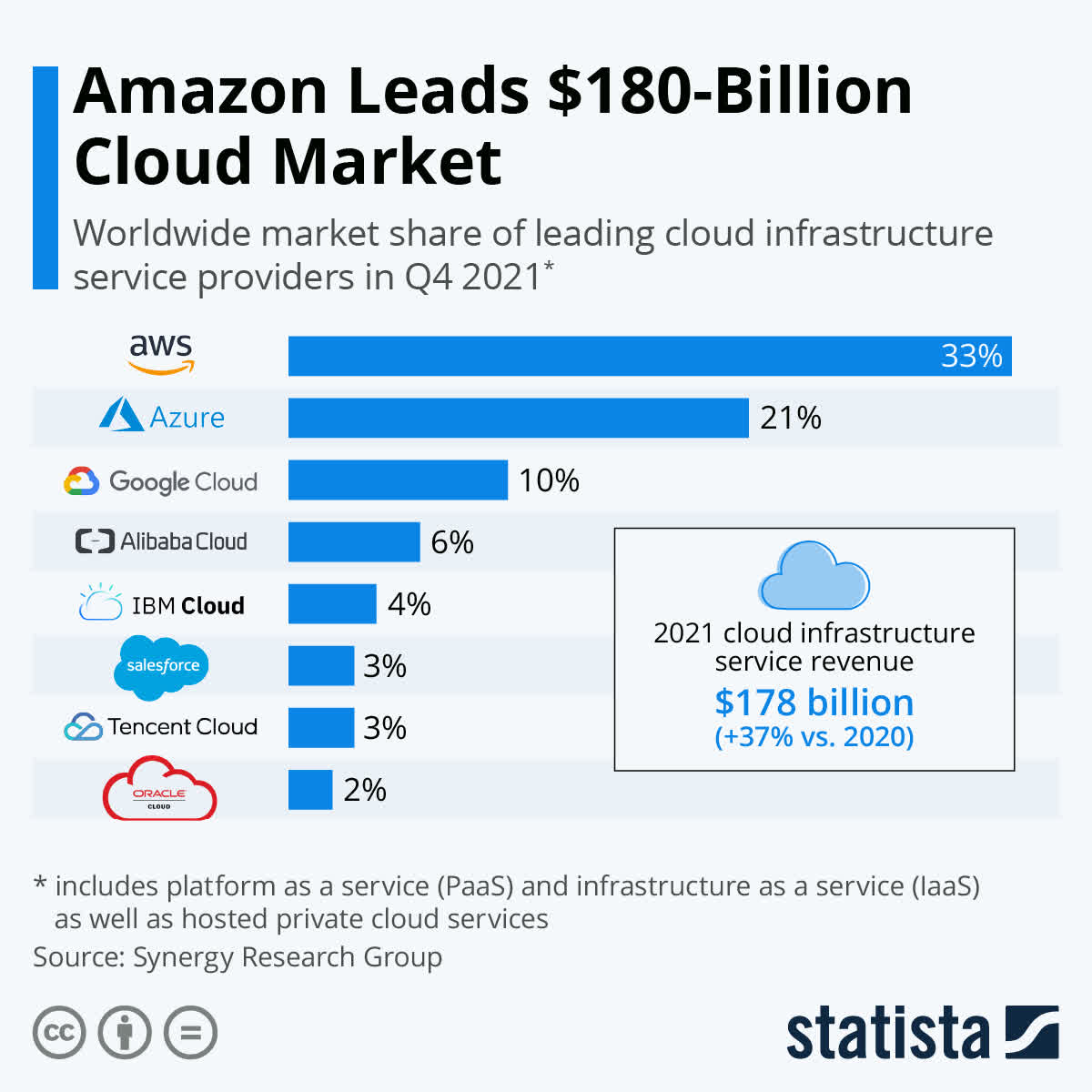

Alibaba's reach is a powerful network effect for its rapidly growing cloud segment. Alibaba Cloud is building out its network globally, and there is a very long runway for the business. Alibaba Cloud just became profitable over the past six months, and should contribute to the company's bottom line going forward. The company still has room to grow its cloud market share:

Global Cloud Market Share(Statista)

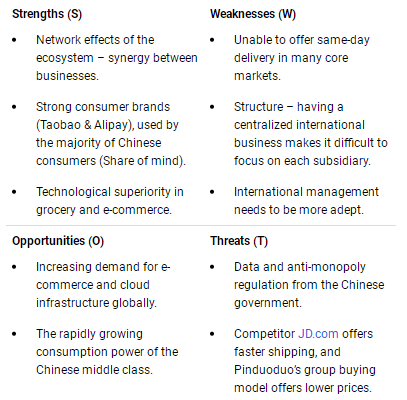

S.W.O.T. Analysis

To analyze what Alibaba does well, along with the risks it faces as a business, we present a S.W.O.T. analysis for the company:

Normalized Earnings

Alibaba's normalized earnings are around $22 billion, or $8.22 per share. The company experienced several one-off hits to its earnings over the past 12 months, including a $2.8 billion fine from the government, increased ad spend on Taobao deals, poor economic conditions in China, and huge goodwill impairments. To normalize earnings, we have taken the average net income over fiscal 2020 and 2021, divided by the current shares outstanding. Keep in mind that revenue and active users have grown substantially since 2020, indicating a conservative figure.

Valuation

We estimate Alibaba will grow normalized earnings at 13% annualized over the next decade, resulting in 2032 earnings per share of $27.90.

- Alibaba is still growing its user count. The company is in the early stages of its international expansion in e-commerce and cloud computing. These businesses have strong industry tailwinds, allowing Alibaba to grow organically. Alibaba also benefits from China's rapidly growing middle class. As a result, the average spend on Taobao and Tmall will increase if user retention remains strong. The same is true for Alibaba's delivery, streaming, grocery, and payments assets. On top of this, the company has $39 billion of working capital on its balance sheet to buy back shares, acquire businesses, and build new businesses.

Our 2032 price target for Alibaba is $488 per share, implying a return of 17% per annum.

- We have applied a terminal multiple of 17.5 for a business that we believe has an enduring network effect, brand, and industry tailwind.