- Quarterly total revenues reachedRMB7,436.3 million, a 97.7% increase year-over-year

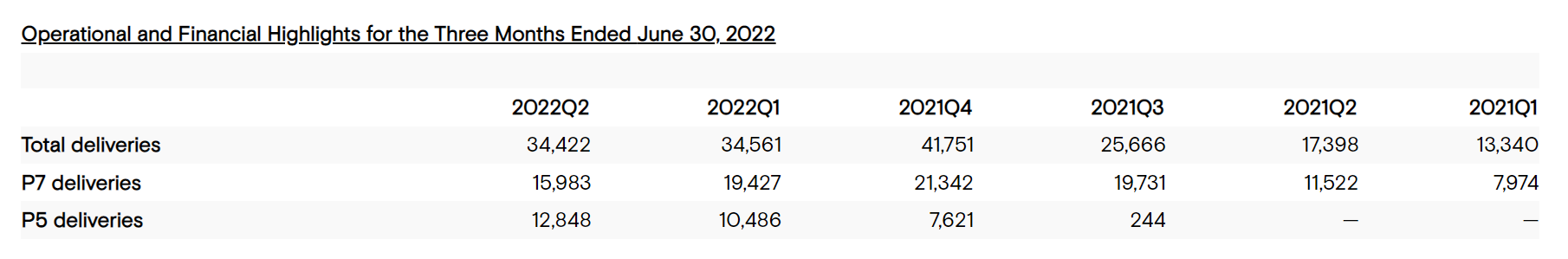

- Quarterly vehicle deliveries reached 34,422, a 98% increase year-over-year

- Quarterly gross margin was 10.9%, a decrease of 100 basis points year-over-year

XPeng Inc. (“XPeng” or the “Company”, NYSE: XPEV and HKEX: 9868) today announced its unaudited financial results for the three months endedJune 30, 2022.

XPeng shares dropped more than 2% after reporting quarterly results.

- Total deliveries of vehicles were 34,422 in the second quarter of 2022, representing an increase of 98% from 17,398 in the corresponding period of 2021.

- Deliveries of the P7 smart sports sedan were 15,983 in the second quarter of 2022, representing an increase of 39% from 11,522 in the corresponding period of 2021.

- Deliveries of the P5 smart family sedan were 12,848 in the second quarter of 2022, among which, over 50% can support XPILOT 3.0 or XPILOT 3.5.

- XPeng’s physical sales network continued expansion with a total of 388 stores, covering 142 cities as ofJune 30, 2022.

- XPengself-operated charging station network further expanded to 977 stations, including 793XPengself-operated supercharging stations and 184 destination charging stations as ofJune 30, 2022.

- Total revenueswereRMB7,436.3 million(US$1,110.2 million) for the second quarter of 2022, representing an increase of 97.7% from the same period of 2021, and comparable to the level of the first quarter of 2022.

- Revenues from vehicle saleswereRMB6,938.5 million(US$1,035.9 million) for the second quarter of 2022, representing an increase of 93.6% from the same period of 2021.

- Gross marginwas 10.9% for the second quarter of 2022, compared with 11.9% for the same period of 2021 and 12.2% for the first quarter of 2022.

- Vehicle margin, which is gross profit of vehicle sales as a percentage of vehicle sales revenue, was 9.1% for the second quarter of 2022, compared with 11.0% for the same period of 2021 and 10.4% for the first quarter of 2022.

- Net losswasRMB2,700.9 million(US$403.2 million) for the second quarter of 2022, compared withRMB1,194.6 millionfor the same period of 2021 andRMB1,700.8 millionfor the first quarter of 2022. Excluding share-based compensation expenses,non-GAAP net losswasRMB2,464.4 million(US$367.9 million) in the second quarter of 2022, compared withRMB1,096.4 millionfor the same period of 2021 andRMB1,528.2 millionfor the first quarter of 2022.

- Net loss attributable to ordinary shareholders of XPeng was RMB2,700.9 million (US$403.2 million) for the second quarter of 2022, compared with RMB1,194.6 million for the same period of 2021 andRMB1,700.8 millionin the first quarter of 2022. Excluding share-based compensation expenses, non-GAAP net loss attributable to ordinary shareholders of XPeng was RMB2,464.4 million(US$367.9 million) for the second quarter of 2022, compared withRMB1,096.4 millionfor the same period of 2021 andRMB1,528.2 millionfor the first quarter of 2022.

- Basic and diluted net loss per American depositary share (ADS) were bothRMB3.16(US$0.47) for the second quarter of 2022. Non-GAAP basic and diluted net loss per ADS were both RMB2.88(US$0.43) for the second quarter of 2022. Each ADS represents two Class A ordinary shares.

- Cash and cash equivalents, restricted cash, short-term deposits, short-term investments and long-term deposits were RMB41,339.3 million(US$6,171.8 million) as ofJune 30, 2022, compared withRMB43,543.9 millionas ofDecember 31, 2021andRMB41,714.0 millionas ofMarch 31, 2022.

Business Outlook

For the third quarter of 2022, the Company expects:

- Deliveries of vehicles to be between 29,000 and 31,000, representing a year-over-year increase of approximately 13.0% to 20.8%.

- Total revenues to be betweenRMB6.8 billionandRMB7.2 billion, representing a year-over-year increase of approximately 18.9% to 25.9%.

The above outlook is based on the current market conditions and reflects the Company’s preliminary estimates of market and operating conditions, and customer demand, which are all subject to change.