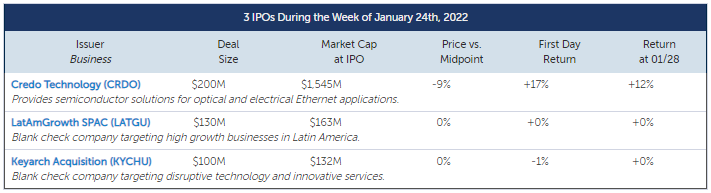

Challenging conditions in the IPO market continued this past week, with only one IPO and two SPACs pricing. The pipeline was slightly more active, with a number of small IPOs and a few SPACs submitting initial filings.

Connectivity solutions provider Credo Technology downsized and priced at the low end to raise $200 million at a $1.5 billion market cap. Founded by three former Marvell employees, Credo Technology provides semiconductor solutions for optical and electrical Ethernet applications. Despite being highly reliant on large customers with volatile order patterns, the company saw triple digit product revenue growth in FY1H22.

Two SPACs went public this week, led by Latin American-focused LatAmGrowth SPAC(LATGU), which raised $130 million. This week we published anote on the sharp uptick in SPAC withdrawals.

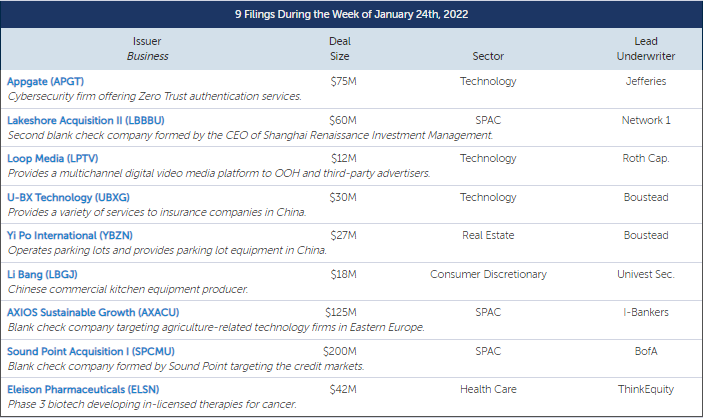

Three SPACs submitted initial filings.Sound Point Acquisition I(SPCMU), targeting credit markets, filed to raise $200 million. Agtech-focused AXIOS Sustainable Growth Acquisition(AXACU) filed to raise $125 million.Lakeshore Acquisition II(LBBBU) filed to raise $60 million, in Bill Chen's second SPAC after Lakeshore I (LAAAU).