Yesterday,I asked the question: should investors dump Apple stockat $155 before this selloff gets any uglier? On the same day, AAPL dipped to around $150 by early afternoon, suggesting that caution has been the right way to play this hand in the very short term.

But this coin has two sides. Yes, Apple stock seems to be clearly in a downtrend, along with the rest of the market. Due to a combination of high inflation, rising rates, supply chain challenges and the Russia-Ukraine conflict, bullishness is nowhere to be found.

However, history suggests that AAPL becomes a more appealing buy when the stock digs a deeper hole. Today, I look at historical trends to argue that now could be a good time to start buying Apple stock — provided investors have enough time and patience to see a turnaround.

History says: buy the dip in AAPL

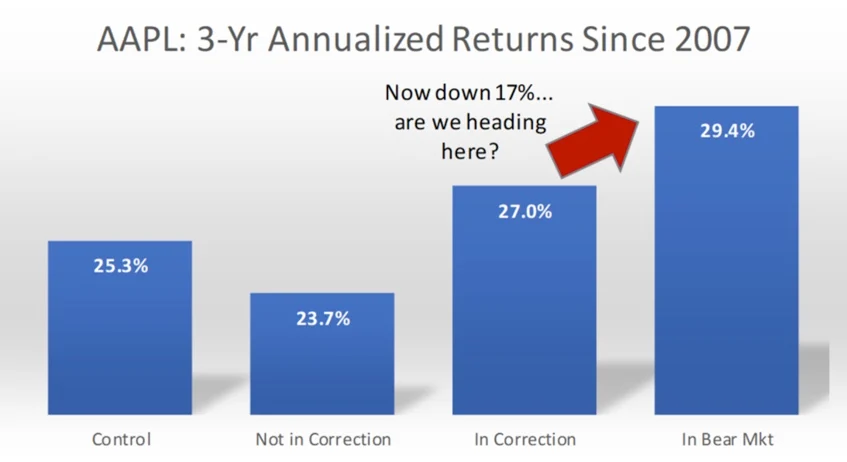

The argument for buying AAPL stock today is illustrated by the graph below. It represents the annualized return over a three-year period, if shares are bought at certain levels below all-time highs: not in a correction of 10%, in a correction, or in bear market (i.e. 20%-plus drawdown).

The key takeaway is simple: investors that could afford to wait three years did better when they bought AAPL on the dip. The larger the decline, the better for future performance.

The more subtle conclusion from the graph above is that there is a linear relationship between future returns and past declines. That is: buying a small dip is usually a good idea, but buying a larger dip has been an even better move.

Currently, Apple stock is in a drawdown of 17% (using mid-day price on Monday, March 14). Another bad day or two, and AAPL could be entering bear market territory. Bargain hunters should be paying attention.

When AAPL crumbles

There is one important observation that is not depicted above. The better gains, by far, have happened when Apple stock sank very deep into bear market — a correction of 50% or more. During the iPhone era, this has happened only once: in the Great Recession of 2008.

After correcting by more than 50%, Apple has produced average annualized returns of 68% in the following three years! Looking all the way back to the 1980 IPO, these returns would have been a smaller (but still phenomenal) 45% per year.

It is hard to tell if Apple stock will correct this much this time. But if it does, history says to back up the truck and buy as many shares as possible.

The key assumption

Buying the dip has proven successful in the past for one main reason: Apple stock has eventually recovered from a decline. This has happened because the company has become a dominant force in tech consumer devices and services.

Buying dips would probably not work going forward if Apple’s business were to deteriorate substantially. So, dip buyers must be confident in the Cupertino company’s fundamentals.

The good news is that, in my view, Apple is about as strong today as it has ever been. The pricey iPhone has become a staple around the world. The Mac is about the most desirable PC in the market. The App Store has become a necessity in the app economy of today.

For the reasons above, I would consider buying AAPL at current levels, assuming that I have the patience to hang on to my shares for a few years.