Summary

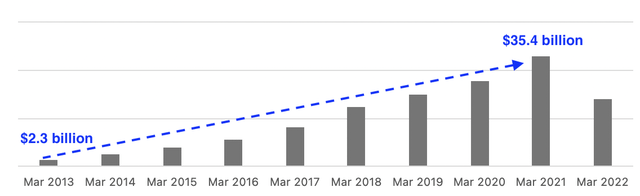

- Alibaba's annual operating cash flow has increased more than tenfold since 2013, surpassing the $20 billion mark. Yet, the share price hasn't gone anywhere.

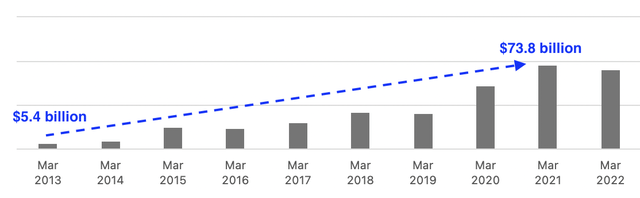

- Moreover, Alibaba's cash balance has increased more than tenfold, from $5.3 billion in 2013 to more than $70 billion today. Yet, as mentioned above, the share price hasn't moved.

- As a result, Alibaba's cash position now reflects ~25% of its market cap. This anomaly cannot last much longer, especially since the Chinese tech crackdown is finally easing.

- Alibaba is dirt cheap, trading less than 50 cents on the dollar, and the company has authorized the biggest buyback in its history. The market will eventually come to its senses.

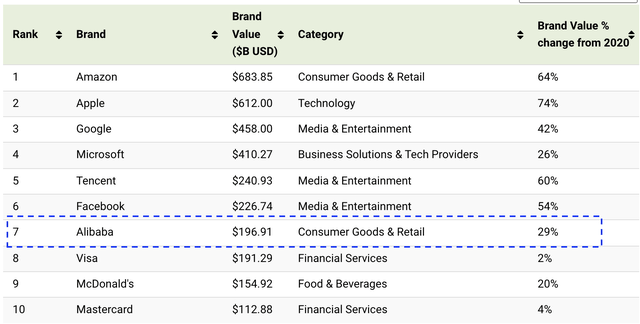

- Alibaba, as a brand, ranks in the top 10 list globally, surpassing the likes of McDonald's, Tesla and Coca-Cola.

Alibaba (NYSE:BABA) (OTCPK:BABAF) has essentially given up all of its gains since its IPO in 2014. In other words, Alibaba has been 'dead money' for almost a decade. However, unlike its share price, fundamentally, Alibaba has made remarkable progress on multiple fronts. Most notably, Alibaba has turned into a cash flow machine, with cash from operations increasing tenfold since its IPO, which in turn has led to a soaring cash balance, making the company cash rich.

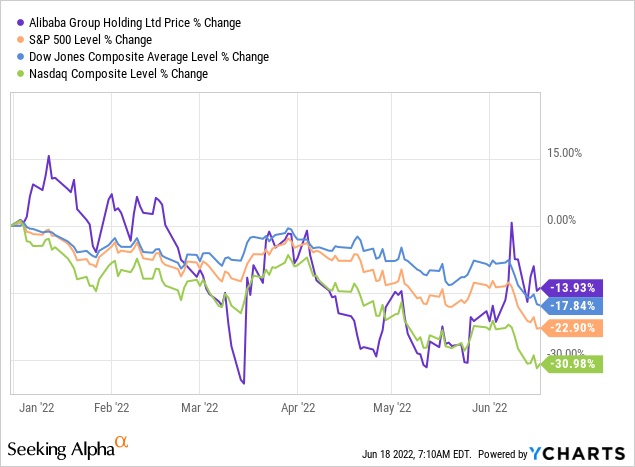

The main reason why Alibaba has entered severely distressed territory is due to the crisis around Chinese tech companies; the so-called 'China's tech crackdown'. The good news is that this crackdown seems to be easing. The first positive signs were reported last month and just yesterday Reuters reported that China's central bank has apparentlyacceptedAnt Group's application to set up a financial holding company, which is seen as a key step to revive Jack Ma's fintech business stock market debut. This created enthusiasm, with Alibaba's share price jumping as much as 10%. However, shortly thereafter, Alibaba pared its gains as Chinese state media denied the Reuters report that the PBOC accepted Ant's application. In any event, it seems that we are amidst a positive sentiment shift, after years of pain, and this is already starting to be reflected in Alibaba's share price. So far this year, the general market indices are in severe turmoil, but Alibaba is faring somewhat better. Specifically, on a YTD basis, Alibaba is down 'only' ~14%, outperforming the major US indices, with the tech-heavy Nasdaq being by far the worst performer, down almost 31%.

Before we go into more detail to illustrate Alibaba's substantial progress since its IPO, it is important to note the following. Even though Alibaba has faced (and will likely continue to face) various macro and regulatory headwinds, it remains one of the world's leading brands. Based on data fromKantar BrandZ, Alibaba ranks in the top 10 list globally surpassing brands of the likes of McDonald's (MCD), Tesla (TSLA), Coca-Cola (KO) and NIKE (NKE). This is quite an achievement.

The World's Most Valuable Brands in 2021

Visual Capitalist

As per thelatest earnings release,Alibaba's financial performance remains impressive, despite reporting a single-digit increase in its fourth-quarter revenue, its slowest growth yet amid COVID-19 outbreaks. Revenue increased 9% as a result of lower demand due to COVID-19 outbreaks in March and logistics and supply chain disruptions at its core e-commerce platforms (Tmall and Taobao). That said, Alibaba’s sales growth still exceeded analyst estimates. Eventually, supply chain disruptions and COVID-19 lockdowns will ease and Alibaba's growth will accelerate.

Looking at the bigger picture, Alibaba is a much stronger company compared to its IPO days. Specifically, annual cash flow from operations surpassed the market $20 billion mark in 2018 and has remained above that level ever since.

Alibaba: Annual Cash Flow from Operations

Seeking Alpha

Alibaba reached its peak annual cash flow from operations in 2021, surpassing $35 billion. I have little doubt that we will be breaking new records in the coming years, once things calm down a little. To put things into perspective, annual operating cash flow was just $2.3 billion in 2013. It is fair to say that the progress that has been made over the past decade is remarkable. What is also remarkable is the growing cash balance (i.e. Total Cash & Short Term Investments), which exceeds $70 billion, and is also hovering around record high levels.

Alibaba: Total Cash And Short Term Investments

Seeking Alpha

To put things into perspective, the cash balance was only $5.4 billion in 2013 and, due to strong operating cash flow, it surpassed the $70 billion mark in 2021, and has remained above that level ever since. This is a really nice position to be in.

Despite outstanding overall progress since the IPO, including the above-mentioned impressive financial results, the market cap has fallen to below $300 billion, and is hovering around record low levels. Looking at it differently,Alibaba's cash position now reflects ~25% of its market cap. I don't believe this anomaly will last for too long, and investors who accumulate at today's depressed prices stand to benefit tremendously, once the dust settles. It is a matter of when, not if. That said, it doesn't mean that it will be a smooth ride going forward. Yes, Alibaba is like a coil spring, but it can most certainly drop further. After all, market sentiment is terrible right now, and for good reasons. High inflation, interest rate hikes, the war in Ukraine and supply chain disruptions are amongst the biggest factors contributing to the market turmoil. As a value investor, the sell off has not made Alibaba a riskier investment. In contrast, investors can now buy one dollar for even less, which in a way makes Alibaba less risky. Based on Alibaba's massive cash pile and strong ongoing cash flow generation, I estimate that Alibaba is currently trading well below 50 cents on the dollar. Also, as long as the share price remains flattish, the discount to fair value will widen even more, as the cash balance will keep on increasing, all else constant, therefore adding to Alibaba's wealth. Also, it is important to note that Alibaba is better diversified compared to its IPO days. Don't discount its 1 billion global active consumers (spread across many online brands), high-margin cloud business and growing brick-and-mortar empire. My bet is that, over the next decade, Alibaba will be a much bigger company and even more diversified. However, even if Alibaba doesn't grow at all, it still is cheap today. I always stress test my investments, trying to be as prudent as possible. To this end, I assume the following scenario for Alibaba.

- Investment horizon of 10 years

- average annual run rate in operating cash flow of $20-$25 billion (this is almost $10 billion less than the peak level experienced in 2021)

- a static world, with zero growth; this means that over the next decade operating cash flow will remain constant at $20-$25 billion annually, and this cash will not be reinvested i.e. it will simply be accumulated on the balance sheet (in other words, zero revenue growth, zero innovation, zero M&A activity, zero share buybacks, etc.).