Summary

- Apple makes fantastic products, but that doesn't mean the stock is a good buy here.

- In fact, Apple has been dead money since I wrote about the stock last November.

- Apple's stock trades at about 24 times earnings, but the company's revenues will likely grow by low single digits in the coming years.

- Apple's stock is overpriced here, has limited upside, and may reach about $100 or lower when the recession arrives.

There's no denying that Apple Inc. (NASDAQ:AAPL) makes excellent products. I've been an Apple enthusiast for a long time, using many of the company's products over the years. I am also fond of the company's stock, and Apple was a top performer in my portfolio for many years (2006-2020). However, the dynamic surrounding Apple has changed. I wrote about the company's stock being "dead money" in November of last year, and Apple's stock hasn't returned anything since then. Apple faces a significant growth problem, and its valuation is relatively expensive for a company with limited growth.

Additionally, Apple faces supply constraints, other issues, and a significant inflation problem. Apple is a company with excellent products, but it has not invented anything revolutionary in a long time. Many market participants expect too much from Apple's stock. Therefore, there are better stocks to own here, and Apple will probably continue being dead money for now.

Apple's Inflation Problem

Despite Apple's beat on revenues and EPS last quarter, the company's stock declined as Apple warned of supply constraints impacting revenues by about $4-8 billion this quarter. We see that Apple is not immune to supply chain challenges, and it is not immune to inflation either. The new iPhone 14 models will start at$1099 for the Pro and $1199 for the Pro Max (according to insiders). That is about $100 more expensive than the company's current models. Moreover, the company's Max model will likely start at $999, roughly $300 more than the iPhone Min it will be replacing.

So, we see Apple's iPhone prices rising, which is not necessarily a good thing this time. Also, the price increase implies that the Pro Max 512 gigabyte version could cost roughly $1,500, and the 1T Pro Max will likely cost a whopping $1,700. These are costly iPhones, and these price increases come at a challenging time for consumers and the economy.

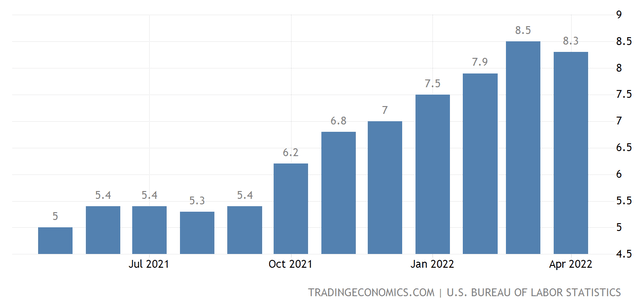

CPI inflation

CPI inflation(TradingEconomics.com )

Inflation has risen sharply recently, with the CPI trending around 8% for several months. This period of price increases signals the highest level of inflation we've seen in about 40 years in the U.S. Furthermore, high inflation may persist for longer than expected and will probably continue weighing on the consumer. Incidentally, we're seeing consumer sentiment data at some of its lowest readings in decades, implying a recession may soon begin. Apple raising prices in or before a recessionary phase will probably cause a decrease in demand for its iPhone and other products. On the other side of the equation, if Apple does not raise prices, revenues will likely decrease due to tighter consumer spending and other variables associated with a recessionary environment.

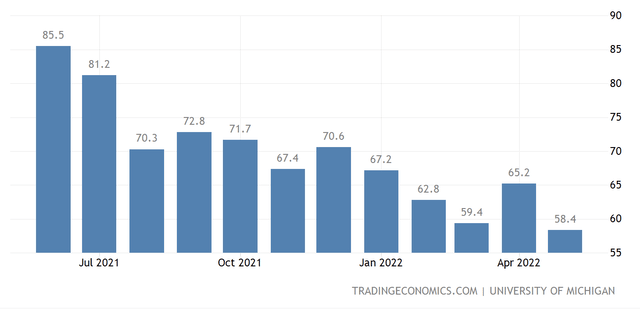

Consumer sentiment

Consumer sentiment(TradingEconomics.com )

If Apple raises prices on its new iPhone 14 lineup, the price hikes may be ill-timed. Prices are spiking all around us on everything from food to fuel. Therefore, some consumers may either wait for a better time to renew their iPhones or opt for a cheaper phone. Of course, I am not talking about the majority of Apple users switching their spending habits due to a slowdown. However, even a relatively small percentage of Apple's users choosing to go an extra year with their old iPhone could impact the company's bottom line.

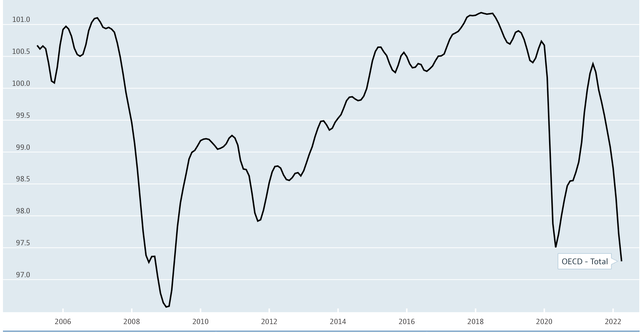

Consumer confidence

Consumer confidence(Data.oecd.org)

Consumer confidence is also down at its lowest level in years. Higher costs from every angle are bombarding the consumer, and now may not be the optimal time for an iPhone price hike. However, I can see why Apple wants to raise prices because if we look at the other side of the equation, we're seeing producer prices rise. Therefore, Apple's bottom line will likely get pressured, and the company needs to raise prices to keep revenues and earnings up.

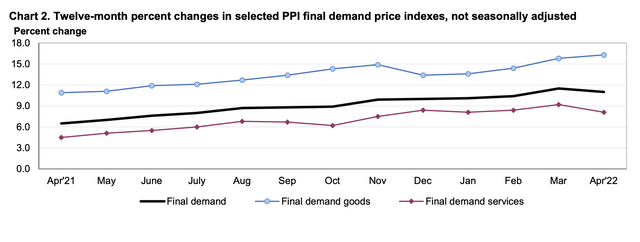

PPI inflation

PPI inflation(pls.gov)

Final-demand-goods is running remarkably hot, above 15%. This dynamic implies that it costs companies 15% more to create products than it did one year ago. Therefore, the iPhone 13 Pro, which cost Apple about $570 to manufacture, may come out to about $650 or more for the iPhone 14. Therefore, Apple needs to raise prices to keep its margins from declining and keep its profitability from dropping as we advance.

Nevertheless, higher prices for new iPhones may dissuade potential buyers and keep revenue growth lower than the company and analysts expect. Analysts anticipate Apple's growth to be low single-digit in the coming years, but the company's growth may be flat or even negative if the recession strikes.

Apple - Relatively Expensive Now

At around 24 times earnings, Apple is relatively expensive now, but there are several scenarios in which I would consider investing in Apple's stock again. The primary factor to see is improved growth. Currently, estimates are for low signal digit revenue growth, and it would be preferable to see the company return to 5-10% growth. Also, Apple's valuation needs to come down. There is little incentive to pay 24 times earnings or 21 times forward EPS estimates for a company growing sales by 2-3% in the coming years.

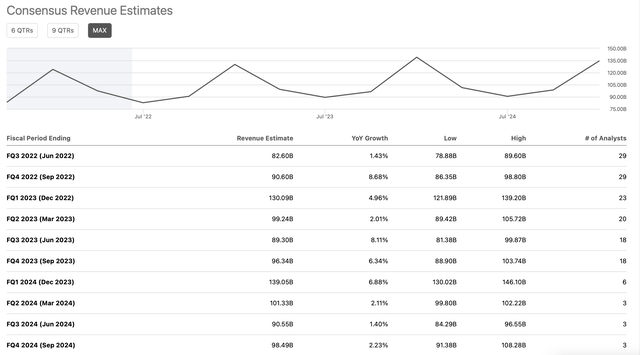

Apple's revenue estimates

AAPL revenue growth(SeekingAlpha.com)

Moreover, if there is a recession, growth could turn negative, and Apple may see declining revenues in the coming years. Therefore, unless Apple's growth story gets back on track quickly (it likely won't), the stock may only be worth around 15-18 times earnings here.

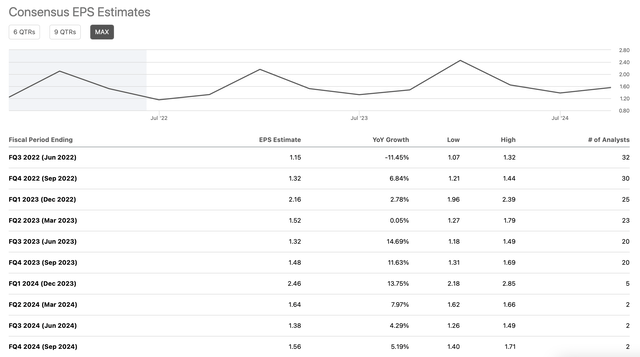

Apple's EPS estimates

AAPL EPS growth(SeekingAlpha.com )

Apple earned $6.04 in EPS in 2021, and the company should deliver approximately $6.15 this year. Now, unless Apple blows away consensus analysts' figures, the company will have very little EPS growth. Also, Apple is trading at around $150 today, illustrating that its trailing and forward P/E ratio is above 24. This valuation is relatively expensive for a company with very little revenue and EPS growth. The stock's 2% projected EPS growth and 24 P/E ratio illustrate that Apple is trading at a sky-high PEG ratio of around 12. Even if Apple earns towards the higher end of estimates and brings in about $6.50 in EPS the year, its PEG ratio would still be very high at around 3.

The Bottom Line

Regardless of how we look at it, Apple is expensive here. I would consider paying roughly 15-18 times earnings for this stock, which implies that the share price needs to drop significantly. A 15-18 P/E multiple suggests a stock price of approximately $90-110, roughly 27-40% below the stock price today. This suggestion may seem dramatic, and some market participants may have difficulty imagining Apple's stock price down there. However, $100 may be an optimal place to buy Apple when a recession occurs.