The Federal Reserve's most-recent dot plot, which signals the central bank's outlook for the path of interest rates, currently shows a medianforecast for three hikes in 2022, though some market participants are expecting more. Goldman Sachs is out with a fresh research noteindicatingthat the Fed will raise rates four times this year, given rapid progress in the U.S. labor market and hawkish signals that signal faster normalization. The forecast comes after last week's release of FOMC minutes, which laid out a triple play for policy tightening: Rate hikes, tapering and a balance sheet runoff.

Bigger picture: Goldman is also predicting an expedited runoff process, which would begin in July, if not earlier. The move would see the Fed shrink its nearly $9T balance sheet by allowing holdings of its Treasurys and mortgage-backed securities to mature. Fed officials have cautioned that they remain data-dependent and would communicate their intentions clearly to the public, but many are flagging the central bank's "transitory" forecast that never came to fruition.

"With inflation probably still far above target at that point, we no longer think that the start to runoff will substitute for a quarterly rate hike," said Jan Hatzius, chief economist at Goldman Sachs. "We continue to see hikes in March, June, and September, and have now added a hike in December. Even with four hikes, our path for the funds rate is only modestly above market pricing for 2022, but the gap grows significantly in subsequent years."

Go deeper:As markets price in the liftoff of U.S. interest rates, yields have been ripping higher. The 10-year Treasury yield has climbed over a quarter of a point since the beginning of the year, soaring 30 bps to 1.81% since Jan. 1. Real yields, which are inflation-adjusted, have also risen at a pace not seen since the height of pandemic fears in March 2020, eating into the positive backdrop for risk assets and threatening equity valuations.

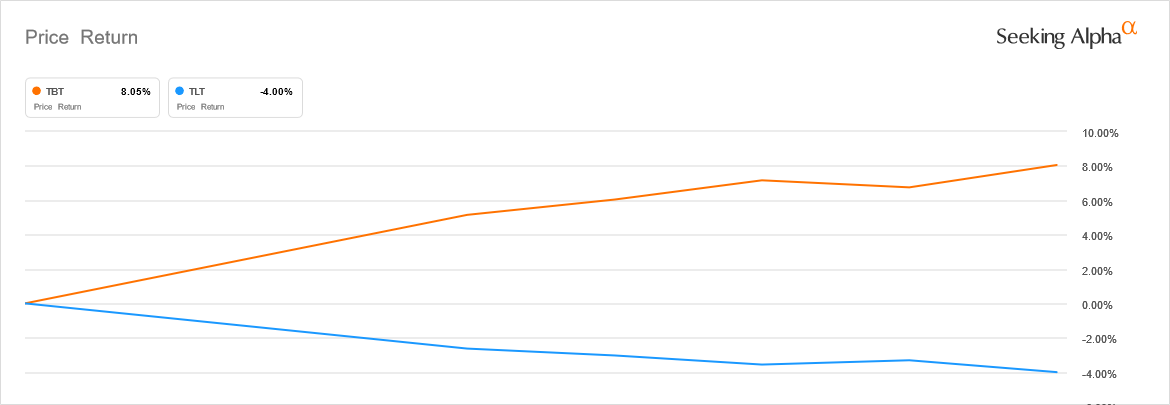

See the divergence of the ProShares UltraShort 20+ Year Treasury ETF(NYSEARCA:TBT)and iShares 20+ Year Treasury Bond ETF(NASDAQ:TLT)over thepast five sessions: