The Nasdaq Composite Index on Wednesday booked its first close in correction territory since March with a rapid surge in Treasury yields, and expectations for interest-rate increases from the Federal Reserve blamed for the weakness in the once-highflying benchmark.

The technology-heavy index is off to a terrible start, down 8.3% so far in 2022, closing out Wednesday down 1.2% at 14,340.26, putting it down 10.69% below its Nov. 19 record peak, and meeting the common definition for a correction in an asset's value.

The benchmark also finished below its 200-day moving average for the first time since April of 2020 on Tuesday.

The index has registered a correction, as defined, 65 times (not including Wednesday's) since it was first launched in 1971 and of those corrections, 24 of them, or 37%, have resulted in bear markets, or declines of at least 20% from a recent peak.

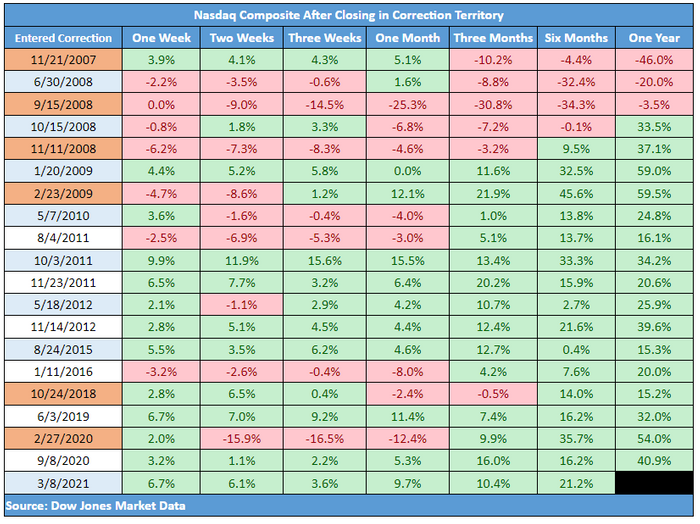

More recently, corrections have served as buying opportunities, with the sojourn into correction on March 8 resulting in subsequent gains for the one-week, two-week, three week, one-month, periods, going all the way out to six months. A similar uptrend took hold when the Nasdaq Composite slipped into correction territory in early September of 2020.

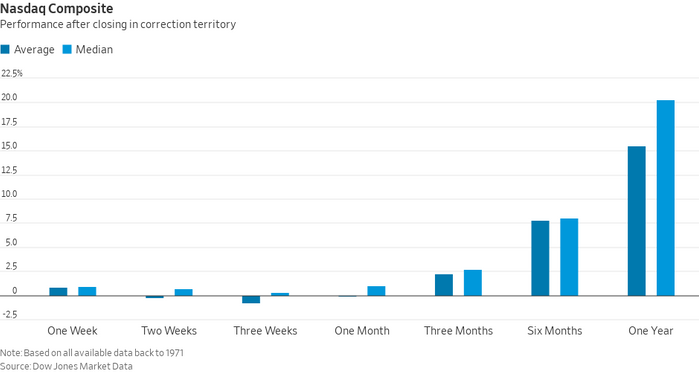

Looking more broadly at the performance of the Nasdaq Composite over the past 65 times it has fallen 10% from a peak, it has finished positive on average, up 0.8%, in the week after, but returns over that first month are weak, until the benchmark breaks through into the three-month period and beyond, where average gains are 2.2%.

U.S. stocks have been falling since the start of the year, with the Dow Jones Industrial Average and the S&P 500 index all down sharply in the month to date, as Treasury yields rise in anticipation of the Federal Reserve tightening monetary policy this year. The rate-setting Federal Open Market Committee next meets on Jan. 25-26 and is likely to set the stage for a series of rate increases, and policy tightenings as it combats inflation.

With the policy meeting looming, the yield on the 10-year Treasury note was trading around 1.83% on Wednesday, while the 2-year Treasury note, which is more sensitive to Fed policy expectations, also has been on the ascent.

Rising yields are weighing on yield-sensitive tech stocks and growth themed areas of the market as a rapid rise in interest rates makes their future cash flows less valuable, and in turn makes the popular stocks appear overvalued, and that is causing a broad recalibration of tech and tech-related shares that populate the Nasdaq.