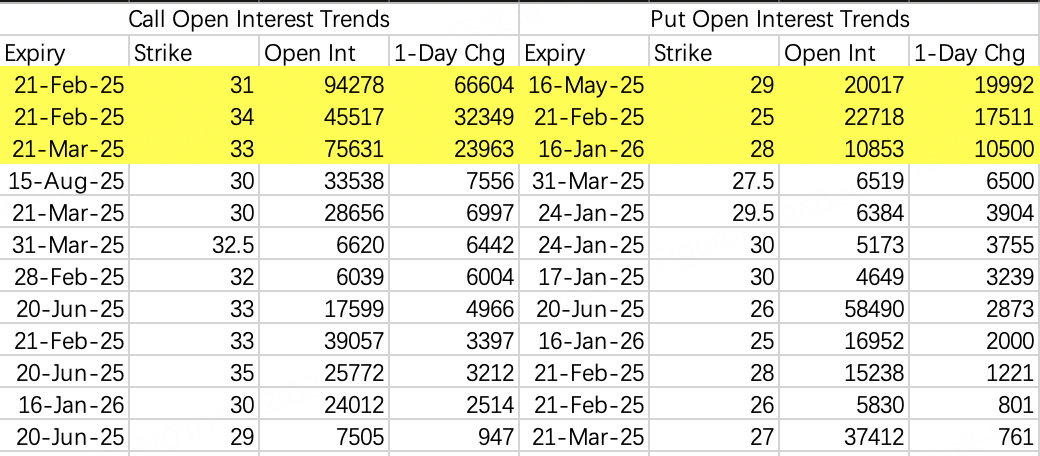

After leverage positions were liquidated, institutions made high-profile purchases of FXI 31 calls

$iShares China Large-Cap ETF(FXI)$

After the rebound in the past two days, institutions have been eagerly entering long positions.

On Tuesday, $FXI 20250221 31.0 CALL$ saw new positions of 66,600 contracts, showing strong bullish sentiment.

The 66,600 new contracts consist of two large orders: a single-leg call and a call spread:

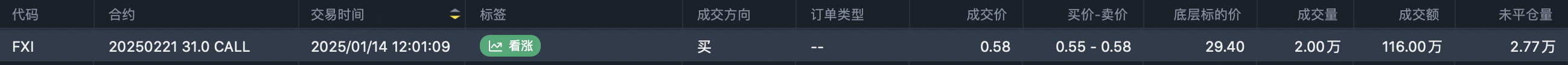

Buy $FXI 20250221 31.0 CALL$ , volume 20,000 contracts

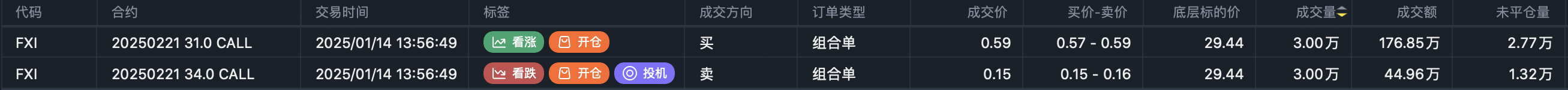

Buy $FXI 20250221 31.0 CALL$ , volume 30,000 contracts

Sell $FXI 20250221 34.0 CALL$ , volume 30,000 contracts

The spread strategy of buying 31 and selling 34 makes sense, expecting the rise by late February to be lower than the December 9 high.

Notably, both orders are genuine institutional trades executed on-exchange.

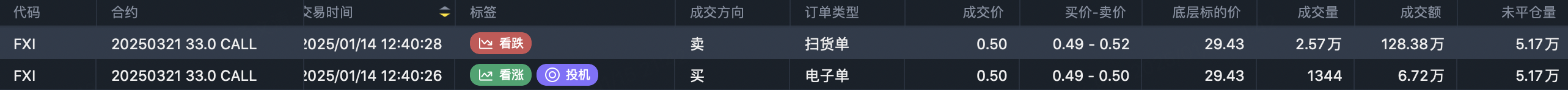

March 33 calls $FXI 20250321 33.0 CALL$ opened 23,000 contracts, with trading prices suggesting seller initiation. Though bearish, the strike price set at previous high isn't entirely contradictory to the above bullish strategy.

Put options 29put $FXI 20250516 29.0 PUT$ opened 19,900 contracts, mainly large sell put orders. Selling at-the-money puts is also a strong bullish signal. This strategy yields 14.7% annually with low margin requirements. If it drops, taking delivery at 2,900 per 100 shares is relatively cheap, but consider carefully before choosing this bullish strategy.

Based on current options positions, Chinese stocks appear bullish overall. However, risks are evident. As always, market movements unlike earnings have no specific dates, so short-term leverage carries extreme risk. For bullish positions, prefer: stocks > options, long-term options > short-term options, options strategies > single legs.

$TSM$

This earnings report focuses on 2025 outlook, though institutional expectations are moderate.

According to research reports, TSM stock has three scenarios: 1. Better than expected (30% probability): +4%; 2. Meeting expectations (60% probability): +2%; 3. Below expectations (10% probability): -5%.

Overall fluctuations within ±5% align with implied volatility expectations. With low earnings volatility expected, we can choose to sell both 180 and 220:

Sell $TSM 20250117 225.0 CALL$ , IV 94%, annualized 47.99%

Sell $TSM 20250117 180.0 PUT$ , IV 91.85%, annualized 46.5%

Theoretically could choose 190 and previous high 222.5, but I prefer pure IV capture.

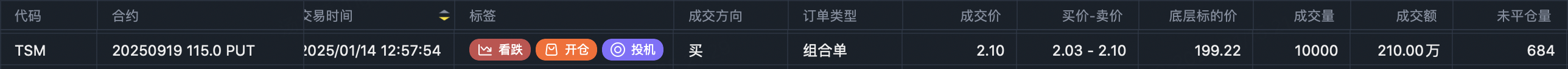

Notably, some stockholders, for unknown reasons, bought 2 million September 115 puts $TSM 20250919 115.0 PUT$ as a hedge. Worth monitoring.

Some may ask: what if earnings massively beat/miss expectations?

That would be great - if Thursday sees huge moves, switch to plan B, implementing our previously summarized Friday strategies.

$NVDA$

January seems to have more trading patterns than the entire past year.

Yesterday's drop to 130 caused deep self-doubt, but then I recalled similar scenarios last week, and the pre-CPI plunge likely had theatrical elements.

Additionally, TSM's Thursday earnings report is the most influential factor.

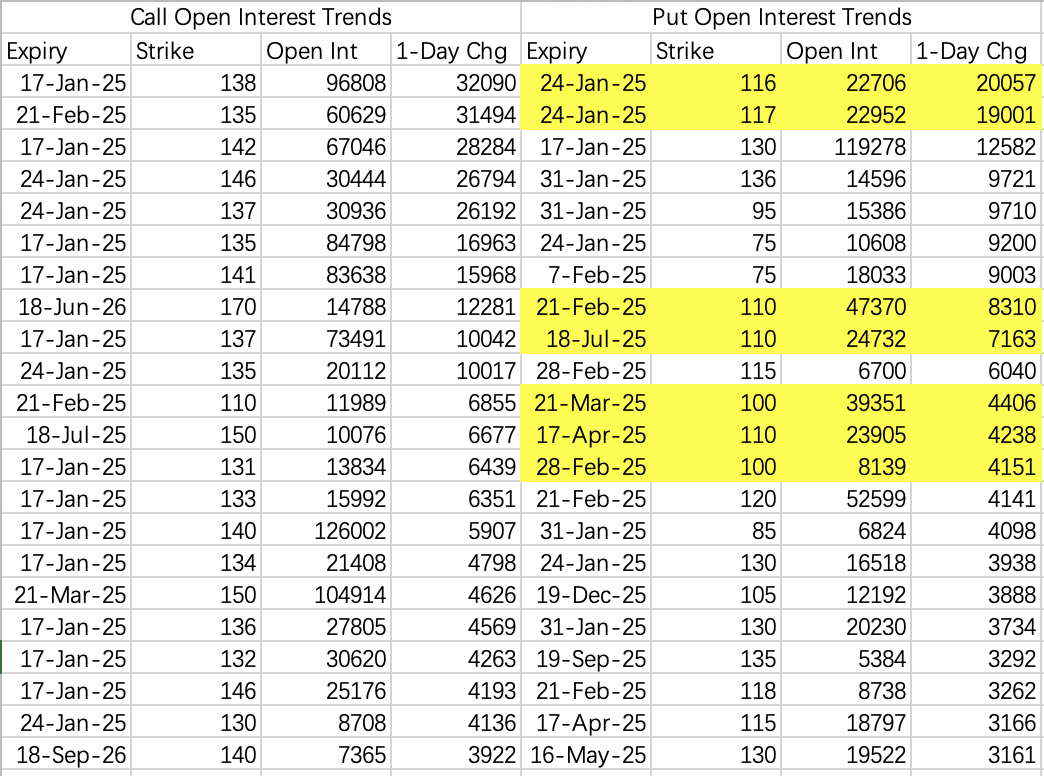

Tuesday's options data shows puts still expecting downside, with institutions systematically building 110 put positions.

This week's closing expectation remains unchanged at 130-140.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- j islandfund·2025-01-16thanks for sharing⭐LikeReport

- Hanisha88·2025-01-16Great article, would you like to share it?LikeReport

- Lordosis·2025-01-16Great article, would you like to share it?LikeReport