$TSM$

Like Tesla, TSM publishes monthly reports, so earnings focus on Q1 outlook and overall 2025 expectations.

Overall revenue in 2025 is expected to grow 20% to $113 billion. Q1 2025 sales are projected at $25-25.8 billion. Capital expenditure for 2025 is expected to increase to $38-42 billion.

Regarding revenue growth, institutions believe annual growth will exceed TSM's expectations, projecting 26-30%.

Earnings data generally meets analyst expectations, with institutional price targets at 250, so continue bullish on NVIDIA!

TSM is also good, but considering margin efficiency and implied volatility, NVIDIA offers better value.

$ASHR$

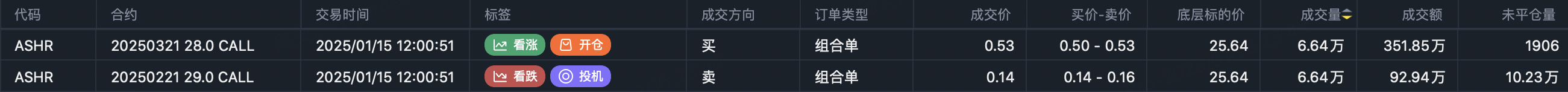

The large single-leg call position of 66,400 contracts traded on December 10-11 $ASHR 20250221 29.0 CALL$ has rolled to March $ASHR 20250321 28.0 CALL$

Looking at the chart, the 29 calls were bought at 0.94 and closed at 0.14, an 85% loss. The option price collapse was mainly due to time decay.

This was an on-exchange trade, and the roll shows institutions are truly confident in Chinese stocks rising, but fear the rally might be too slow for February 21 expiration. This makes buying 2026 expiration options somewhat reasonable.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.