$300 Million NVIDIA Call Options Purchase, With a Surprising Strike Price!

$NVDA$

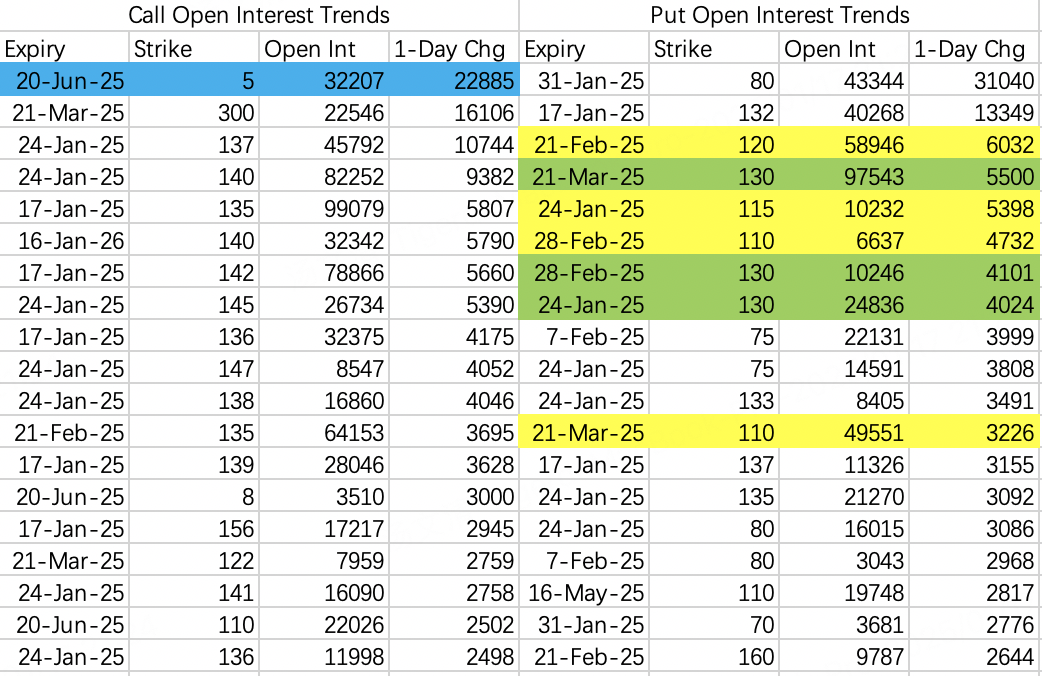

After TSM's earnings report on Thursday showing long-term AI benefits, I expected to see large bullish options positions in NVIDIA. I was stunned to see 22,800 new June contracts with a $5 strike price! $NVDA 20250620 5.0 CALL$

With NVIDIA trading around $135, a $5 strike means deep in-the-money options, with prices approximately equal to stock price minus strike price. Each contract cost around $13,000, making the 22,800 contracts worth about $296 million.

Deep in-the-money options have poor liquidity, and since this large order wasn't executed on-exchange, it took considerable time to fill.

While the strike price may not provide much directional guidance, a $300 million purchase representing 2.28 million shares upon exercise is definitely bullish.

As for why they chose $5 instead of $50, $30, or $20, that remains unknown. Caution is never wrong, especially for someone spending $300 million on call options.

TSM's Earnings Report Major Positive Guidance

I briefly mentioned TSM's earnings highlights on Thursday, but missed the most important point, likely what the $300 million options bet is based on:

$TSM$ raised its 5-year long-term revenue CAGR target to nearly 20% and extended the timeframe to 2024-2029 (previous guidance was 15-20% for 2021-2026)

This statement needs no explanation, right?

I recall last year's second-half speculation about AI demand verification this year, with market skepticism about AI's practical applications. However, after TSM's statement, any bearish expectations and positions need reconsideration.

20% growth rate for the next five years - consider the magnitude of that!

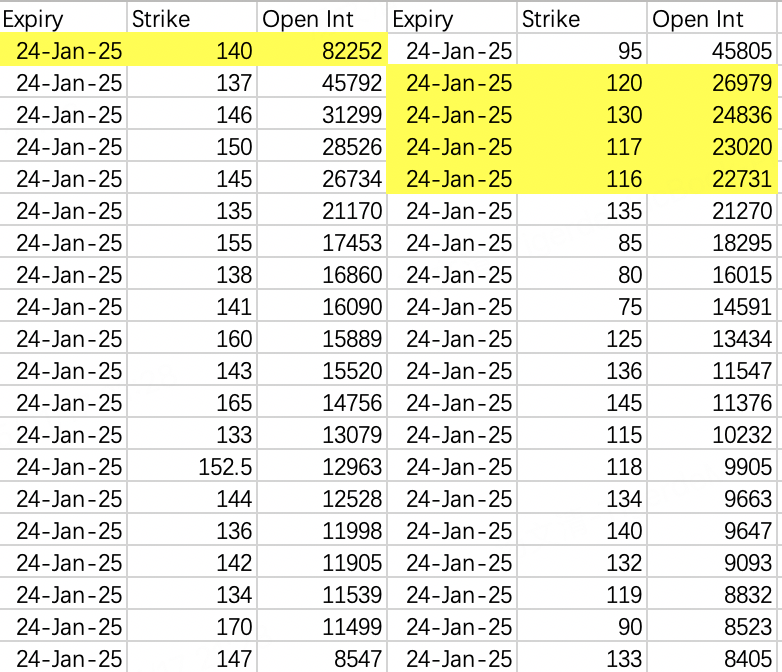

Reviewing the position details again, put options are split into two camps - one still targeting a pullback to 110, the other seeing 130 as the bottom.

I think 130 is wise - who would benefit from a pullback to 110?

Based on next week's open interest data, price range appears to be 120-140, though like this week, it might not reach 120, staying within 130-140.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- KSR·01-19👍LikeReport

- Targarean·01-18ThanksLikeReport