💰Trump Takes Office: 100-Day Plan & 4 Key Concerns for US Stock Traders

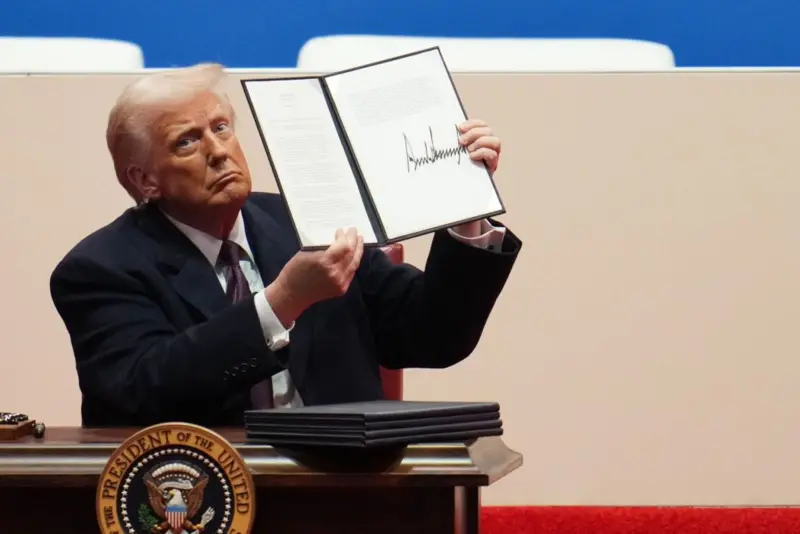

I. Donald Trump was sworn in as the 45th President of the United States on Monday.

At 12:00 noon Eastern Time on January 20, Trump's inauguration ceremony took place in the U.S. Capitol Rotunda. At 10:00 a.m. on January 21, Trump will also hold a national prayer service at the Washington National Cathedral.

Over the previous weekend, Trump family meme stocks shook the market. TRUMP, MELANIA, and BARRON were all launched for trading on the Solana platform, with asset prices surging and the wealth myth unfolding in the blink of an eye.

At the inauguration ceremony, the Republican addressed specific issues directly and detailed the policy commitments and actions he would take within his first 100 days in office.

Special Offer: Trump-Related Assets: Performance from Election Win to Inauguration

II. Policy Commitments and Actions Trump Plans to Implement within 100 Days

Based on Trump's speech at the inauguration ceremony on January 20, 2025, and related reports, the following are the policy commitments and actions the new U.S. president plans to implement within his first 100 days:

1. Immigration Policy

Border Security: Trump plans to declare a "national emergency" at the southern border on his first day in office and reinstate the "Remain in Mexico" policy.

Mass Deportation of Illegal Immigrants: He promises to immediately halt all illegal entries and deport "millions of criminal immigrants."

End Birthright Citizenship: Trump plans to end "birthright citizenship" through an executive order, which may trigger constitutional disputes.

Crackdown on Criminal Gangs: Designate transnational criminal gangs as "terrorist organizations" and use military force to enhance border security.

2.Energy and Environmental Policy

Increase Traditional Energy Production: Trump plans to declare a "national energy emergency," expand domestic oil production, and cancel mandatory policies for electric vehicles.

Repeal the "Green New Deal": He promises to repeal the Biden administration's environmental policies and restore traditional energy industries.

Rename Geographic Areas: Trump plans to rename the Gulf of Mexico as the "Gulf of America."

3.Economic and Trade Policy

Tariff Policy: Trump plans to impose tariffs on products from Canada, Mexico, and China on his first day in office.

Combat Inflation: Lower living costs through executive orders, including housing, medical, and food prices.

Establish an External Revenue Service: To collect tariffs and taxes.

4.Domestic Policy

Restore Military Strength: Trump promises to rebuild "the world's most powerful military" and reinstate soldiers dismissed for refusing COVID-19 vaccines.

Combat "Weaponization of Government": He plans to end the federal government's "weaponization" against political opponents through executive orders.

Social Policy: Trump plans to cancel protections for "gender-affirming care" and cut funding for "woke" schools.

5.Other Policies

Social Media and Technology: Trump plans to restore TikTok's operations in the United States.

Education and Culture: He promises to end government policies that "attempt social engineering through race and gender" in public and private life.

Healthcare: Trump plans to cancel "counterproductive" appliance requirements to lower living costs.

6.Foreign Policy

Regain Control of the Panama Canal: Trump plans to reclaim control of the Panama Canal.

Withdraw from the Paris Climate Agreement: He plans to withdraw from the Paris Climate Agreement once again.

These policy commitments and actions demonstrate Trump's hardline stance and determination to take swift action in his second term. However, some policies may face legal and implementation challenges.

III. As a US stock investor, you may have questions on following 5 issues:

Q1: How does the stock market generally fluctuate on the first trading day after a Republican president's inauguration?

According to statistics, since World War II, the $.SPX(.SPX)$ has had an average decline of 0.27% after a presidential inauguration, with an equal probability of rising or falling on the speech day or the following trading day (if the inauguration day is a holiday).

Q2: How did the U.S. stock market perform during Trump's first term (2017-2021)?

The $.SPX(.SPX)$ rose by about 70%, with an annualized return of 14.1%, second only to the performance during Bill Clinton's tenure.

The $.DJI(.DJI)$ increased by 57%.

The $.IXIC(.IXIC)$ surged by 142%, mainly driven by the strong performance of technology stocks.

Overall, the U.S. stock market performed strongly during Trump's first term, especially in the financial, industrial, and technology sectors. However, the market was also affected by uncertainties such as trade frictions and the pandemic.

Sector

ETF

Growth (2017-2021)

Financial Sector

58%

Industrial Sector

45%

Materials Sector

41%

Energy Sector

25%

Technology Sector

12%

Consumer Staples

20%

Utilities

15%

The main reasons for the strong growth were:

Tax Cuts: The Tax Cuts and Jobs Act of 2017 reduced corporate and individual tax rates, boosting economic growth and corporate profits, which in turn drove the stock market higher.

Deregulation: The Trump administration's relaxation of regulations in the financial and energy sectors enhanced market confidence and boosted the performance of related sectors.

Trade Policy: Although the Trump administration launched trade wars against some countries, causing market volatility, the overall impact of trade policy on the market was relatively limited.

Q3: How will the policy directions mentioned in the January 20th inauguration speech affect US stock market sectors and companies?

1. Energy Sector

Policy Content: Trump announced plans to increase the extraction of traditional energy sources and revoke incentives for electric vehicles.

Traditional Energy Industry: The traditional energy sector, including oil, coal, and natural gas, may benefit. For example, energy giants like $Exxon Mobil(XOM)$ , $Duke(DUK)$ and $Chevron(CVX)$ may gain more opportunities for extraction due to policy support.

New Energy Industry: Electric vehicle manufacturers and related industries may face setbacks. Tesla(TSLA) and RivianAutomotive,Inc.(RIVN) may face policy headwinds. Additionally, the U.S. operations of battery companies like ContemporaryAmperexTechnology(300750) and LG Energy may also be affected.

2. Automotive Industry

Policy Content: Trump plans to revoke electric vehicle incentives to save the traditional U.S. automotive industry.

Traditional Automakers: $General Motors(GM)$ and $Ford(F)$ may benefit from policy support.

Electric Vehicle Manufacturers: Tesla, Rivian, and other electric vehicle companies may face policy pressure and a potential loss of market share.

Automotive Parts Suppliers: Suppliers dependent on the electric vehicle supply chain, such as $Anhui Bossco Environmental Protection Technology Co.,Ltd.(300422)$ may be affected by the uncertainty in the electric vehicle market.

3. Trade and Tariffs

Policy Content: Trump plans to impose tariffs on foreign imports, especially from China, Canada, and Mexico.

Manufacturing: U.S. manufacturing companies reliant on imported parts, such as machinery, electronics, and automotive industries, may face increased costs.

Export Companies: Foreign companies in electronics, machinery, and home appliances may face risks of reduced exports due to higher tariffs.

Multinational Companies: $Apple(AAPL)$ and $SAMSUNG EL.GDR(SMSN.UK)$ may adjust their production layouts due to supply chain disruptions or increased costs.

4. Technology Sector

Policy Content: Trump may continue to pursue trade protectionism and technology policies.

Semiconductor Industry: The U.S. may strengthen export controls on semiconductor technology, affecting the global semiconductor supply chain. $Intel(INTC)$ and $NVIDIA(NVDA)$ may benefit from policy support, while foreign semiconductor companies may face greater external pressure.

Tech Giants: $Alphabet(GOOG)$ and $Amazon.com(AMZN)$ may face new market uncertainties due to trade policy adjustments.

5. Financial and Investment

Policy Content: Trump may push for the delisting of Chinese companies from U.S. exchanges.

Chinese Companies: $NIO Inc.(NIO)$ , $Li Auto(LI)$ , and $XPENG-W(09868)$ $XPeng Inc.(XPEV)$ may face delisting risks, affecting their financing channels.

Financial Market: Under financial regulatory policies, the liquidity and business opportunities in the U.S. financial industry may improve, benefiting the financial market. $JPMorgan Chase(JPM)$ , $Morgan Stanley(MS)$ $Wells Fargo(WFC)$ $Bank of America(BAC)$

6. Infrastructure and Construction

Policy Content: Trump plans to rebuild U.S. infrastructure.

Construction and Engineering Companies: $Caterpillar(CAT)$ and Bechtel may benefit from the infrastructure construction plan. $GE Aerospace(GE)$’s layout in the fields of smart grid and renewable energy may receive policy support.

Q4 : How might Trump's presidency impact global asset classes?

U.S. Equities

Short-term Bullish Outlook: Trump's policies, such as tax cuts, deregulation, and support for traditional energy, are seen as pro-growth measures that could boost corporate profitability and drive U.S. stocks higher.

Sector Performance: The financial and energy sectors are likely to benefit from deregulation and support for fossil fuels. Small-cap stocks may also see gains due to domestic focus and potential tax cuts.

2. Global Trade and Emerging Markets

Trade Tensions: Trump's proposed tariffs on imports, particularly from China, Mexico, and potentially other countries, could lead to prolonged trade disputes and higher inflation. This could slow global economic recovery and pose risks to emerging market economies.

Emerging Markets: Higher U.S. interest rates and a stronger dollar may lead to capital outflows from emerging markets, increasing debt vulnerabilities and economic instability. However, some regions like India and ASEAN countries might benefit from trade realignments.

3. Interest Rates and Inflation

Rising Rates: Trump's fiscal expansion plans and potential tax cuts could drive up U.S. Treasury yields, making it more expensive for emerging markets to service their dollar-denominated debt. The Federal Reserve may also face pressure to maintain higher interest rates to manage inflation.

Inflation Risks: Protectionist trade policies and higher tariffs could lead to increased inflation, limiting the potential for rate cuts and adding to economic uncertainty.

4. Fixed Income

Challenges for Bonds: Higher tariffs and inflationary pressures could limit the potential for rate cuts, making fixed income investments less attractive. The Federal Reserve's ability to cut rates in 2025 may be constrained by the risk of an inflationary trade war.

5. Currency Movements

Stronger U.S. Dollar: Expectations of fiscal expansion and higher interest rates are driving up the value of the U.S. dollar, attracting capital from emerging markets and tightening global liquidity. This could exacerbate debt repayment burdens for emerging economies.

6. Geopolitical Implications

U.S. Foreign Policy: Trump's administration may take a more assertive stance on issues like Ukraine and Iran, potentially leading to geopolitical tensions. This could further impact global market sentiment and investment flows.

7. Digital Assets and Financial Innovation

Crypto Regulation: Trump's administration is likely to usher in a more crypto-friendly regulatory framework. This includes the possibility of shifting oversight from the SEC to the Commodity Futures Trading Commission (CFTC), which is seen as more favorable for the industry. The crypto market is likely to see a surge in new financial products, including more exchange-traded funds (ETFs) and potentially staking-enabled funds.

Conclusion

Trump's presidency is likely to reshape global capital flows, trade alignments, and investment strategies. While there are opportunities in sectors like small-cap stocks and emerging markets, investors should also be cautious of the potential for increased volatility and inflationary pressures. A strategic approach that balances exposure to resilient sectors with regional diversification will be crucial for navigating this complex economic landscape.

The above content is for communication only. For more Trump trading hotspots and opportunities, you are welcome to leave a message in the comment section.

A tool to boost your purchasing power and trading ideas with CashBoost!

Open a CBA today and enjoy access to a trading limit of up to SGD 20,000 with upcoming 0-commission, unlimited trading on SG, HK, and US stocks, as well as ETFs. Find out more here.

Other helpful links:

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

2. How does the stock market generally fluctuate on the first trading day after a Republican president's inauguration?

3. How will the policy directions mentioned in the January 20th inauguration speech affect US stock market sectors and companies?

4. How might Trump's presidency impact global asset classes?

Read the article to get all the answer.

1. How did the U.S. stock market perform during Trump's first term (2017-2021)?

2. How does the stock market generally fluctuate on the first trading day after a Republican president's inauguration?

3. How will the policy directions mentioned in the January 20th inauguration speech affect US stock market sectors and companies?

4. How might Trump's presidency impact global asset classes?

Read the article to get all the answer.

บทความนี้ดีเยี่ยม คุณอยากแชร์หรือไม่