HSTECH beat NDX, Time To Invest China?

So far this year, $HSTECH(HSTECH)$ has far outperformed $Invesco QQQ(QQQ)$ $NASDAQ 100(NDX)$ and Hong Kong stocks have rallied, are there still opportunities ahead?

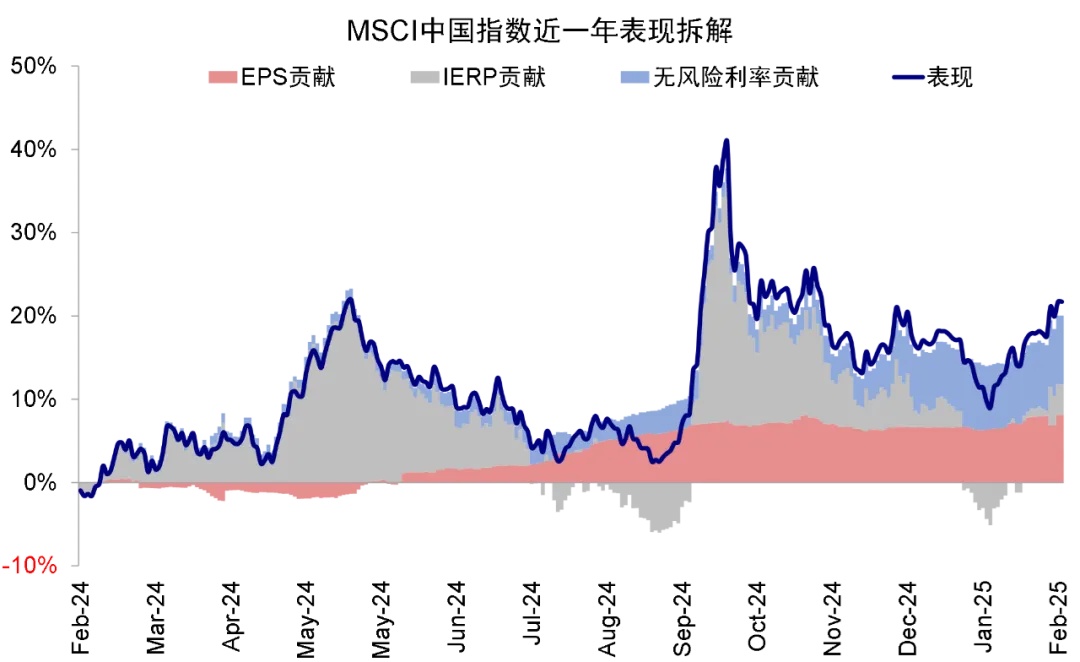

Core Driving Factors

Strengthened policy expectations

The mainland's growth stabilization policies continue to increase (quota cuts, real estate relaxation, consumption promotion, etc.), coupled with the marginal easing of US-China relations, the market's risk appetite has improved significantly.The central economic work conference "seeking progress while stabilizing" tone to further consolidate economic recovery expectations.Global liquidity inflection point catalyzed

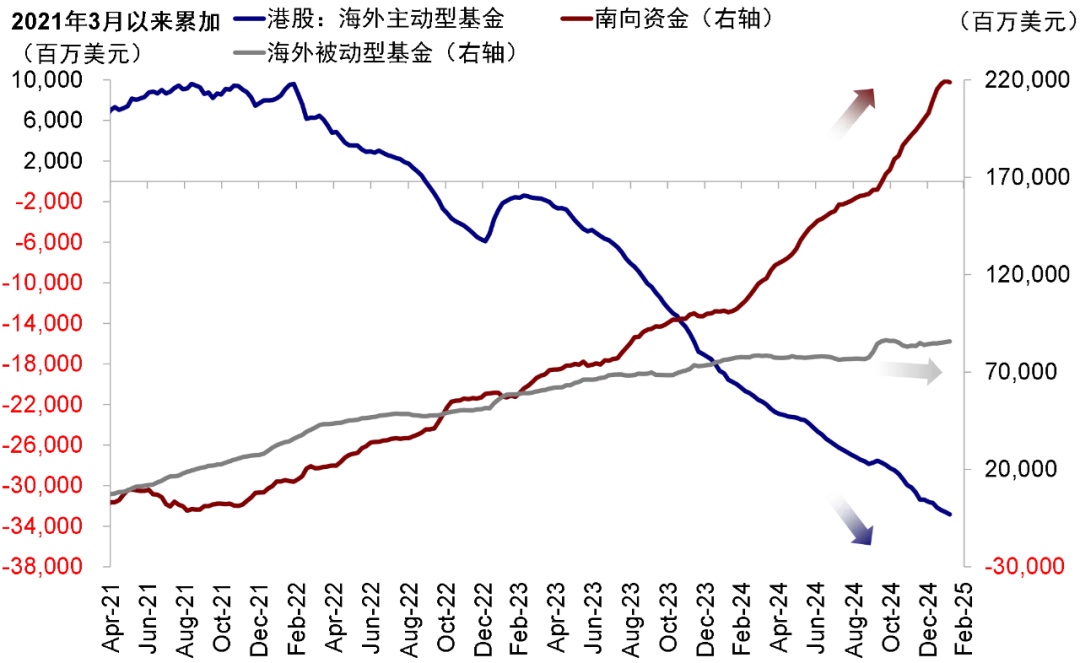

Fed rate hike cycle ends, 2024 rate cuts are expected to warm up, the dollar index weakened to promote the return of foreign capital to emerging markets.Hong Kong stocks as an offshore market is highly sensitive to global liquidity, since November the scale of net foreign capital inflows hit a record high for the year.Extreme valuation repair demand

Hang Seng Index previously dynamic PE as low as 7.8 times (nearly ten years 3% centile), AH premium index exceeded 150, the technical formation of severe oversold.Valuation depressions to attract the accelerated entry of configuration funds.

Characteristics of the current market environment

Valuation still has relative advantage

After the rebound, the PE of HSI has risen to 10.2x (30% percentile of the last decade), and the horizontal comparison of global major stock indices is still discounted by about 20%.Financial, real estate and other weighted sectors PB is still below the historical pivot.Funding continued to improve

Southbound funds bought net for 14 consecutive weeks (accumulated over HKD180bn), while overseas active fund positions rebounded to 8.3% (+2.1pct from Oct low).The proportion of short positions closed in the derivatives market reached a yearly peak.Marginal upward revision of earnings expectations

2024 HSI constituents EPS growth rate is expected to be revised upward to 8-10% (consumption/technology leading), downward pressure on earnings revision of real estate chain eases, and internet leaders reduce costs and increase efficiency to release profit elasticity.

Headroom and Key Variables

Upside Measurement

Neutral scenario, if earnings growth is realized and valuation is repaired to historical pivot (PE 11.5x), corresponding to HSI target of 21,500-22,500 points (currently around 19,500 points, with potential increase of 10-15%); if sentiment further repairs to early October highs, HSI may challenge 24,000 points under extreme liquidity-driven conditions.

If sentiment further repairs to early October highs, corresponding to HSI around 23,000 extreme liquidity-driven or challenge 24,000 points.

Short-term signs of overdraft, short-selling turnover ratio is rising instead of falling, reflecting still divergent views within the investor community.

Core Observation Indicators

Domestic policy transmission effects (social financing, PMI, real estate sales)

Fed's monetary policy path (US bond yield curve shape)

Direction of corporate earnings revisions (tech/consumer earnings guidance)

Geopolitical risks (US/China tech sanctions developments)

Risk Warning

A 10-15% technical retracement could be triggered by a global risk-off if the US economy's "soft landing" is disproved, or domestic policy implementation falls short of expectations.Be wary of amplified volatility in high beta sectors (biotech, real estate).

Investment Recommendations

Main Line 1: High Dividend Defense

Focus on telecom, energy and other centralized SOEs (average dividend yield 7%+) $ $CHINA MOBILE(00941)$ hedge against potential volatility.Main line two: boom reversal track

Featured Internet leaders (valuation reshaping + AI commercialization), consumer electronics (inventory cycle bottoming out), innovative drugs (Fed easing favors Biotech financing). $BABA-W(09988)$ $TENCENT(00700)$ $XIAOMI-W(01810)$External environment characteristics:

If U.S. AI trends continue, U.S. assets will be attractive and inflows will push up the dollar in positive feedback;

If U.S. AI is weak and China is strong, inflows will slow and positive feedback will be difficult to sustain, impacting U.S. growth and U.S. equities, and potentially prompting the U.S. to profit from tariffs and competitive depreciation of the U.S. dollar, posing a challenge to global trade, inflation and growth.

Tactical Tool Selection

Utilize Hang Seng Technology ETF (good liquidity) and HK Stock Connect High Dividend Fund to hedge individual stock earnings report risk.Options market implicit volatility retreat, can layout bullish spread strategy.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- littlesweetie·2025-02-10难以置信的见解!感谢分享![Wow]LikeReport

- EraGrowth_Wealth·2025-02-10collllll, always believe ChinaLikeReport