Hysterical Sell-Off Seamlessly Transitions to Earnings-Season Optimism

The market’s behavior on Monday was peculiar—it might have hit a key support level, forcing both bulls and bears to make decisions. Bulls cautiously went long, while some bears retreated, and others rolled their positions.

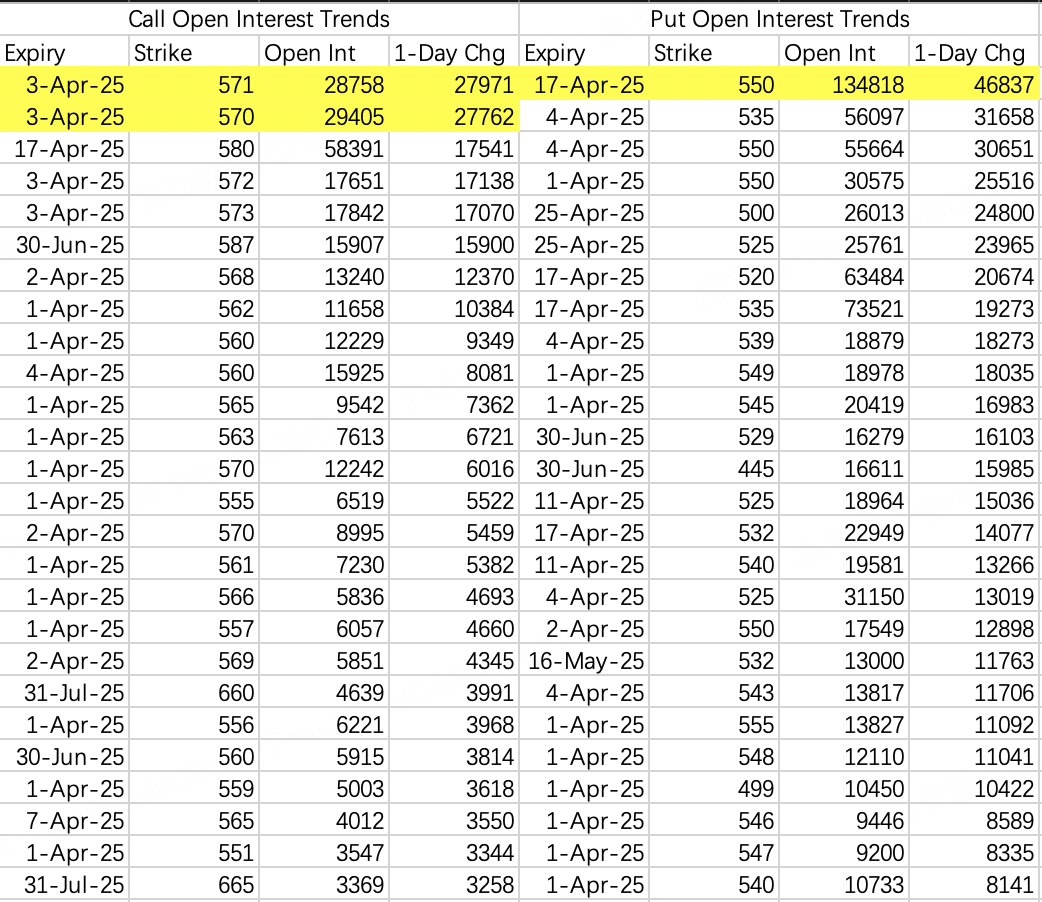

$S&P 500(.SPX)$

There were numerous large single-leg bullish trades on $SPX$, most of which had expirations at the end of June. The bullish strike prices were concentrated at 588–590, which seems like a reasonable target.

However, based on $SPY$ options activity, bearish open interest remains higher.

$NVIDIA(NVDA)$

The situation is very complex, as both bullish and bearish positions are extremely polarized. At this point, it’s likely that some individuals know the specifics of the tariff agreement, but it’s unclear which side has insider information.

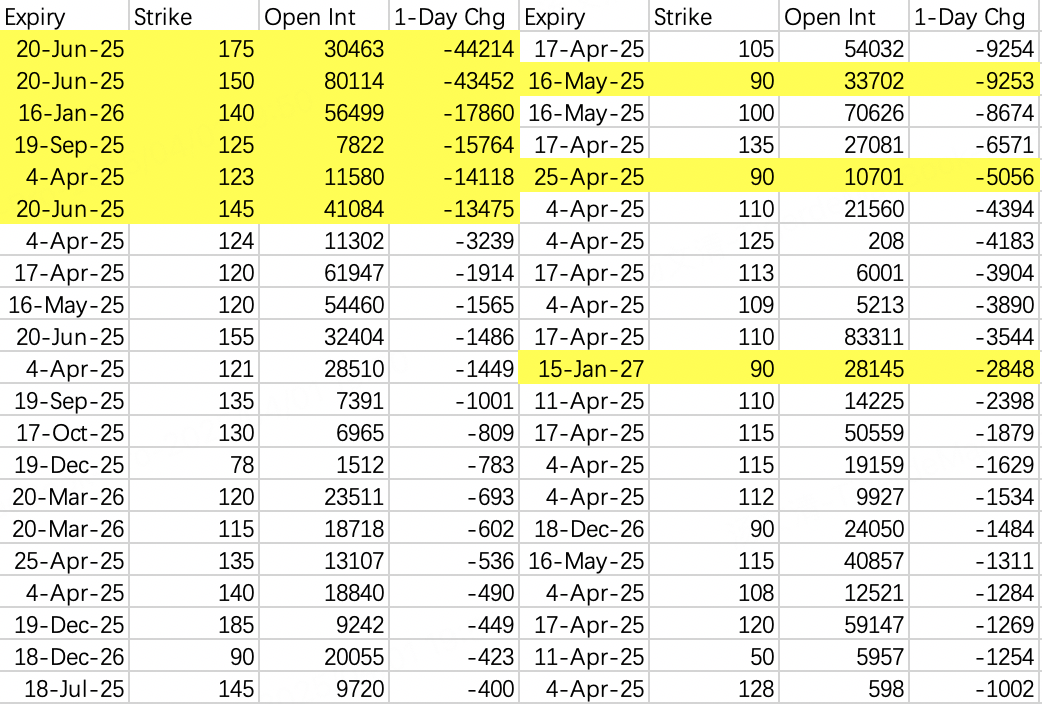

In terms of overall market activity, both bulls and bears rolled their positions:

Bulls rolled to lower strike prices, reflecting cautious optimism.

Bears rolled their positions to maintain their bearish outlook.

By looking at the closing rankings, the following trends are evident:

Bullish positions at 140 (

$NVDA 20260116 140.0 CALL$) and 145 ($NVDA 20250620 145.0 CALL$) were closed.Bullish positions at 150–175 were rolled into new positions. The likely reason for closing these positions is that their targets were set too high.

In addition, a large bearish sell-call position at $NVDA 20250919 125.0 CALL$ was also closed, likely because the 100 price level had already been reached, achieving the bearish target.

On the bearish side, a large number of in-the-money puts expiring on April 17 were closed.

Looking at the new open positions:

Bullish positions in the 150–175 range were rolled into a 135–160 call spread, significantly lowering the upside target while extending the expiry to July.

The sell-call position at 125 was closed, but the trader then bought the

$NVDA 20250815 115.0 CALL$, signaling a cautious bullish outlook.

Bearish positions were concentrated at surprisingly low strike prices. However, many of these low-strike positions appear to have been opened by sellers. For this week’s expiration, the 100 put has mixed activity, with both buyers and sellers, suggesting it might act as a floor for the stock price.

For October expiration, 100 puts ($NVDA 20251017 100.0 PUT$ ) saw 11,000 contracts opened, predominantly by sellers.

Among all the large trades, what stands out the most is the roll of the call spread. While it’s unclear whether the bears or bulls have insider knowledge, the adjustment to lower strike prices indicates new information has led to a revision of Q2 expectations. Rolling from 150–175 to 135–160 suggests tariffs have severely impacted the upper limit of a potential Q2 rebound.

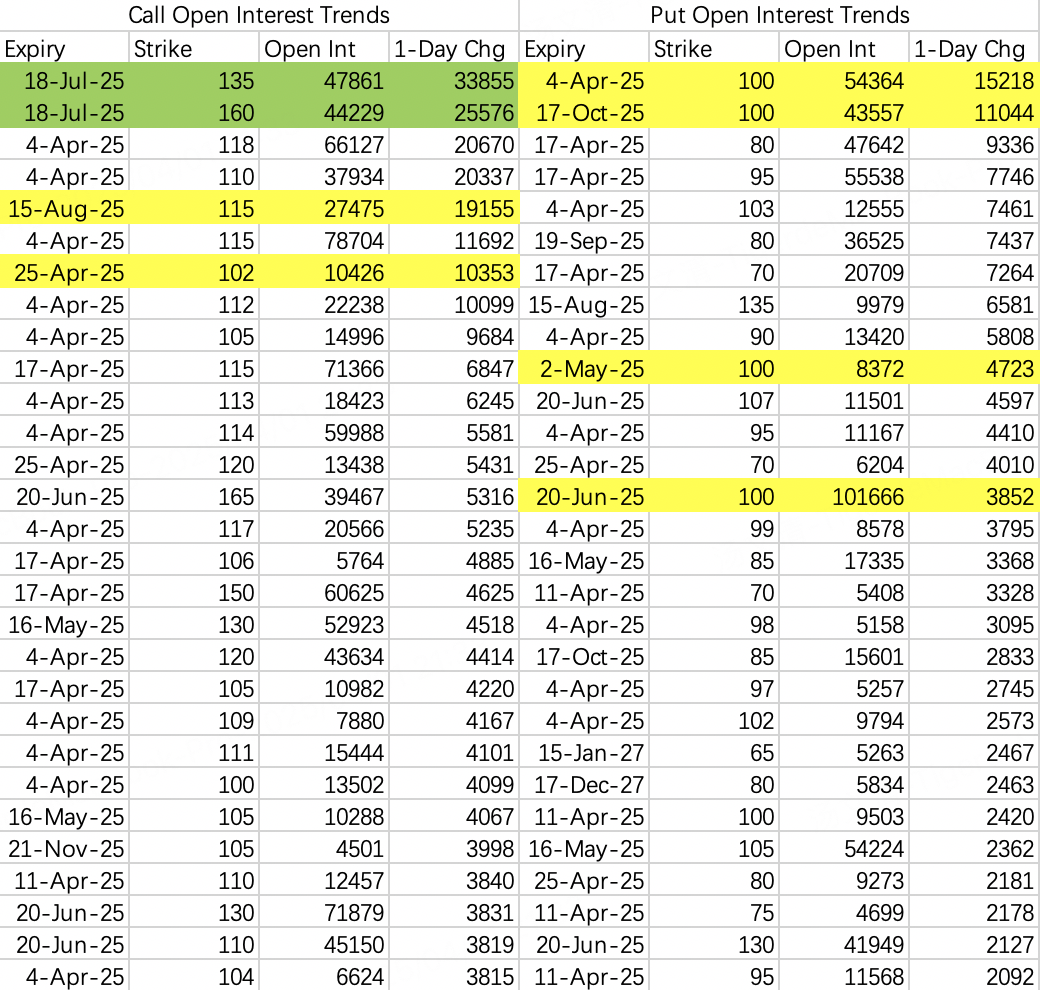

$Taiwan Semiconductor Manufacturing(TSM)$

Similar to the trends above, traders are buying in-the-money calls, suggesting a bullish outlook but with a conservative mindset.

$TSM 20250620 145.0 CALL$: Volume of 23,000 contracts, with a total transaction value of $59.34 million.

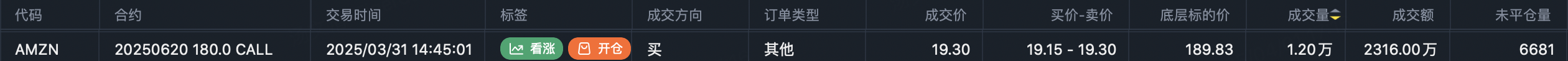

$Amazon.com(AMZN)$

The same pattern applies here—traders are buying in-the-money calls, signaling a bullish but cautious stance.

$AMZN 20250620 180.0 CALL$: Volume of 12,000 contracts, with a total transaction value of $23.16 million.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Tiger_CashBoostAccount·04-03Great job on your latest stock market success! Your commitment to research and analysis is evident in your results.Trade with Tiger Cash Boost Account and use contra trading toenhance your strategies."Welcome to open a CBAtoday and enjoy access to a trading limit of up to SGD 20,000with upcoming 0-commission, unlimited trading on SG, HKand US stocks. as well as ETFs.

- How to open a CBA.

- How to link your CDP account.

- Other FAQs on CBA.

- Cash Boost Account Website.

LikeReport - How to open a CBA.