BUY THE DIP? Big-Techs Are Still The Best Choice

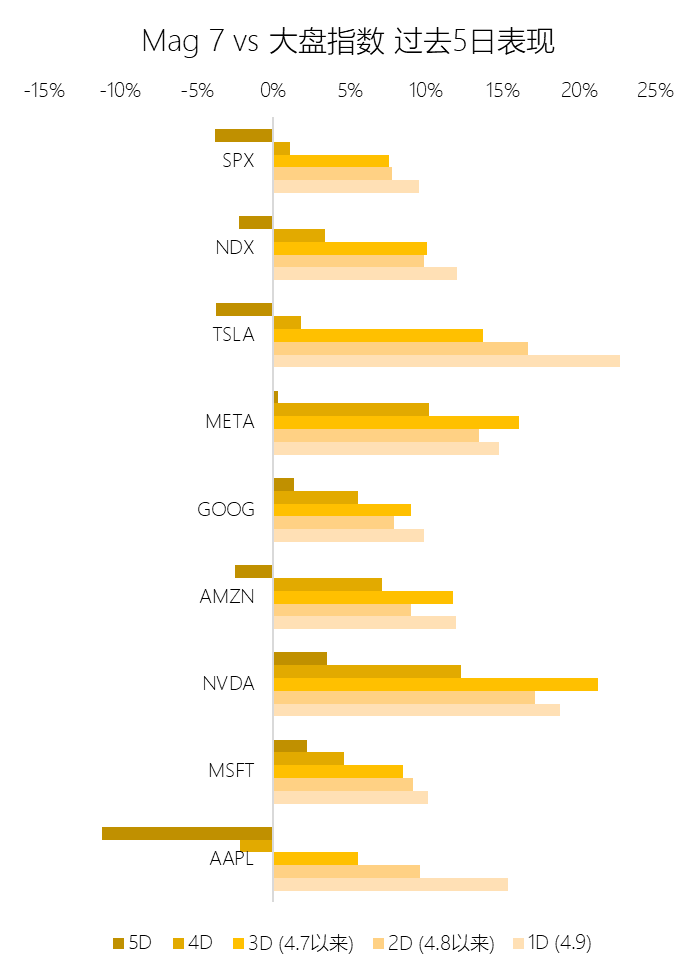

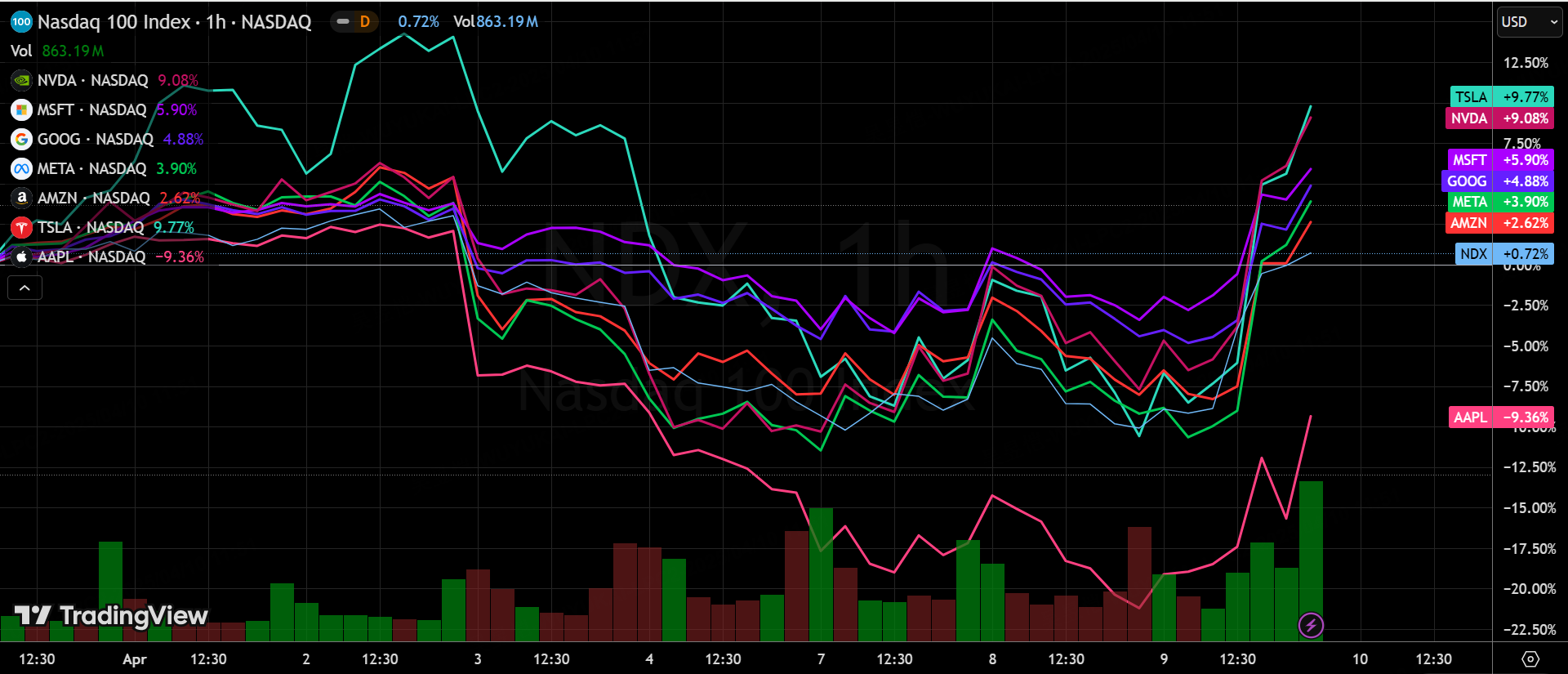

U.S. stocks saw a big rally at the 18-hour limit and produced the third-largest one-day gain since World War II, with $NASDAQ 100(NDX)$ rallying 12% in a single day on April 9th. $S&P 500(.SPX)$ rallied 9.52%, recovering ground lost since April 3rd.

As the weight of the U.S. technology stocks have also become the biggest beneficiaries of the rebound, except for $Apple(AAPL)$ and $Tesla Motors(TSLA)$ have outperformed the broader market.And these two manufacturing companies are among the biggest beneficiaries of globalization.

There is no need to repeat the reasons why the technology sector is more resilient, as previously analyzed in " The Impact of Tariff Policies on US Mag 7".

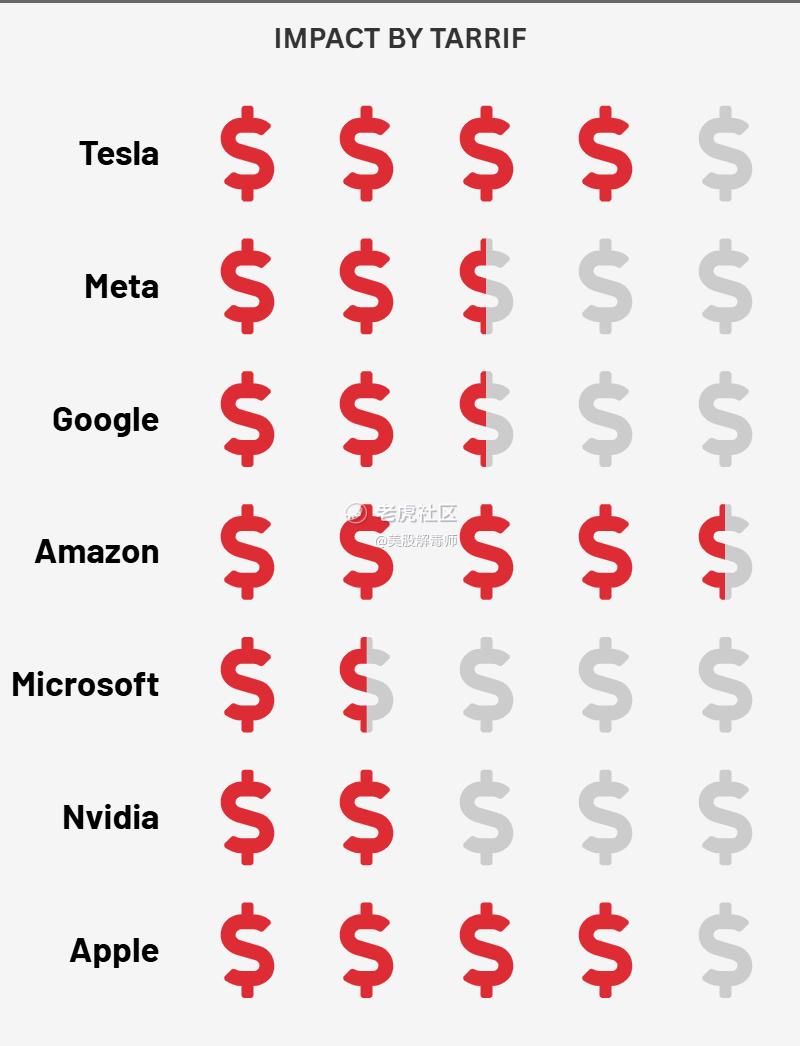

AAPL

Most hit, profits or drop 30%; iPhone price hike (if all in the U.S. production costs or rise 90%), supply chain 80% in China, short-term difficult to replace.

Actively exploring alternative paths but difficult to see results; limited space for lobbying exemptions.

MSFT

Direct impact is small, main business is stable, cloud business are long-term contracts; rising cost of data center equipment in turn becomes a reason to postpone investment.

Indirectly affected by lag in spending cuts by enterprise customers.

GOOGL / META

Hardware limited but low revenue share; advertising business is more indirectly affected by the overall economy.

EU may retaliatory tax has been expected by the market, the impact is limited.

AMZN

Facing a triple whammy of cost-supply chain-consumer power.

Cost of goods up 15-20%, small parcel duty-free eliminated.

Profits may be reduced by up to $10 billion, accounting for up to nearly 17% of 2024 profits.

High risk of consumer downgrade, customers may spend $2,600-3,900 more per year.

Response strategy: supply chain renegotiation, commodity structure optimization, but difficult to fundamentally resolve.

NVDA

Chips are tariff-free but finished products may be taxed or may have to absorb the cost.

TSMC's U.S. factories help diversify risk, but short-term benefits are limited.

TSLA

Parts and components are highly dependent on China and Mexico, and the cost of key models has increased significantly.

Model 3 or 20% price hike; 4680 battery relies on China for raw materials despite local production.

Wedbush drastically cut the price target, reflecting the decline of market confidence.

As far as tariffs are concerned, the related uncertainty has been largely released and risk expectations are gradually digested.

In the next 90 days, trade negotiations other than China will continue to advance, and on the whole it is more difficult to appear drastic disturbances.At present, the U.S. and China in the tariffs on the game has basically come to an end, the next game center of gravity may be shifted to other areas.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

- Venus Reade·2025-04-10China retaliates with 84% tariff. Good news for AMD and NVDA, among others. Trump will perceive this as a win he can tout as it is a significantly lower tariff than his 125% levied on China.1Report

- Merle Ted·2025-04-10Tesla is the future. Up 20% yesterday means the world agrees with this. Tesla 1000 EOY.1Report