Friday’s Update: Big Moves Possible This Week

Caught a cold over the weekend, and after looking at the market, things played out pretty much as expected last Friday—so I just stayed in bed to recover on Monday.

But I just pulled up Friday’s data, and wow, it really surprised me.

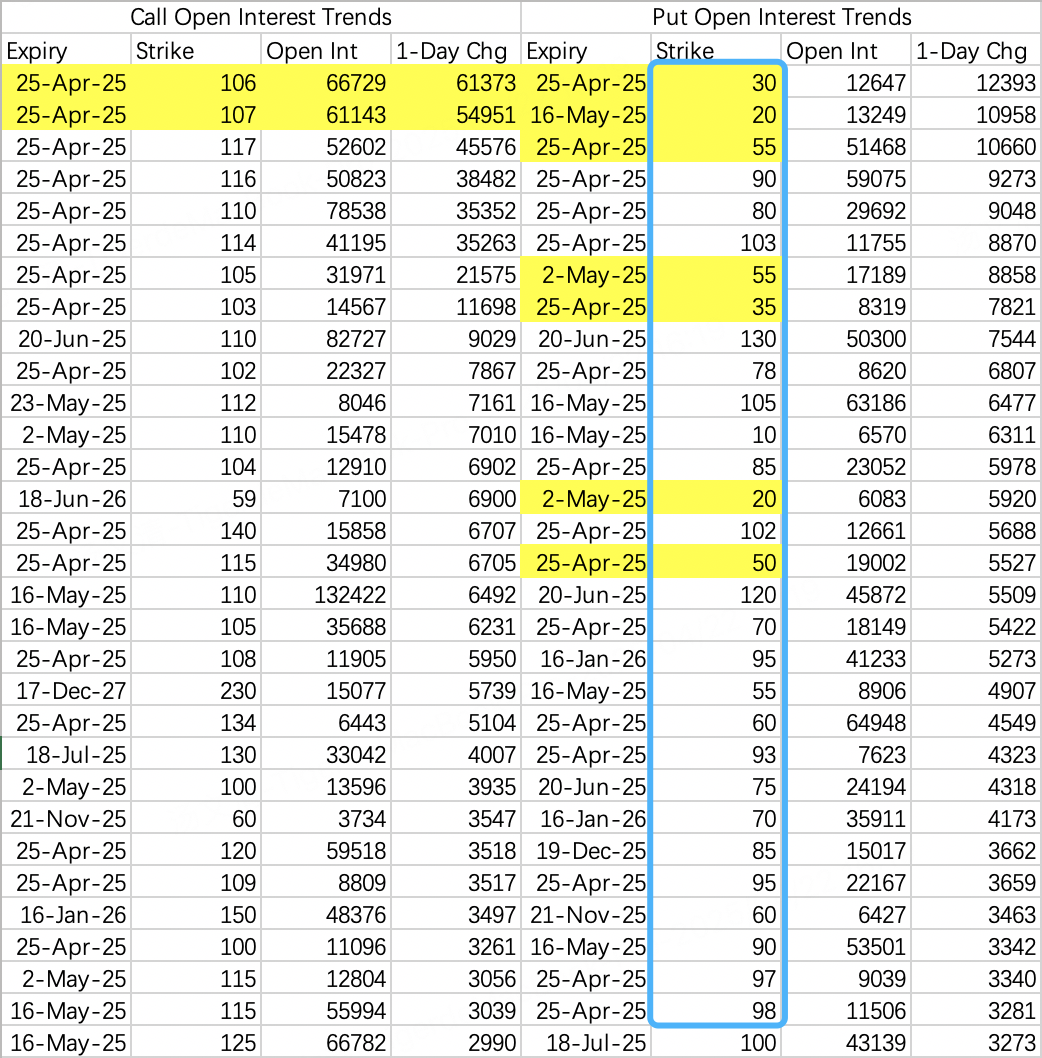

For $NVIDIA(NVDA)$ , let’s check institutional sell calls as usual: strikes at $106$ and $107$, hedged by $116$ and $117$. So, the upper bound for this week is around $110$.

But the lower bound is where things get scary. Take a look at where traders are opening bearish positions on NVIDIA—strikes at $20$, $30$, $55$, and some even at $10.

If this were before, I’d have written this off as a joke—buying $1$-dollar puts is basically lighting money on fire. But if you review previous years’ opening records, you’ll see that under normal conditions these trades were rare. This year, though, we’re seeing these outlier trades more and more.

So who’s opening these positions? The first guess is always institutional hedging, but who hedges NVIDIA all the way down to $10$? My theory—outlandish as it sounds—is that these are market makers, opening these positions to fulfill their obligations in case of an extreme move.

Don’t think only retail traders panic in a crash—market makers get spooked too. They don’t want to be the counterparty in a free-falling market. That’s why, in an extreme crash, market liquidity dries up and bid-ask spreads go haywire.

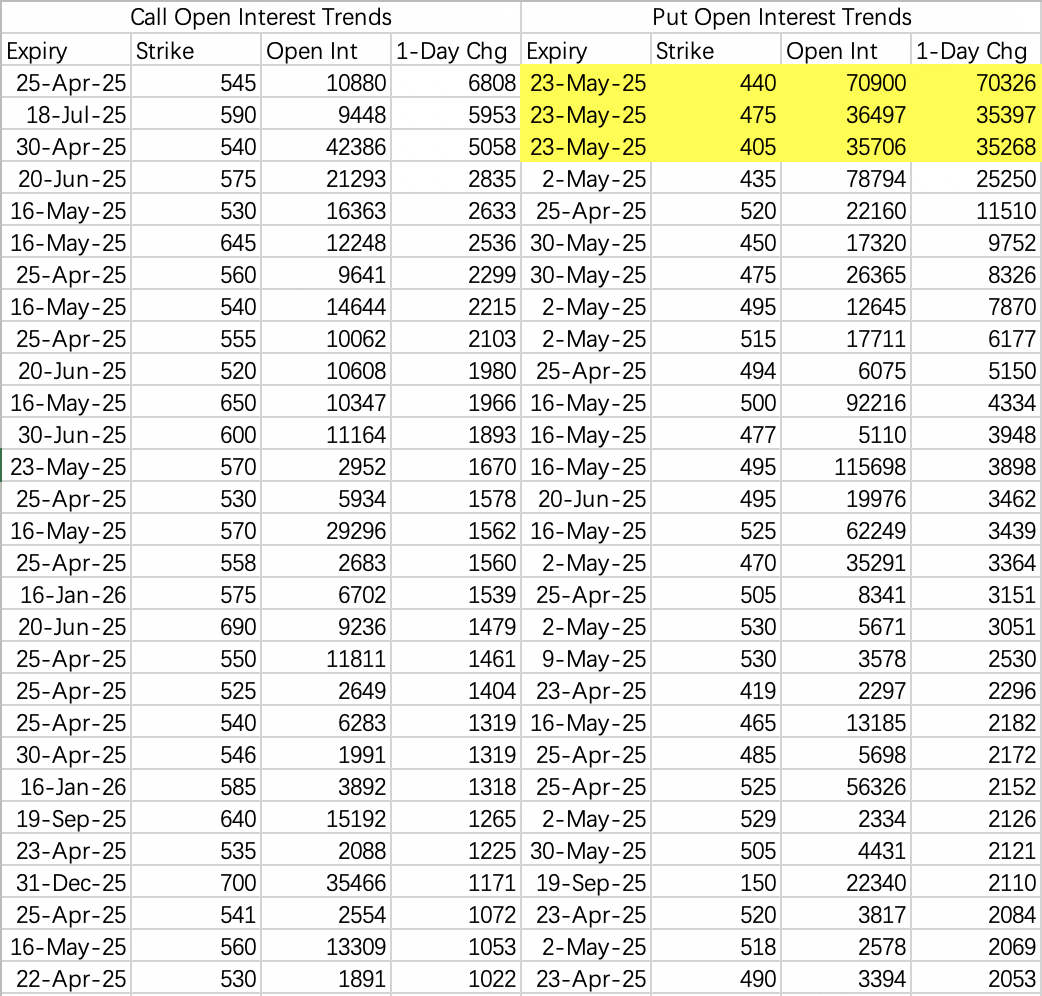

You can see signs of crash hedging in $SPDR S&P 500 ETF Trust(SPY)$ options too. On Friday, there were new bearish butterfly structures—$405$-$440$-$475$.

Lately, I’ve seen multiple butterfly trades with over $10,000$ contracts targeting profits below $480$ but above $400$. This tells you institutions are seriously hedging the risk of breaking below previous lows.

Will this crash start this week? Not necessarily, but it could easily happen before the end of May. So, if you’re holding stocks, make sure you’ve got puts in place for hedging. If you see a crash—like NVIDIA dropping to $95$ on Monday—don’t get greedy selling puts for extra premium and over-leveraging yourself. Play it safe. This might not be the bottom yet.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.