Was the Forced Unwinding of This Week’s Chip ETF Sell Put Block a Good Thing or a Bad Thing?

$VanEck Semiconductor ETF(SMH)$

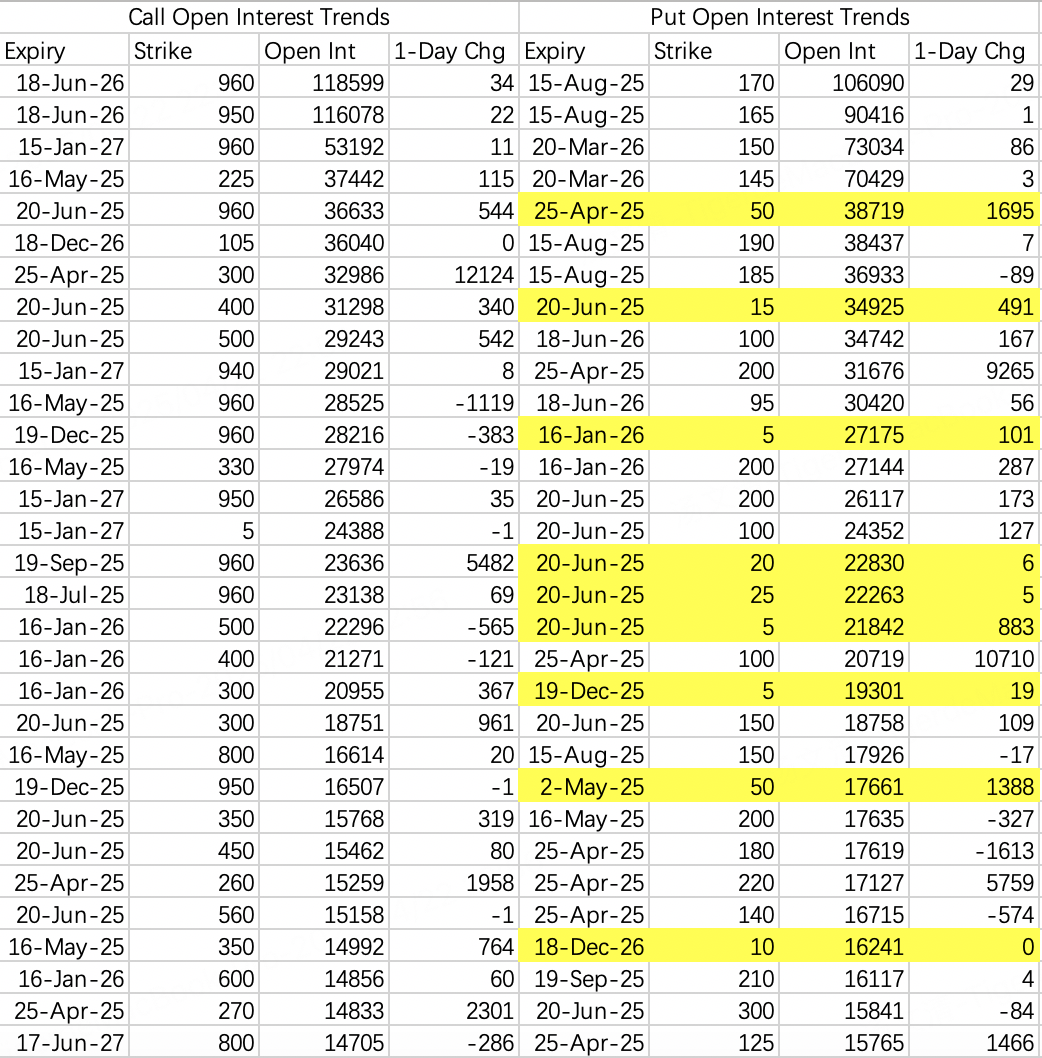

The massive sell put at $175$, $SMH 20250425 175.0 PUT$ , was closed out on Monday.

As mentioned in the April 15 article, someone sold 120,000 contracts of the $175 put expiring this week back on April 14. Unsurprisingly, they didn’t make much—by April 21, just four days before expiration, the position was hastily closed.

Even though $175 is a deep out-of-the-money strike and close to expiration (so time decay should be fast), Monday’s chip stock crash caused put prices to rise instead of fall. The price ended up about the same as a week earlier, so the sell put didn’t make money.

It’s the classic scenario: a huge put position gets closed, and chip stocks rebound right after. Market makers didn’t score big, but they also avoided major losses.

$NVIDIA(NVDA)$

Let’s talk NVIDIA next.

That big SMH unwind reminded me of Friday’s NVIDIA options data from my last update. Were those extreme deep OTM puts just for show, staged for that gigantic SMH position?

SPY $470 translates to about NVIDIA $60–$70, so puts at $20–$30 are really pushing it.

Whether these were real hedges or just for optics, we’ll probably only know for sure next month.

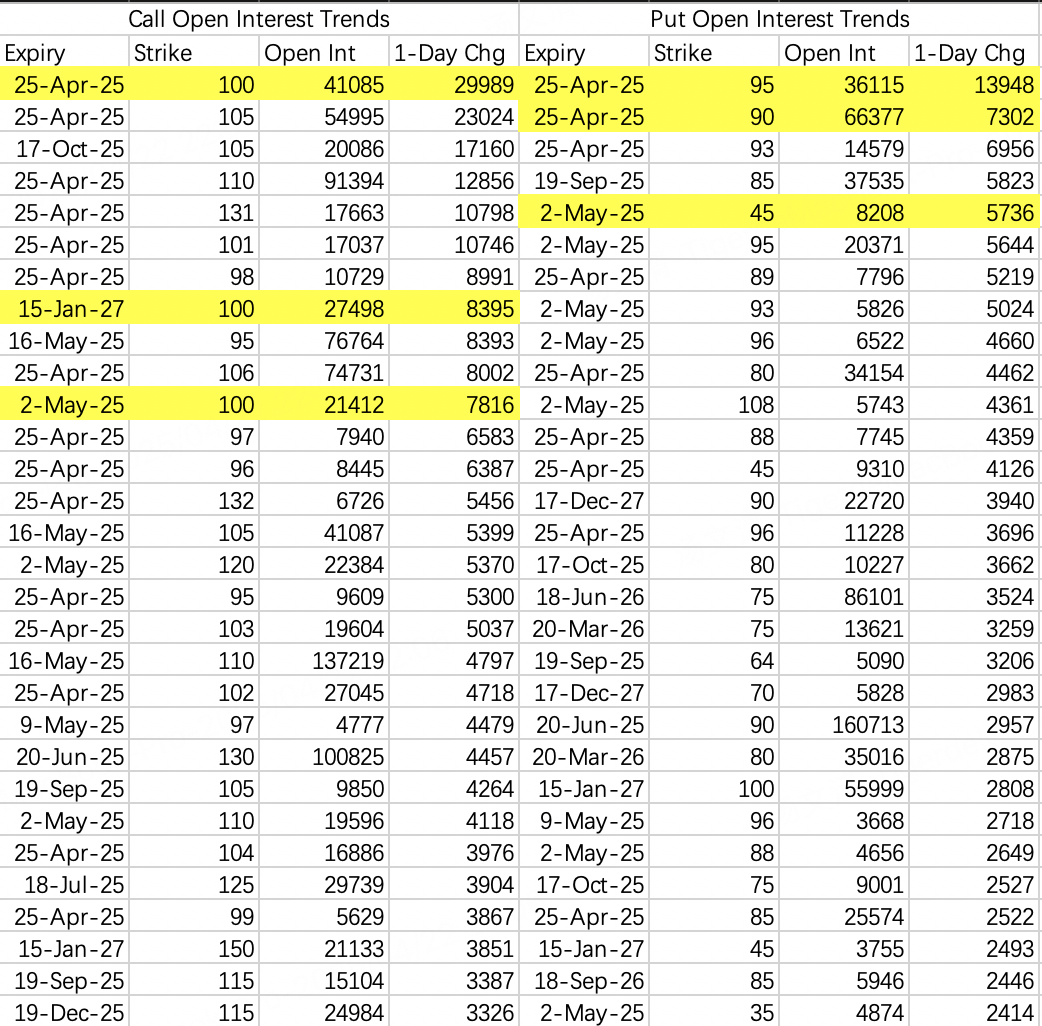

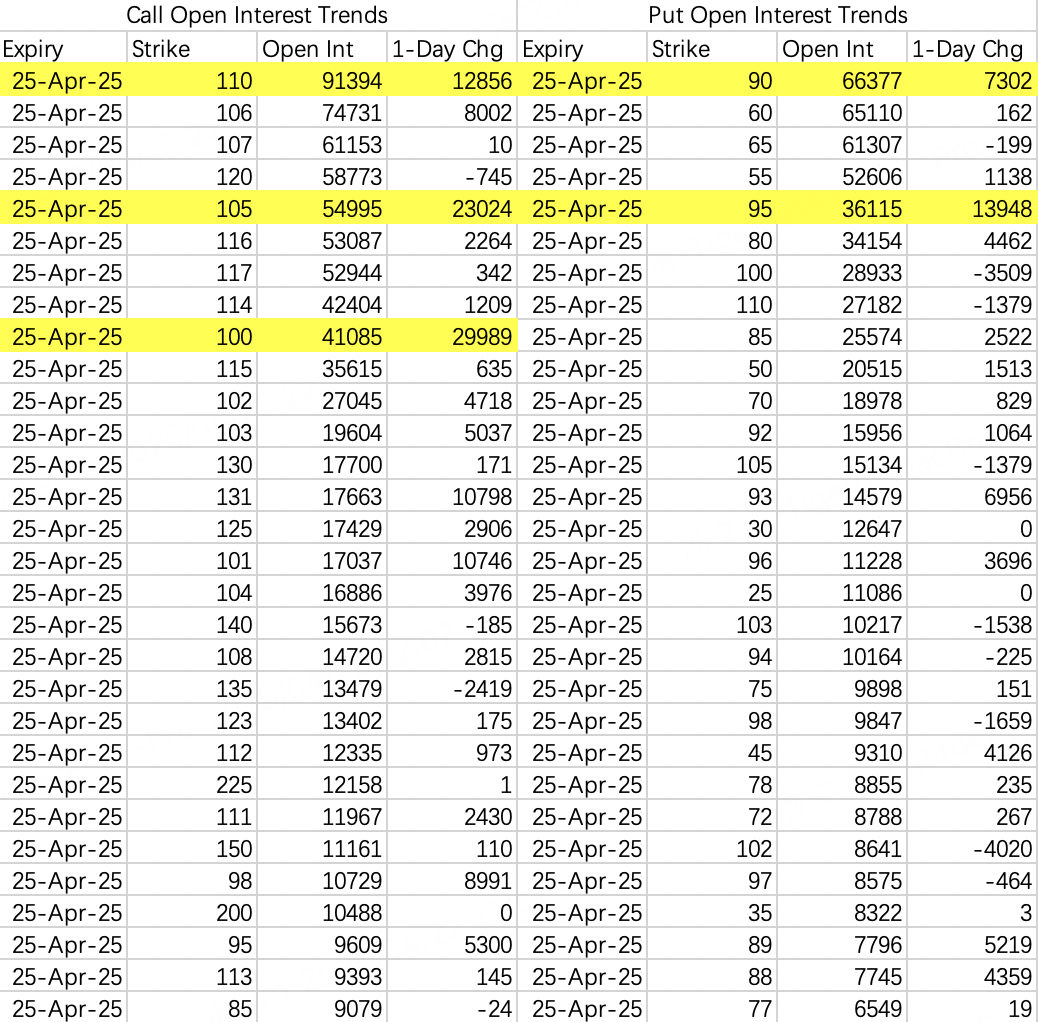

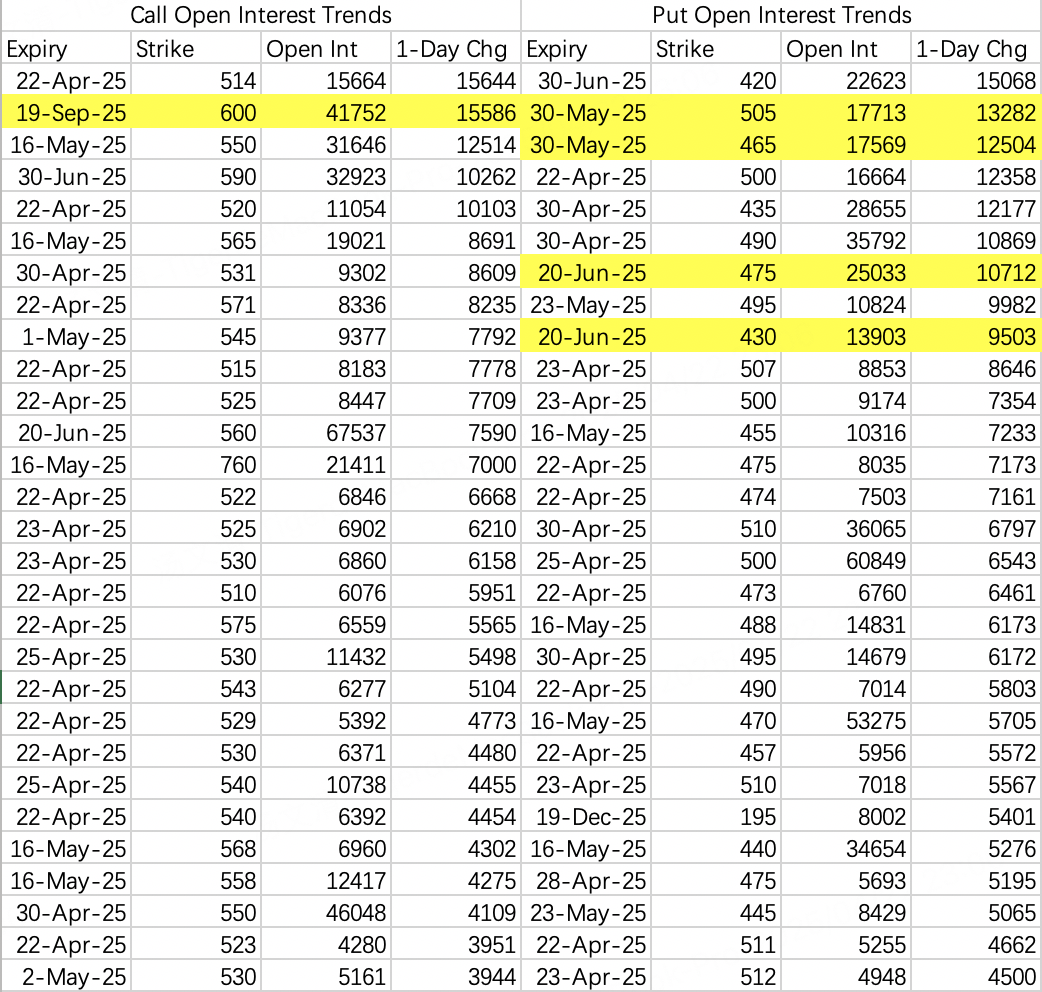

Monday’s NVIDIA options activity looked a lot more normal. Barring anything extreme, this week’s expected range is $90–$110.

Although NVIDIA didn’t drop below $90 on Monday (which lowers risk), don’t let your guard down. This week, the top two open interest strikes on the put side are $90 and $60—a $30 gap, which is pretty rare in terms of market sentiment divergence.

$Taiwan Semiconductor Manufacturing(TSM)$

TSM’s big sell put at $130, $TSM 20250425 130.0 PUT$ , was not closed early and expired safely in the money.

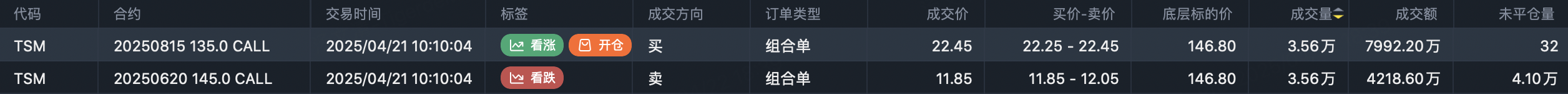

On the other hand, institutional long call roll trades in TSM are a mixed bag. The good news: open interest stayed at 35,600 contracts before and after the roll. The bad news: the strike was rolled down from $145 ($TSM 20250620 145.0 CALL$ ) to $135 ($TSM 20250815 135.0 CALL$ ).

That $145 call ($TSM 20250620 145.0 CALL$ ) was opened pre-earnings, and the report itself was decent, but this time the roll down to a lower strike matches the previous price low, not a bullish outlook.

$Tesla Motors(TSLA)$

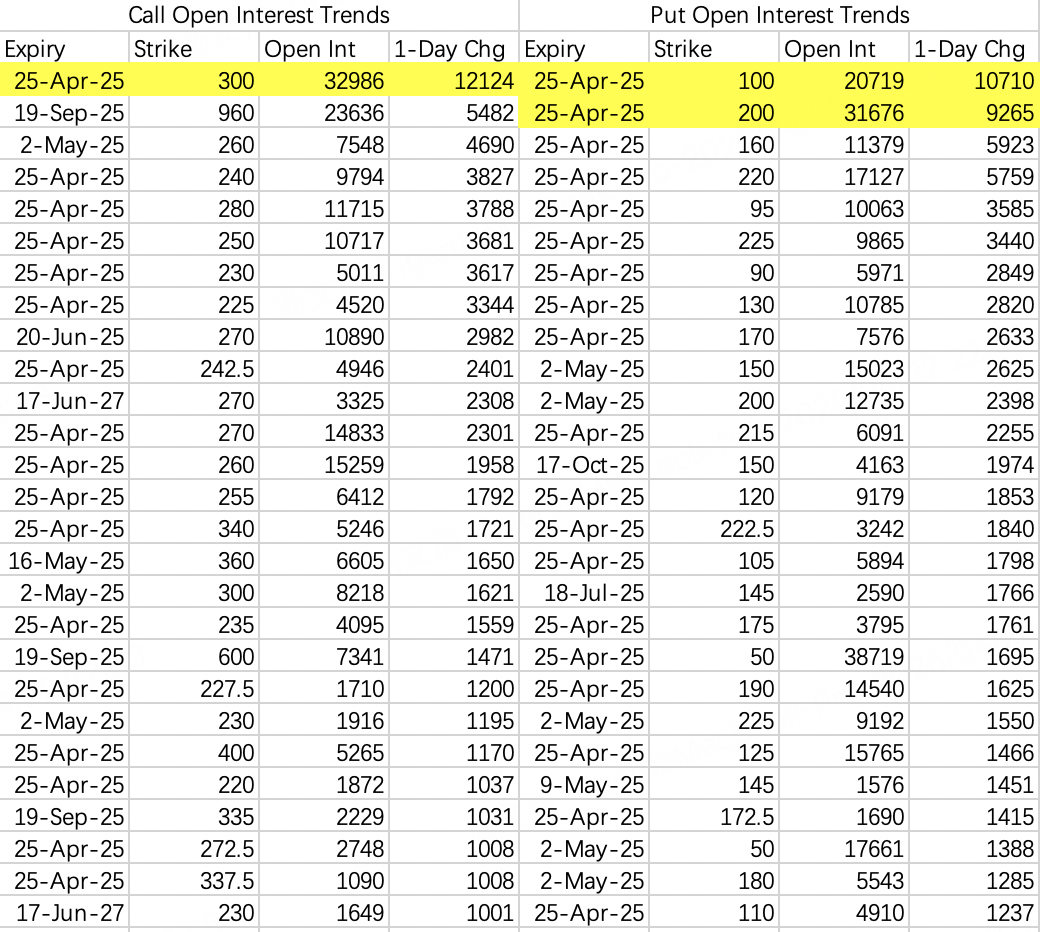

Tesla reports earnings tomorrow, but for now, the only thing the market seems to agree on is that it won’t break below $100 this week.

For this week’s expiring $200 puts, the flow is pretty balanced. But in this context, someone went all-in buying the $300 call expiring this week. There’s absolutely no bullish fundamental case for that, so it’s unclear what the buyer is thinking.

Ignoring this earnings report, looking at the bearish open interest, it’s definitely not the time to be bullish.

$SPDR S&P 500 ETF Trust(SPY)$

SPY’s bearish open interest is similar to before—focused on levels below previous lows. It’s notable, though, that there are quite a few long-dated bullish positions popping up, like the September 19 expiry $600 call, but honestly, those don’t seem very meaningful right now.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.